In this post, we’ll provide a bit of background about what the Flexible Spending Account (FSA) rollover option is and how it works. We’ll also cover details about when it applies and what to expect in different situations.

What is the FSA rollover option?

The FSA rollover option is offered by some employers to employees as a form of protection against losing funds in a Medical FSA. This includes funds in either a General Medical FSA or a Limited Medical FSA.

As background, all FSAs come with a built-in “use-it-or-lose-it” rule. This rule refers to the default treatment of unused funds at the end of the plan year. Depending on how the FSA plan is designed, unused funds might be forfeited by the employee.

When the FSA rollover option was passed in 2013, the goal was to introduce more flexibility toward the treatment of unused funds at the end of the plan year. The FSA rollover option allows employees with an FSA to roll over up to $500 of unused funds into the new plan year. Think of it like unused vacation time that carries into the next year.

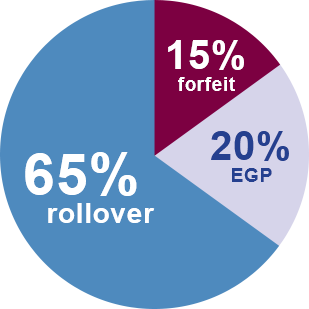

Since the FSA rollover option was introduced, it has gained traction with employers, with 65%* currently offering the option.

How does the FSA rollover option work?

There are rules as to when an FSA rollover is permitted. Here’s a few examples:

The FSA rollover only happens AFTER the run-out period of the prior plan year has finished.

If your company offers a run-out period, that must end before you are given access to your rollover balance.

People often think that the $500 will rollover at the end of one plan year and be available on the first day of the next plan year. However, this is not the case. While the new FSA funds from the new plan year are available on day one, the rollover funds are only made available after the run-out period at your company has been completed.

Once the run-out period and associated time periods (e.g. 21 day grace period for denied claims) have finished, the funds from the FSA rollover will be available.

The FSA rollover cannot be offered if an Extended Grace Period is also offered.

Employers are limited by the IRS for what they can offer to ease the “use-it-or-lose-it” rule. While 15%* of employers keep the “use-it-or-lose-it” provision in place, the remaining 85%* offer either the FSA rollover option or an Extended Grace Period (EGP).

What’s the difference? The FSA rollover gives employees up to $500 to carry into the next plan year after the run-out. The EGP option gives employees an additional two and a half months to use up FSA funds. (You should refer to your Plan Highlights for the times that are applicable to your plan).

You can read more about the EGP and how it compares to the FSA rollover option in our blogs here and here.

The employer decides the amount that can roll.

It is at the discretion of the employer to decide how much will roll up to $500. That number is not a guarantee. However, most employers allow the entire $500 to roll into the next year. (Again, refer to your Plan Highlights to determine the amount that’s applicable to your plan).

What happens if I don’t re-enroll in the plan?

Your funds still roll into the new plan year to use up. As a reminder, if your company offers a run-out period, that must end before you are given access to your rollover balance.

Let’s say you had an FSA in 2018 and you have an FSA balance that can roll, but you decided not to re-enroll for 2019. Once the 2019 year starts (and after the run-out ends), up to $500 of the balance will roll for you to use. You won’t have a new election amount to spend down. Just the rolled over balance.

How do I know if my employer offers the FSA rollover option?

To find out if your employer offers the FSA rollover option, you can check your Plan Highlights. Not sure where to find your Plan Highlights? Check out our blog “What are plan highlights and where do I find them?”

If you want to know more about the FSA rollover option, visit our FAQs page.

* Data based on BRI clients as of June 2018