Why do we get an education?

When I ask people this question, I receive a variety of answers like, “that’s just what we do!” or “so young adults can find out what interests them.”

While these answers are true in a sense, they’re too superficial. The ultimate purpose of education is to make a living, and there is a measurable correlation between an education and an income. Unfortunately, simply getting an education is not enough – where you graduate from carries significant influence. Malcom Gladwell highlighted this well in an episode of Revisionist History, when he referenced an interview with the late Justice Antonin Scalia at American University’s Washington College of Law.

“When picking for Supreme Court Law Clerks, I can’t afford a miss. So I’m going to be picking from the law schools that are the hardest to get into, that admit the best and the brightest –- they may not teach very well, but if they come in the best and the brightest then they’re probably going to leave the best and the brightest.”

Justice Scalia’s statement represents the traditional way hiring managers filter their recruitment. This approach clearly overlooks the quality candidates who attend lower-ranked universities for a variety of reasons, but the cost of seeking out these candidates has historically outweighed the benefits.

This antiquated approach needs to be overturned, and the technology is available to do so in a scalable manner.

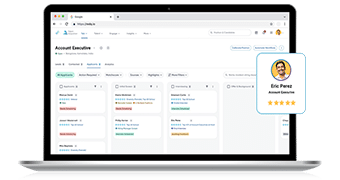

Eightfold’s Talent Intelligence Platform can enable companies to seek qualified candidates from a broader range of universities while minimizing the incremental costs. This can ameliorate the student debt crisis because it will give “the best and the brightest” high school students the confidence to attend less expensive universities without fear that it will inhibit their future employment potential. Additionally, employers will be able to pay for the quality of the talent they are hiring, not the arbitrary standard set due to the tuition the new employee needs to pay back to their alma mater.

Companies are incurring the cost of rising tuition

When I graduated from Georgetown University nearly a decade ago, I had approximately $200,000 in undergraduate debt. Fortunately, I had offers from companies across three different industries: consumer banking, international consulting, and consumer goods. In hindsight, I should have selected international consulting because it better aligned with my personality and growth mindset, but instead I selected consumer goods because it paid the most and appeared to have the highest potential for income growth.

My career headed down a very different path, and it cost me several years of unfulfilling work. But as I look back, I believe that the international consulting company was a casualty of the rising debt crisis, too. It lost a qualified candidate solely because it could not pay what I needed to satisfy my inflated cost of living due to federal and private loan payments. In the years since then, my income has more than doubled due to my work ethic and performance, but I still filter potential employers based on whether they will pay me enough so that I can continue paying off my Georgetown debt. I have met dozens of colleagues who also consider their loan repayments when evaluating an employer.

This unlocks an interesting observation: universities are charging students more in tuition, but companies that attract talent from top universities need to pay these employees more to make up for the increasing cost of a bachelor’s degree.

Employees are the ones who are shackled by debt, but ultimately companies are the ones who need to cough up the cash to introduce equilibrium into the system. If they don’t, then these candidates will be forced to look elsewhere!

Why aren’t companies fighting back against this domino effect?

I believe it is because, as Justice Scalia identified, companies were historically beholden to top-tier universities to provide a pipeline of candidates. The cost of this association was paying candidates an income that reasonably aligned with the high cost of tuition, rather than with the candidates’ true talents and capabilities.

Invisible Talent

When the late Justice Scalia spoke at American University’s Washington College of Law, he elaborated on what he looks for when picking a Supreme Court Law Clerk by sharing this story:

“One of my former clerks, who I am the proudest of, now sits on the 6th circuit court of appeals. Jeff Sutton. He [initially] wasn’t one of my clerks, he was Louis Powell’s former clerk. But I wouldn’t have hired Jeff Sutton –- he went to Ohio State! But he’s one of the very best law clerks I ever had, he is a brilliant guy.”

Even though Justice Scalia empathically expressed that he recruits from top universities because it improves his hit rate on finding top clerks, he recognizes that his best clerk did not attend a top university and therefore would have been overlooked! This story affirms the comment that Jennifer Carpenter, VP of talent acquisition at Delta Air Lines, made: “A candidate’s potential is far more relevant than any skill pedigree they may show up with.”

Why would someone with potential to have a successful career not attend a top-tier university?

In the case of Jeff Sutton, the very thing that held him back from attending University of Michigan Law -– part of the Top 14 -– made him Justice Scalia’s best law clerks. As Malcom Gladwell points out in the episode of Revisionist History, Jeff behaved like a methodical and persistent “hare” which has served him well on the Supreme Court but likely cost him dearly on the LSAT score, which tests the ability to answer difficult questions quickly (like a “tortoise” would). Therefore, even though Jeff Sutton had the capabilities necessary to excel as a Supreme Court law clerk, his inability to master the LSAT “relegated” him to Ohio State and out of Justice Scalia’s radius for recruitment. Jeff was able to break into the Supreme Court through a metaphoric back door because Justice Powell was retiring, but there are certainly millions of other “Jeff Suttons” out there who never receive such a chance.

A second reason why a high-potential candidate may not attend a top-tier university is because of the cost.As this mother expressed in 2016, her son was accepted to the University of Wisconsin (ranked #46 in national universities) but, when he did not receive any financial aid, had to make the difficult decision to attend Rutgers University (ranked #62) instead. His classmates who were admitted to Johns Hopkins (ranked #10) and Carnegie Mellon (ranked #25) also chose Rutgers because they could not afford to take on the debt of those private universities.

This raises an essential question: if the “best and the brightest” are electing to forgo top-tier universities because it would not be financially responsible to do so, then don’t companies have a duty to meet these students where they are rather than cast them out of consideration because they did not take on debt?

The student debt crisis has garnered enough attention that high-potential students are responding by attending less reputable universities so that they do not add to the $1.5 trillion crisis. Since these students are making the responsible choice, companies must meet these high potential students where they are, or risk propagating the crisis indefinitely.

How AI can broaden the scope of hiring without incremental cost

When I graduated from Georgetown, the best way to get noticed was to attend a career fair and meet your potential employers in person. The online portal was clunky and suboptimal because it felt like I was throwing my resume into a void. Almost 10 years later, video conferencing and automated interview technology is making it possible for the same companies to virtually reach students on hundreds more campuses without incurring incremental costs. A larger reach means more applicants, but artificial Intelligence can amplifying HR professionals’ capacity to evaluate candidates, and can integrate evidence-based models of working to reshape the workforce.

Through predictive analytics, AI-powered hiring technology can help hiring managers strategically find capable candidates who may otherwise be overlooked due to unconscious bias. This technology can benefit a company’s hiring practices throughout all levels of hiring, meaning the cost of applying this approach toward recent graduates would be nominal. The benefits, however, will be far reaching and can ameliorate the student debt crisis because students will no longer believe that they must pay $70,000 per year, including living costs, to attend a university that will get them noticed by top employers.