A report from the Employee Benefit Research Institute (EBRI) and Greenwald & Associates highlights the behavior and attitudes of health care consumers with high deductible health plans (HDHPs). The report shows that consumers of HDHP are more engaged with their plan than those not in an HDHP and that they have many characteristics associated with greater financial stability. Specifically, the online survey of 2,010 privately insured adults between the ages of 24 and 61 (1,235 were in an HDHP vs. 775 in a more traditional health plan) showed that individuals using an HDHP had higher incomes and more education than those enrolled in more traditional health coverage. Nearly 30% of those in an HDHP had a household income of $150,000 or more, compared to 17% of enrollees in more traditional health plans. Forty-five percent of HDHP enrollees have a college degree, and another 27% have a graduate degree.

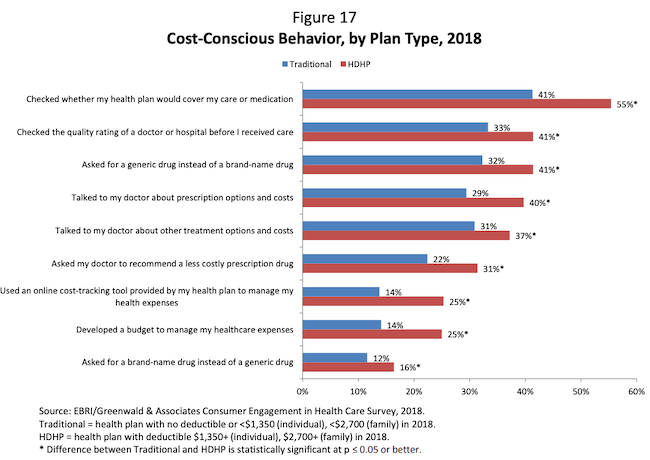

From a social determinants of health perspective, higher education and income are linked to better health, which explains HDHP enrollees were also more likely to report being in very good health. Education also relates to higher health literacy. This is consistent with the report’s findings that 39% of those in an HDHP sought out cost information in the past two years before receiving care (vs. only 25% of those in a traditional health plan). Also, 45% of those in an HDHP checked whether the plan would cover care or medication while 41% of those in a traditional plan did so. HDHP enrollees were also more likely to have checked the quality rating of a doctor or hospital before receiving care (41% vs. 32%), asked for a generic drug instead of a brand name (41% vs. 32%), and talked to their doctor about prescription options and costs (37% vs. 31%) as well as asked their doctor about less costly prescriptions (31% vs. 22%), used an online cost-tracking tool provided by the health plan (25% vs. 14%), and developed a health care budget (25% vs. 14%). HDHP enrollees were also more likely to have reported having participated in a wellness program.

These consumer behavior differences relative to traditional health plan enrollees could be shaped by the structure of HDHPs (increased financial liability), which encourage members to be good financial stewards of their health care consumption. It could also be a function of HDHPs attracting individuals who are willing to bear the financial risk and feel comfortable with their ability to navigate the health care system prudently.

HDHPs don’t always have rosy statistics relative to traditional health plans. The survey also found that HDHP enrollees were more likely to delay receiving care in the past year because of costs (33% vs. 18%). HDHP enrollees were also less likely to report that they do not have any financial concerns.