What is a PEO? In a nutshell:

A Professional Employer Organization, or PEO, is an outsourcing partner who is responsible for handling most human resource functions on behalf of their clients. They share employment liability, and, oftentimes, make it possible for their clients to gain economies of scale to bring improved benefits packages to their employees. A PEO is an extension of your business and engages with your management team to address complex employee-related matters, along with a technology platform to manage all employee data.

Ready to learn more? In this article, we’ll discuss the following:

- What is a PEO?

- What types of companies should use a PEO?

- Key PEO Services & How They Can Help Your Company

- 6 Major Benefits Of Working With A PEO

- How much does it cost to work with a PEO?

- How To Pick The Right PEO

- What do PEOs look like across industries?

- PEO Case Studies

- Learn More About PEOs & GenesisHR Solutions

Learn even more about what a PEO is—and how to find the right one for your organization. Download Everything You Need To Know About PEOs!

What is a PEO?

A Professional Employer Organization, or PEO, is a company that enters into a co-employment relationship with an employer (your company) that allows the PEO to manage your human resource functions by becoming your employer of record in order to provide the services your business needs. The PEO also assumes associated responsibilities and provides ready expertise in human resources management, including:

- Employee onboarding

- Health benefits

- Payroll

- Payroll tax compliance

- Leaves of absence

- Paid time off practices

- Workers’ compensation administration

- Unemployment insurance claims

- COBRA

You and the PEO also share certain responsibilities, especially around employer compliance.

For example, the PEO will provide information around state and federal compliance issues that impact you and your business. The PEO representative will communicate the requirements to you and, in many cases, provide guidance on how to meet them. However, in some cases, it is up to you to take action. As a simple example, the PEO will likely provide the required state and federal labor law poster, but it is up to you to post it in your worksite in an area visible to all employees.

One important subset of PEOs are certified PEOs (CPEOs). A certified PEO is a PEO that has met certain stringent IRS requirements around payroll tax status, background and experience verifications, and appropriate bonding protections. This certification increases the PEO’s credibility and guarantees high-quality service. The CPEO IRS designation is a voluntary program, which means that not every PEO will qualify, nor are all of them willing to undergo the rigorous processes required to become an IRS-certified PEO. Organizations that do become CPEOs (like GenesisHR) demonstrate the importance of their business operations and finances—which will only benefit you as a client.

In any PEO co-employment relationship, risk is shared between the PEO and your company. Think of this shared risk as both sides having ‘skin in the game.’ Your PEO is going to do their best to guide you appropriately in order to mitigate (and minimize) your risk, as well as theirs.

See also: What is co-employment, and what is not?

