When you’re laser-focused on growing a business, the external but essential aspects of operations like payroll management become yet another “to do” in an already jammed schedule. On top of this, misconceptions about payroll pose some of the biggest, most costly risks to a business owner.

Think of a comparable example: many individuals and households consult an accountant about their taxes to get accurate, current information and cut through incorrect assumptions. We suggest you take a look at the myths surrounding payroll management with this same mindset. But, to take that look, you need to be able to separate fact from myth. Ready for a deeper dive on outsourcing your payroll?

↠ Learn more about the benefits of outsourcing to a PEO

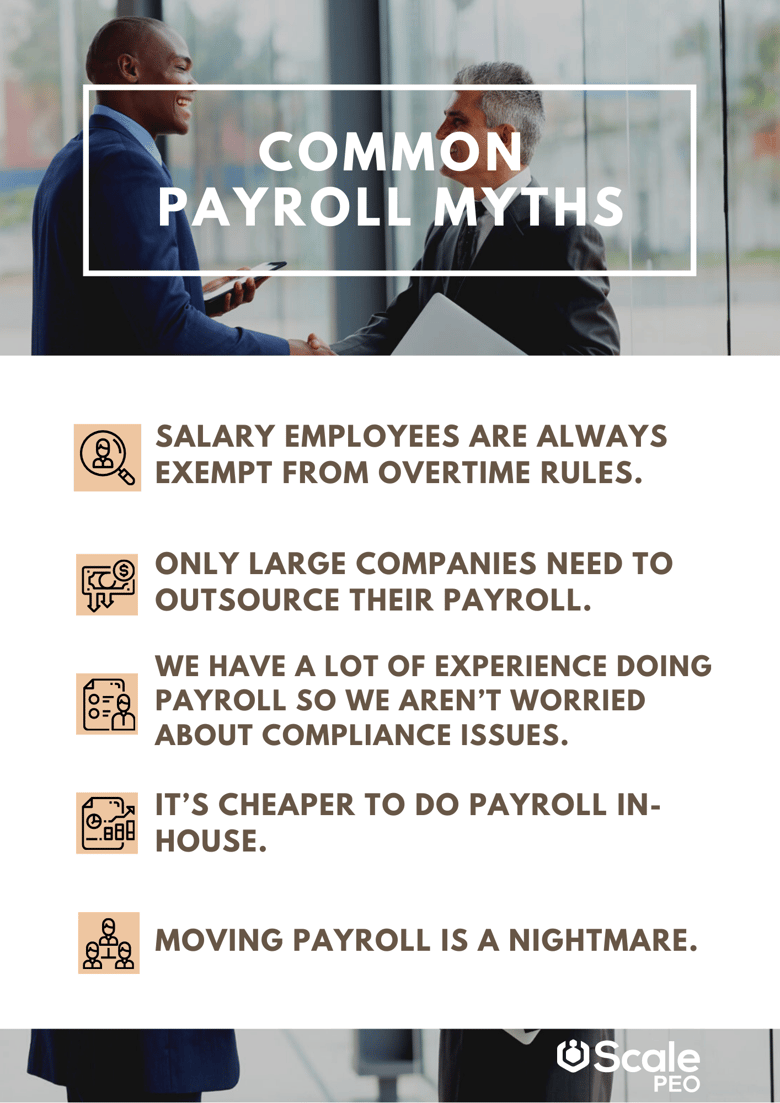

Below are five incorrect or outdated statements we hear about payroll again and again. Have you fallen victim to any of these falsehoods? If so, don’t worry. We have you covered.

Now, let’s shine some light on these myths so you can bust them.

Myth #1: "Salary employees are always exempt from overtime rules."

Reality: Nope, not always.

One of the most persistent payroll myths centers around “White Collar” exemptions. The fact is, according to the Fair Labor Standards Act (FLSA), for “executive, administrative, professional, computer and outside sales employees” to qualify for an exemption, they must not only be paid on a salary basis, but they also must meet certain job duties and be paid the minimum salary for exempt employees (currently $684 per week). The high price of misclassifying an employee’s exempt status includes not only back wages for any unpaid time but also attorneys’ fees, fines, and taxes.

Bottom line, never assume someone is exempt based solely on their job title

Myth #2: "Only large companies need to outsource their payroll."

Reality: Even small companies with only 5 employees can benefit from outsourcing their payroll.

Think about it. Payroll providers have technology, cloud-based platforms, and reporting capabilities that a small business doesn't. These providers employ professionals dedicated to payroll and help with automatic tax payments and filings, direct deposits, and more. Finally, many payroll providers are set up to work explicitly in the small business market.

It's ultimately not your company's size that counts but rather if it makes business sense for you to outsource payroll.

Myth #3: "We have a lot of experience doing payroll so we aren’t worried about compliance issues."

Reality: Approximately 40% of small businesses have to pay the IRS an average penalty of $845 a year for late or incorrect filings.

This number isn’t surprising once you think about how many local, state, and federal policies exist and how often they can change. Let’s be real. When was the last time you brushed up on the latest labor and tax laws? The odds are it’s been a while, if ever. A good payroll provider is an expert in both payroll and compliance and helps shield your business from penalties caused by confusing government complexity.

Myth #4: "It’s cheaper to do payroll in-house."

Reality: Really? Running payroll in-house requires the following:

- Employee(s) and All Associated Costs (i.e. recruitment, hiring, training, back-up for when people are out of the office)

- Payroll Software

- IT Support

- Security and Disaster Planning & Recovery

In addition to the above costs, don’t forget that time is money. All time spent performing repetitive back-office tasks could be better spent on revenue-generating activities and growing the company.

Myth #5: "Moving payroll is a nightmare."

Reality: Change is scary. And change involving payroll is especially scary.

Luckily, payroll providers know this -- that's why most of them have entire teams dedicated to getting new clients up and running to ensure a smooth transition. So, if you're worried about the move, communicate your fears. A good provider should give you clear information on what the process will be like and who you can turn to for help. While the prospect of moving payroll may seem daunting, it's more important to focus on the long-tail benefits: streamlined functionality with cloud computing, more time for you to focus on the business, increased compliance, cost savings, and more.

Ready to find out what else you may be overlooking in regard to your payroll, HR and compliance? Then schedule a chat with us today.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, legal advice. If you have any legal questions regarding this content or related issues, then you should consult with your professional legal advisor.

Editor's Note: This post was originally published November 5th, 2018 and has been completely revamped and updated for accuracy and comprehensiveness.

.png?width=705&name=payroll%20CTA%20(1).png)