Disasters happen – one glance at the news each day will easily demonstrate this. Yet, the information we come across is typically about multi-billion-dollar organizations that tend to have more options than entrepreneurs.

As entrepreneurs, we have far less leeway when crises hit. We live or die with the business and often calculate losses in more than finance but blood, sweat, and tears.

If you’re in it for the long haul and intend to fight for survival, you need to ask – and answer – the vital question of “What happens when the next crisis hits?” To help you get the ball rolling on this, here are some that every entrepreneur should be prepared to answer;

How Much Cash Remains and Will I Roll the Dice?

Despite often having a smaller pool of funds, not all entrepreneurs maintain it in liquidity. Most of us will have the money in various pots ranging from stocks and other investments to equipment or earmarked for operational expenses.

The hallmark of a crisis is that things change, and often exceptionally rapidly. You need to prepare for a significant rewriting of your finances, including writing off some investments or slashing operational expenses in specific ways.

Tips for financial restructuring process:

- Redefine your goals

- Make operational improvements

- Increase net asset turnover

Once you’ve done that, the remainder will serve as a traffic light. You need to consider if it’s sufficient for you to weather the crisis or if you can’t afford to risk losing everything.

Is The Operational Model Still Viable?

Many entrepreneurs embarked on their endeavors based on operations models that proved viable in the past. Yet landscapes change, especially with the introduction of advances in technology.

While larger organizations can afford the luxury of reworking operational models, entrepreneurs often don’t have the time – nor funds – to experiment.