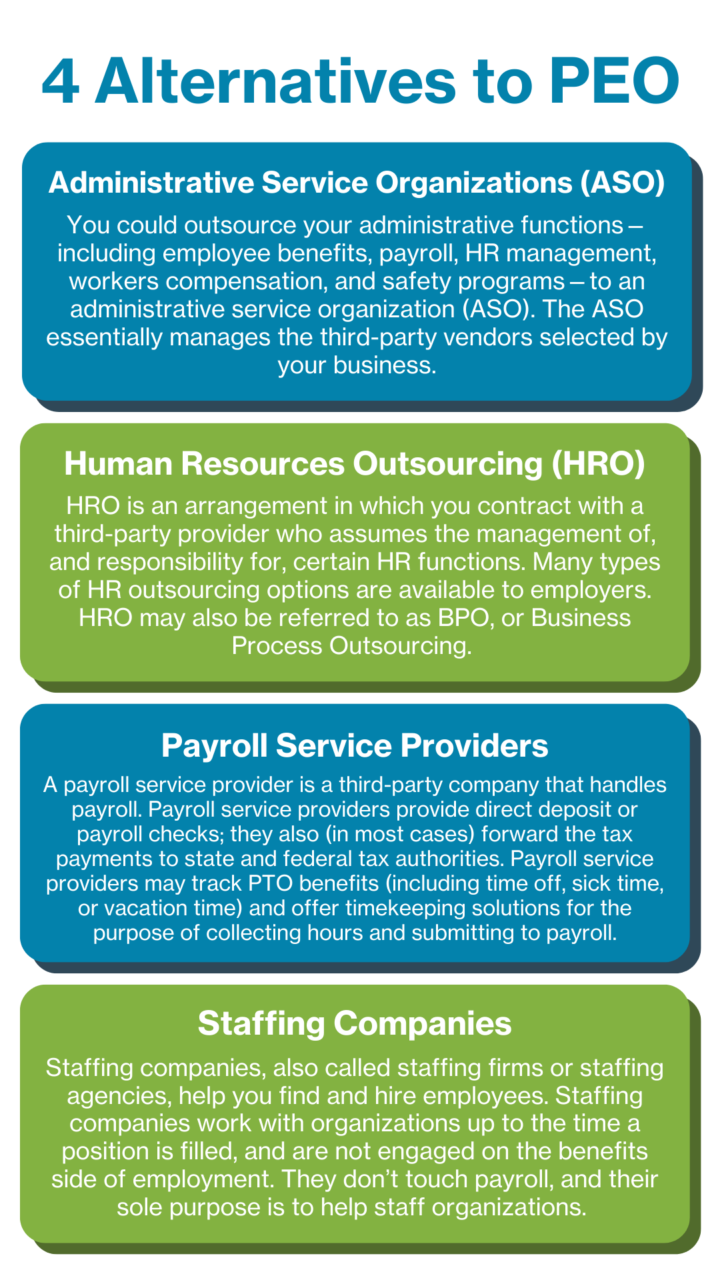

What are the alternatives to PEOs?

While PEOs are an excellent option for small and midsize businesses, they are certainly not the only option. Read this article to make sure you understand the pros and cons of using a PEO, and what you can realistically expect from partnering with a PEO firm.

We also encourage you to take a look at some PEO alternatives. Seeing what they offer in comparison to a PEO partnership will give you a good idea of what you can (or should) expect. Some of the main types of alternatives include:

- Administrative Service Organizations (ASO). You could outsource your administrative functions—including employee benefits, payroll, HR management, workers compensation, and safety programs—to an administrative service organization (ASO). The ASO essentially manages the third-party vendors selected by your business.

- Human Resources Outsourcing (HRO). HRO is an arrangement in which you contract with a third-party provider who assumes the management of, and responsibility for, certain HR functions. Many types of HR outsourcing options are available to employers. HRO may also be referred to as BPO, or Business Process Outsourcing.

- Payroll Service Providers. A payroll service provider is a third-party company that handles payroll. Payroll service providers provide direct deposit or payroll checks; they also (in most cases) forward the tax payments to state and federal tax authorities. Payroll service providers may track PTO benefits (including time off, sick time, or vacation time) and offer timekeeping solutions for the purpose of collecting hours and submitting to payroll.

- Staffing Companies. Staffing companies, also called staffing firms or staffing agencies, help you find and hire employees. Staffing companies work with organizations up to the time a position is filled, and are not engaged on the benefits side of employment. They don’t touch payroll, and their sole purpose is to help staff organizations.

Here’s how to tell which option is right for you.

How A PEO Relationship Works: The Division Of Tasks & Responsibilities

If you were to partner with a PEO, both you and the PEO would sign a co-employment agreement where you will share and allocate responsibilities and liabilities:

- The PEO assumes much of the responsibility and liability for the business of employment, such as risk management, benefits administration, human resource management, and payroll and employee tax compliance. As a small business, you do not fully remove your responsibility; you simply have an expert who shares the responsibility and who handles this administration.

- Your company retains responsibility for and manages and develops your employees. You also retain control over core business activities such as product development and production, business operations, marketing, sales, and service.

- You and the PEO share certain responsibilities with regard to employment law compliance.

- As a co-employer, the PEO will provide you with a complete human resource solution, including a comprehensive benefits package that will help you attract and retain top talent.

What types of companies should use a PEO?

