Employers have the responsibility to accurately calculate payroll deductions and pay employee benefits taxes.

To ensure your business runs smoothly keeping your employees happy is one of the most important things to keep on top of. Also, of course, getting their wages right is crucial to being a good employer.

Also read: Managing HR Compliance in the Age of Technology

Here are some of the basics to help you calculate these.

Payroll Deductions

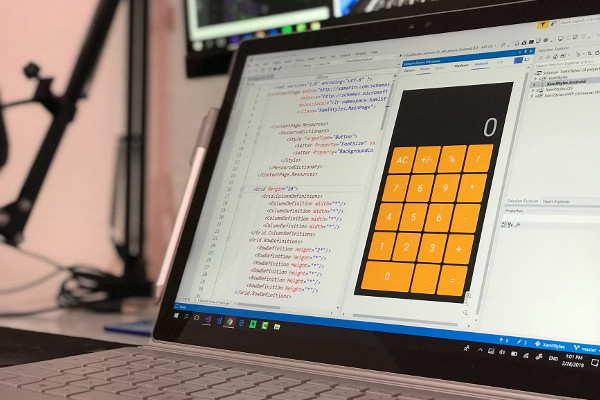

There are some payroll deductions that are completely necessary and you must calculate them correctly. These include Social security, Federal tax and state and local tax. This will ultimately result in what your employees get paid as a NET wage so you need this to be right both for your employees and for the government. To help you to calculate your deductions you can use this payroll deductions online calculator.

What are your responsibilities?

As an employer, you are responsible to withhold and pay certain taxes. To keep yourself up to date with the IRS and run your business correctly you need to ensure your payroll deductions are completed correctly. Your responsibilities include taxes, social security, and Medicare.

Taxes

Employers must submit taxes according to the IRS deposit schedule. This is based on the employer’s total tax liability for the whole withholding period. Tax calculations are based on a percentage of the total wages each employee is paid at the Federal and state rates at the time.

Social security and Medicare

The Federal Insurance Contributions Act or FICA requires employers to withhold Social Security and Medicare contributions from employee paychecks and pay their own contribution. The withholding and contribution should then be paid to the IRS.

Also read: 3 Laws HR Needs to Communicate to New Moms

Who gets employee benefits?

You can’t offer employee benefits to a choice few. If you want to offer employee benefits then they must be offered to each and every employee. The same benefits should be offered across the board with no differences.

What employee benefits can you deduct on your tax return?

Employee benefits are another way to keep everyone happy with your business, but how do make that work for you too? There are certain claims you can make which will help employee benefits cost your business less. Here are a few examples of employee benefits that you can deduct from your tax return.

Health plans, life insurance, and dependent care assistance are all deductible to employers if they are compliant with IRS regulations and qualified. Cafeteria plans are also tax deductible. Gifts are deductible if they are of nominal value and bonuses and awards are deductible to your business but may be taxable to employees. As long as you set up a qualified educational assistance program, under IRS regulations then you can deduct tax for the cost of providing educational assistance to employees.

What employee benefits you cannot deduct?

Costs such as bills at golf clubs or country clubs for employees cannot be deducted. If you are unsure about whether you can deduct a benefit or not you should speak to the IRS or your lawyer to check before you submit your tax return.

Do you understand your payroll deductions and employee benefits?

Depending on the size of your business the responsibility for payroll may be your own or you may employ a person or team to look after payroll for you. Of course, this article is not meant to be legal advice, just to provide you with some general information about the subject. If you are unsure about your businesses tax returns then you should consult legal advice so you get the correct information based on your business.

Download the white paper and see how you can create an integrated, engaging employee experience using people analytics!

Image via Pexels.com

Leave A Comment