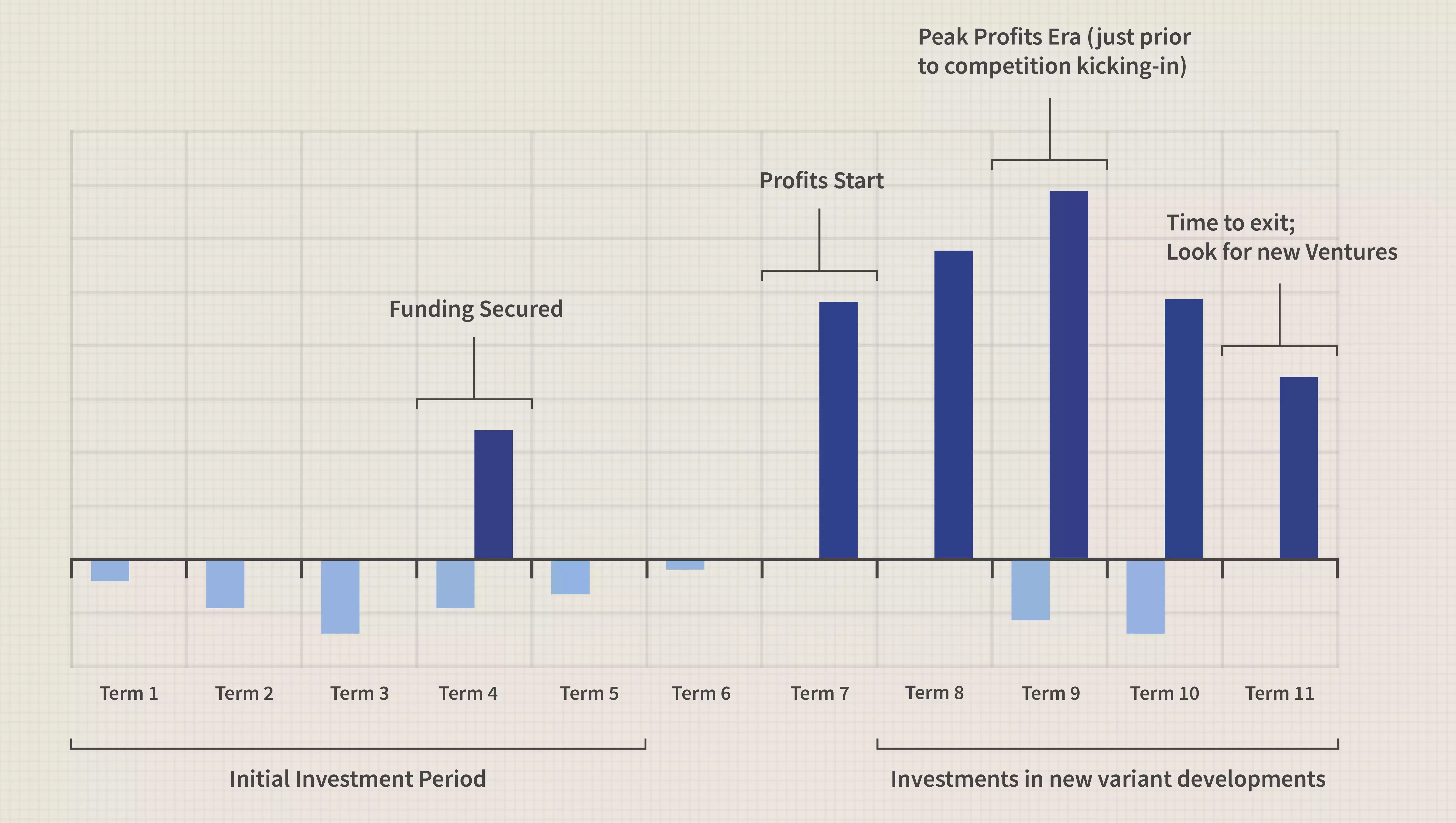

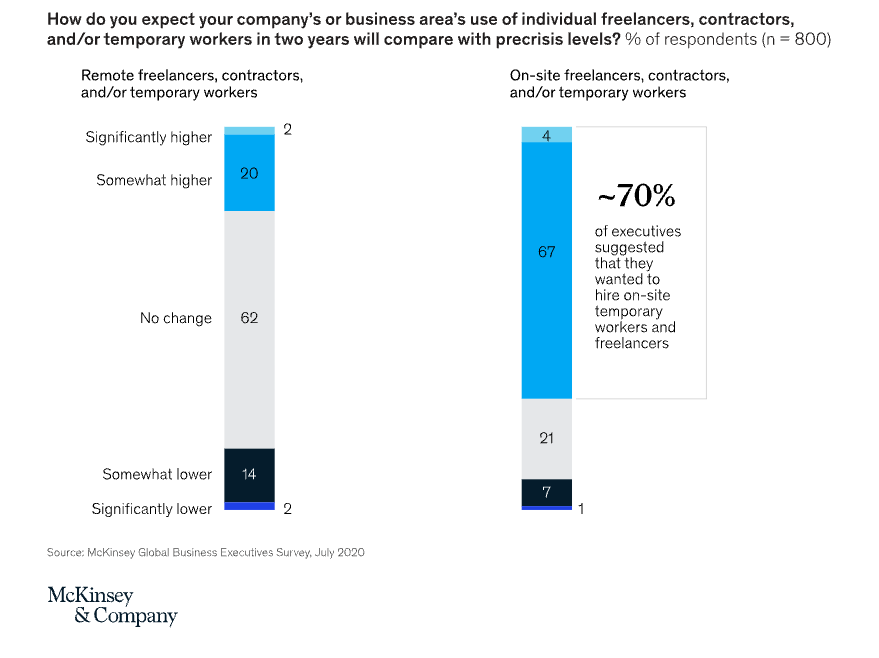

As entrepreneurs, the very core of what we do is risky due to the potential for change. To outline this, the financial crisis of 2007 – 2009 led to what we now call the “gig economy,” opening up entirely new opportunities for entrepreneurs.

Regardless of how unlikely it is that something terrible (or good) will occur, entrepreneurs need to retain an agile mindset and be prepared to adapt quickly.

Should I Retain My Highly-Trained Staff?

If the next crisis to hit is financial, entrepreneurs with limited funding will often face a delicate balancing act. You may have a great product, production process, staff, and such – but no market. Something needs to go, but which?

Staff is generally one of the most significant operating expenses, and hiring – then training – staff is a lengthy and expensive process. Remote staff may be even more costly in terms of the software and effort needed to manage the team.

Yet, the nature of this cost makes it one of the most vital areas towards which to consider slashing investment. The question here is whether you’re willing to bite the bullet and let staff go instead of holding on until the market normalizes.

Here are some questions that can help you to decide:

- What will retention mean to your bottom line?

- How long do you estimate the crisis will last?

- Have you calculated the real operational value of your experienced staff?

Are There New Opportunities Available?

When crises hit, many entrepreneurs panic, and things become a battle for survival. Tough times can be confusing, but they are also excellent to re-assess the market and see new opportunities.

Remember again that agility is one of the most potent advantages that entrepreneurs have. If you can spot a good opportunity, you also need to be prepared to ask if it’s worth wading into quickly. It doesn’t need to be an entire paradigm shift, but even as a side quest.

Some ways to identify new opportunities;

- Listening to your customers

- Observing the competition

- Analyzing industry insights

Facing adversity is a challenge, but looking beyond that and spotting potential is the true hallmark of a successful entrepreneur.