PEOs are best suited for small to midsize businesses with 10 to a few hundred employees. Business owners who are concerned about their company’s exposure and liability, as well as their own ability to successfully manage complex employee benefits, payroll, taxes, and more, will find value in a PEO partnership.

Key PEO Services & How They Can Help Your Company

A PEO like GenesisHR Solutions helps your business manage complex employee-related matters. PEO services include administration of the following:

- Onboarding

- Health benefits

- Payroll

- Payroll tax compliance

- Leaves of absence

- Paid time off practices

- Workers’ compensation claims

- Unemployment insurance claims

- COBRA

A PEO contracts with your business to perform these processes, assume associated responsibilities, and provide ready expertise in human resources management.

At GenesisHR Solutions, we offer a suite of integrated services to effectively manage your critical human resource responsibilities and employer risks. We deliver these services by establishing and maintaining an employer relationship with the employees at your worksite, and by contractually assuming certain employer rights, responsibilities, and risks.

Here’s a look at some of the most common PEO services your company can take advantage of by working with us:

1. PEO Insurance Offerings

Under a PEO partnership, your small business will gain a huge advantage in finding competitive insurance plans because the PEO selects a carrier or carriers. PEOs have access to more expansive product offerings, which they can then make available to their small business partners, who likely wouldn’t have access to these offerings on their own.

At GenesisHR, we offer the following insurance options:

- Group health, dental, and vision through Blue Cross Blue Shield of Massachusetts, Delta Dental, and Vision Service Plan

- Long- and short-term disability coverage with UNUM

- Life/AD&D products with UNUM

Arguably, health insurance is the most important benefit you provide to your employees. While a PEO does not provide health insurance, we do select and manage a comprehensive, best-in-class benefit offering so you can recruit and retain the best employees. Our plan selections will always be a good match for your company’s budget and your employees’ needs; we also guide you through the administration, education, and training aspects of health insurance.

Also, as a PEO partner, you’ll have the opportunity to access all the health insurance plans we have available through our partner, Blue Cross Blue Shield of Massachusetts. Learn more about how PEO health insurance works for small businesses.

2. Competitive Benefits

To get top talent, you need competitive benefits. Don’t miss out on great employees because your small or midsize business can’t afford the benefits your competition offers. In addition to the insurance benefits listed above, GenesisHR offers the following:

- 401(k) plan options

- Employee assistance plan (EAP)

- Retail & entertainment discount program

- Employee self-service tools for onboarding, benefit enrollment, and paid time off management

In addition to the actual products, we also offer benefit plan administration. No longer do you have to spend time figuring out the Affordable Care Act, determining if you’re getting a good plan, addressing compliance issues, or even communicating plan details to your employees. We help you choose the best strategies for your needs and even manage insurance vendor relationships.

3. Payroll

A PEO partner should also manage payroll and taxes, and ensure your payroll taxes are deposited and filed in an accurate and timely manner. We handle these PEO payroll tasks:

- Single- and multi-state payroll

- Online processing

- Time clock feed options through our partner, TIMECO, or through your current time clock feed

- Holiday, sick, vacation, and other accruals

- Unbundled, transparent payroll reporting

- Child support and miscellaneous garnishments

- W-2 preparation and distribution

- State unemployment insurance tax account (SUTA) management

- Employer tax deposits and filings; Form 940, Form 941, and W-3 transmittal (our tax engine uses your ZIP code to calculate correct tax info, so we know the exact amount to tax your employees)

4. Health Savings Accounts (HSA), Health Reimbursement Accounts (HRA), and Flexible Spending Plans (FSA)

To find and retain top talent, you need benefits offerings that are in line with those offered by large enterprises, including tax-advantaged health savings accounts. GenesisHR offers HSA, HRA, and FSA options for our partner companies and manages these accounts so you can focus on recruiting top-notch employees and on managing your core business—not on administrative work.

