A Pulse on People Analytics

Nearly 70% of respondents to the 2016 i4cp/ROI Institute study on the state of human capital analytics expected to see their analytics budgets grow in 2017. A year later, we sought to gain insight into the extent to which budgets actually grew and how organizations are using their funds. Through a seven-question pulse survey, we received feedback from 147 HR and people analytics professionals. Respondents included directors (30%), managers (28%), vice presidents (14%), C-level (8%), and individual contributors (20%). Here’s what they told us:

Organizations focus on accessing and reporting data.

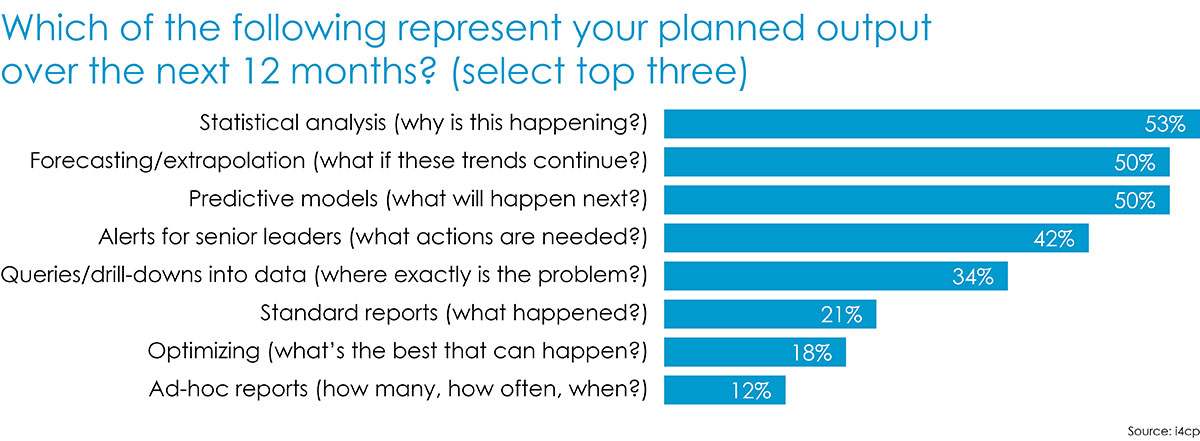

Respondents were asked to identify the three outputs that most reflect their activity in analytics. While seven people reported not knowing, the remainder indicated that the focus on analytics in their organizations is on accessing and reporting data through standard reports (70%), ad hoc reports (59%), and queries and drill-downs (39%). Over the next 12-months, organizations will advance the analytics ball, placing greater emphasis on statistical analysis (53%), forecasting/extrapolation (50%), and predictive models (50%). These results align with other predictions that suggest that 2017 will be the year of people analytics. Figures 1 and 2 show current outputs and planned outputs over the next 12 months.

Identifying gaps in skills is the most useful insight.

As part of their effort, organizations are using analytics to predict attrition and track diversity. However, insights related to capability reign most important. Skills gaps are a problem for organizations and identifying those gaps are complex, which is likely why insights that identify gaps in anticipated technical skills needed in the next 1-3 years versus current supply add the most strategic value to organizations, with 63% of respondents selecting it. In addition, ascertaining quality of hire (44%) and knowing who among the total workforce possesses the qualities/capabilities most common among the organization’s top talent (43%) were among the top three.

The biggest barriers to moving the analytics practice forward are funding and leadership commitment.

While our 2016 research indicates how people analytics budgets are growing and management is becoming more supportive than in the past, 26% of respondents to this pulse survey identify funding and leadership commitment as the top barriers to moving analytics forward.

Given that funding and leadership commitment are the biggest barriers, it was no surprise that 51% of respondents are not planning to hire new talent to support their human capital analytics practices anytime soon. Only 27% of respondents indicated they plan to hire in the next six months, and 22% aren’t sure.

Qualifications balance the quantitative with the qualitative.

For those organizations planning to hire, quantitative analysis is the primary qualification, with 71% of respondents selecting it. However, this quantitative focus requires a balance with the qualitative. Communication/storytelling (58%) and qualitative methodologies (52%) are among the top three skills organizations are looking for when hiring for the human capital analytics practice. In fact, storytelling and quantitative acumen are two of six competencies that make up a “ superhero analytics team.”

In the end, analytics is about insights and impact.

So, the question is, does investment in analytics payoff? It’s a question with which even big data analytics practitioners must contend. While support for analytics waivers, and will likely increase as contribution becomes more evident, those responding to the survey indicate there is good intent behind the analytics practice. As shown in the figure below, value-add of investing in analytics is defined by new knowledge/insights gained with analytics (75%) and business impact resulting from insights garnered with analytics (74%) as perceived by respondents.

In summary, our small sample of practitioners tell us:

- Organizations are focused on accessing and reporting data but plan to move toward analytics activity within the next 12 months.

- Insights into organization capability offer the most strategic value to organizations.

- Funding and leadership commitment are greatest barriers to progress with analytics.

- Organizations hiring for analytics are looking for skills in quantitative analysis, storytelling, and qualitative methodologies.

- Value in analytics is defined by new knowledge/insights gained with analytics and business impact resulting from insights garnered with analytics.

Consider this:

How accurately do these findings reflect your human capital analytics practice and what you have observed in others? What can you do to gain greater executive commitment to your analytics practice?

In related news, I’ll be overseeing the i4cp People Analytics Series , which kicks off on Tuesday, June 27 exclusively for i4cp Exchange members. Contact your account manager if you’re not already signed up to take part.

Patti Phillips, Ph.D ., is the president and CEO of ROI Institute and Chair of i4cp’s People Analytics Board .