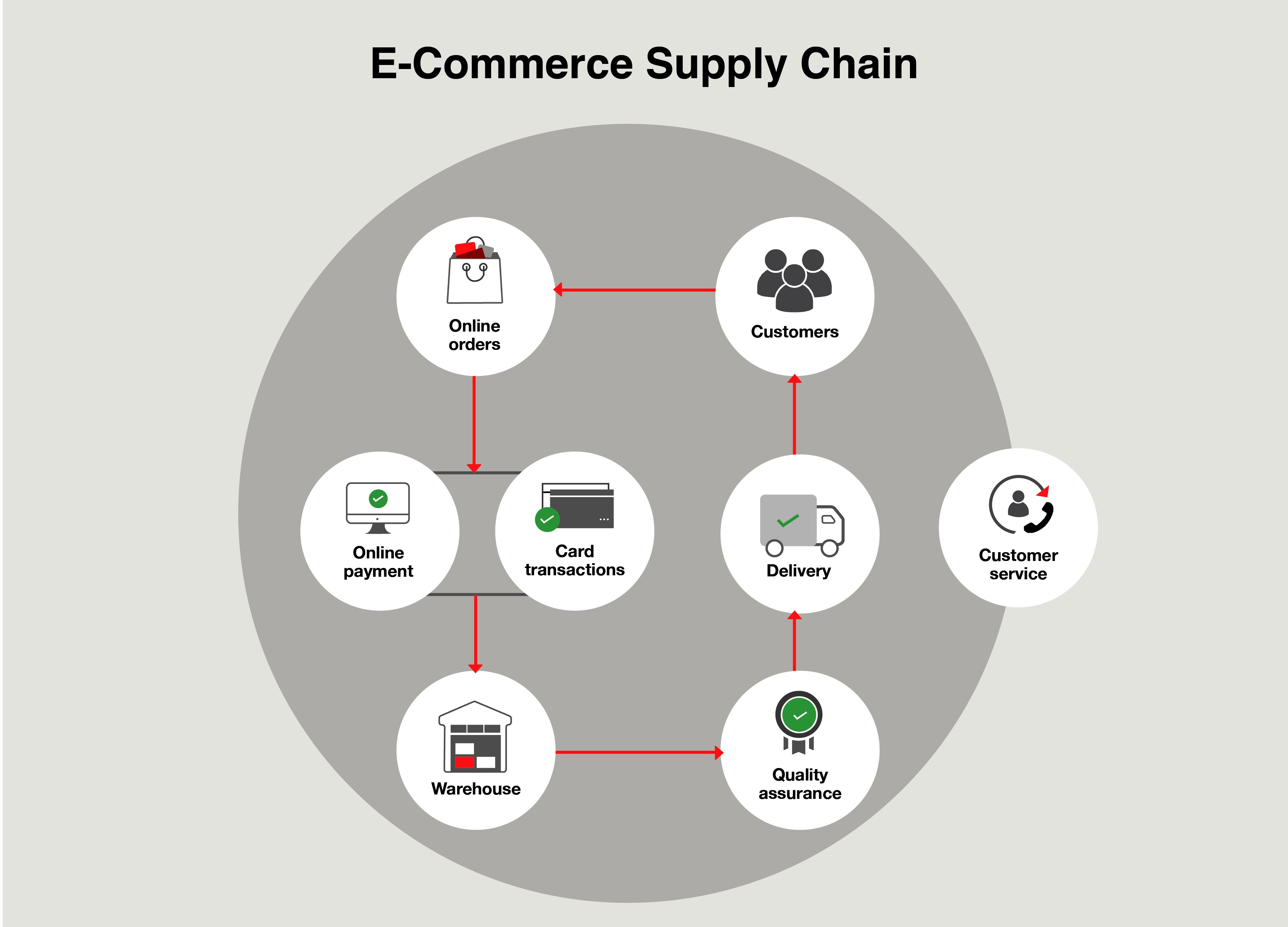

How Resilient is My Supply Chain?

The impact of some crises can have far-reaching consequences which may force many entrepreneurs to re-assess operations. What happens if you’re unable to source the materials you’re used to getting, or regulations suddenly cause you to use alternatives?

Sudden changes in supply can drastically impact cost, production times, and more. If you aren’t prepared to make quick shifts in a relatively controlled manner, you may quickly find yourself priced out of house and home.

Even the slightest change can cause ripples across the board. For example, what happens if your entire remote workforce cannot use your regular VPN provider and needs to shift to one that costs three times as much?

Healthy small-scale supply chains should;

- Consider supplier diversity

- Have a smooth onboarding process

- Be constantly monitored for even the slighter fluctuations

Is Taking on More Credit Wise?

Many entrepreneurs personally finance their businesses, and it can be tempting to face a crisis with more funds if credit lines remain relatively solid. Before doing this, careful thought needs to go into the exact scope and magnitude of the crisis.

Are the problems you’re facing going away naturally or caused by a systemic fault? The latter might not be solvable by simply adding more funds and is a hazardous endeavor if that comes from a personal loan.

Here are some things to consider before taking on more credit;

- The situational cost of credit

- Level of risk to be addressed in deploying the credit

- Value of your collateral

Final Thoughts: The Iceberg is Large and Very Dangerous

Being an entrepreneur at times of crisis is like running the titanic completely without lifeboats. As captain of the ship, your awareness of the iceberg’s size and nature is crucial to survivability.

The most important thing to never forget is to look past the problems and also aim for opportunities.