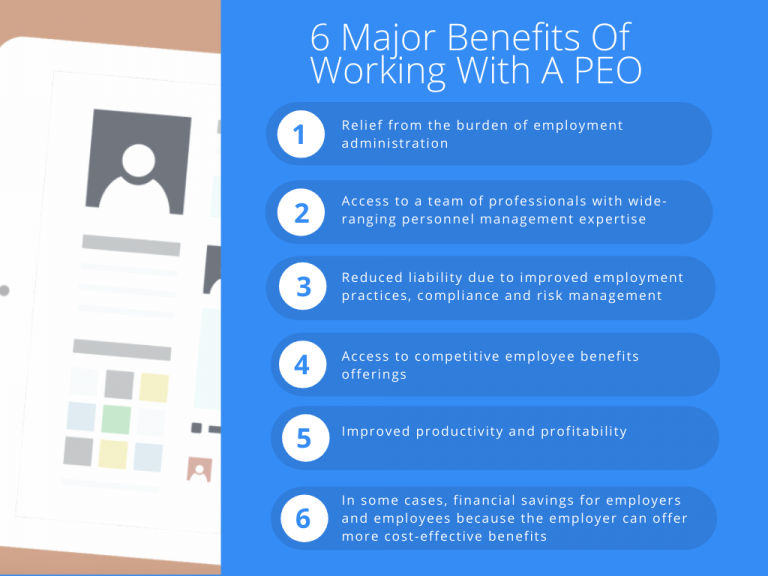

6 Major Benefits Of Working With A PEO

In our three decades as a Massachusetts-based PEO, we’ve seen our clients benefit from the PEO relationship in myriad ways. PEO benefits include:

- Relief from the burden of employment administration

- Access to the expertise of a team of professionals with wide-ranging personnel management experience

- Reduced liability due to improved employment practices, compliance, and risk management

“Small businesses that work with a PEO grow 7 to 9% faster, have 10 to 14% less employee turnover, and are 50% less likely to go out of business.” —NAPEO

- Competitiveness in the labor market thanks to a comprehensive employee benefits package

- In some cases, financial savings for employers and employees because the employer can offer more cost-effective benefits

- Improved productivity and profitability

What are the considerations of working with a PEO?

A common belief is that working with a PEO is “too expensive.”

However, this doesn’t accurately reflect the reality most small and midsize businesses are facing—one that requires them to either hire an HR resource on staff or outsource this role to a qualified competent partner like GenesisHR Solutions. Either way, in order to make sure you are in compliance and being efficient with your time, you need someone who’s solely dedicated to the HR aspects of your company.

The cost of a PEO will always be lower than hiring a staff resource. It is also important to note that you can’t hire the expertise that a PEO like GenesisHR can bring—and you certainly can’t do it by hiring just one individual. From this perspective, it is truly more costly for businesses to operate on their own, without a PEO partner.

How much does working with a PEO cost?

The cost of hiring a PEO varies considerably; providers, company size, and industry all play a role in PEO pricing. However, that cost is often offset by the financial and time savings your company gains through this working relationship. Partnering with a PEO on things like employee benefits, retirement accounts, and workers compensation can save you money. You can also save a tremendous amount of time with a PEO, which translates into a positive return on investment.

At GenesisHR, we do not “bundle bill” (a common billing tactic in the HR industry). Instead, the amount you pay for our PEO services is based on a set amount per employee per month. We break out your costs this way because transparency in billing is important to us.

Learn more about our pricing structure—and get answers to other frequently asked questions—here.

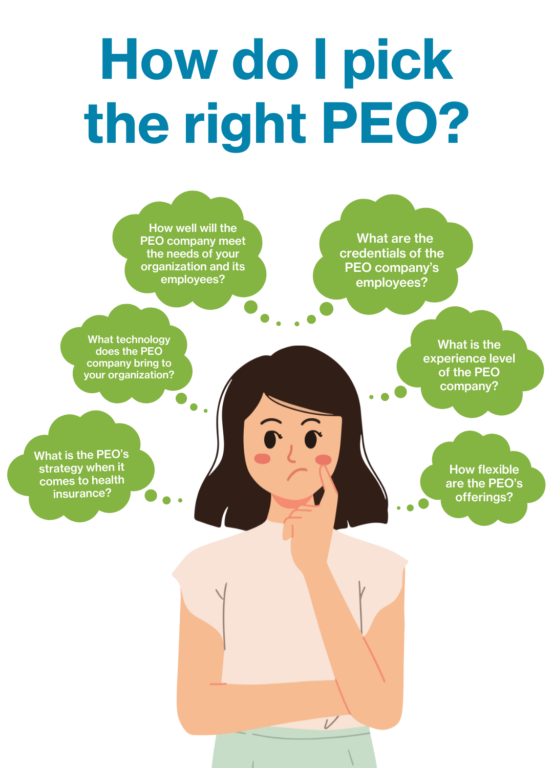

How To Pick The Right PEO

You’re putting no small amount of money (as well as trust) into your PEO partnership, so you certainly want to make sure you explore all the best options, get your questions answered plainly, and narrow down your PEO options to the best fit. Get started with your search by including these six must-answer questions in every interview you do with a prospective PEO:

- What are the credentials of the PEO company’s employees?

- What is the experience level of the PEO company?

- How well will the PEO company meet the needs of your organization and its employees?

- What technology does the PEO company bring to your organization?

- What is the PEO’s strategy when it comes to health insurance?

- How flexible are the PEO’s offerings?

Every candidate should be willing to answer these questions (and any others you may have). If

you get a vague response, consider it a red flag and investigate further or move on.

Read more: How To Pick The Right PEO Company: A Checklist and Six Things to Consider When Choosing a PEO as Your Human Resource Outsourcing Partner

What do PEOs look like across industries?

PEOs provide services to an estimated 175,000 small and mid-sized businesses across all industries and the nonprofit sector. If you’re interested in working with a PEO, you will almost certainly be able to find one that specializes in your line of business, is located near you, or has similar core values.

As a small business owner, you’re aware that, next to payroll, health insurance benefits are the most expensive line item in your budget. So if you’re struggling to cover it, you’re not alone: One 2021 report reveals that 65% of small business owners say providing health insurance to their employees is the biggest challenge they face!

For that reason, partnering with a PEO who knows the insurance market should be inherent to your business planning. By partnering with a PEO, you can get access to health insurance options your small business would not be able to procure otherwise. You also can rely on your PEO to administer and manage health insurance plans, negotiate with brokers or navigate the marketplace, and plan for the subsequent year’s insurance offerings as well.

By partnering with a PEO, you can get access to health insurance options your small business would not be able to procure otherwise.

Partnering with a PEO can be especially helpful for nonprofit organizations.

Limited budgets, complex liability issues, and a lack of experienced HR professionals all pose challenges for nonprofits. Happily, in a PEO partnership, nonprofit leaders have an option for dealing with these issues. Here are six ways partnering with a PEO helps your nonprofit. Are you an independent contractor? The PEO service model can help you, too!

PEO Case Studies

You don’t have to take our word for it—our long-standing customer base is proof that PEOs like GenesisHR are invaluable to the businesses they serve. But in case you were looking for some hard numbers:

Compared to companies that don’t work with a PEO, those that do:

- Grow 7-9% faster

- Have 23-32% lower employee turnover

- Are 50% less likely to go out of business

With respect to employee turnover, the data by industry is noteworthy as well. The percentage points by which a PEO client’s employee turnover rate is lower than expected are:

- Professional, Science and Technology Services—23%

- Construction—17%

- Finance and Insurance—15.4%

- Wholesale Trade—7.3%

- Health Care, Social Assistance—6%

- Manufacturing—2.3%

And the PEO model works for more than just PEOs and their partner companies. Following the same idea of a PEO partnership, take a look at how The Battlegreen Run Foundation applied a similar model to the road race, which resulted in huge success.

Learn More About PEOs & GenesisHR Solutions

Hopefully, we’ve answered your question, “What is a PEO?”—and you’re ready to learn more!

If you’re a small to midsize business located in the New England region—our PEO may be a good fit for you. A free consultation is the best way to get your questions about PEOs answered. Feel free to reach out anytime—we’d love to meet you!