Why tax pros should be up to speed on 401(k) plans

Every business owner has to make decisions that are outside his or her expertise. When it comes to small business 401(k) plans, our internal research has shown that an accountant or bookkeeper is most likely to be the first person a business owner turns to for answers.

As a tax pro, you probably know the tax benefits and contribution limits of a 401(k) plan, but do you have the information you need to help your clients choose a plan? Like, what do typical fee structures look like, or what common mistakes do smaller employers often make? This three-part guide goes beyond the basic tax benefits to give you more information to help clients make great decisions about their 401(k) plan. Offering the right plan can mean saving more for retirement, improving your client’s relationship with employees, and avoiding extra work.

This article gives you some basic information about how people like your clients think about retirement plans and what you can do to help them make good decisions. In parts two and three, we get into more detail about 401(k) plans. Feel free to skip ahead:

- Part 2: How to help clients choose the right 401(k) provider

- Part 3: Quick answers to your clients’ 401(k) questions

A little info about small businesses (and their employees)

Research shows that less than half of all small businesses offer a retirement plan — and that half of all US families have no retirement savings. So when one of your clients decides to go the extra mile by offering a 401(k), it can have a big impact on the way their employees think about them:

- Close to 6 in 10 workers who are extremely satisfied with their benefits are also extremely satisfied with their jobs

- Retirement benefits are one of the two benefits employees want the most

- Employees with a retirement plan are significantly less likely to consider leaving their current job

- When offered, over 80% of employees participate in company-sponsored retirement plans

Are 401(k)s required?

No states currently require employers to offer a specific kind of retirement plan, but several states have passed legislation that establishes a state-sponsored retirement plan (like CalSavers in California and OregonSaves in Oregon) and/or mandates that businesses provide a retirement plan. These state-sponsored plans are a helpful step for putting employees in better shape to retire, but a well-run 401(k) plan can mean lower fees for businesses and employees — and higher annual contribution limits than existing state-sponsored plans.

Is a 401(k) the right type of retirement plan to recommend?

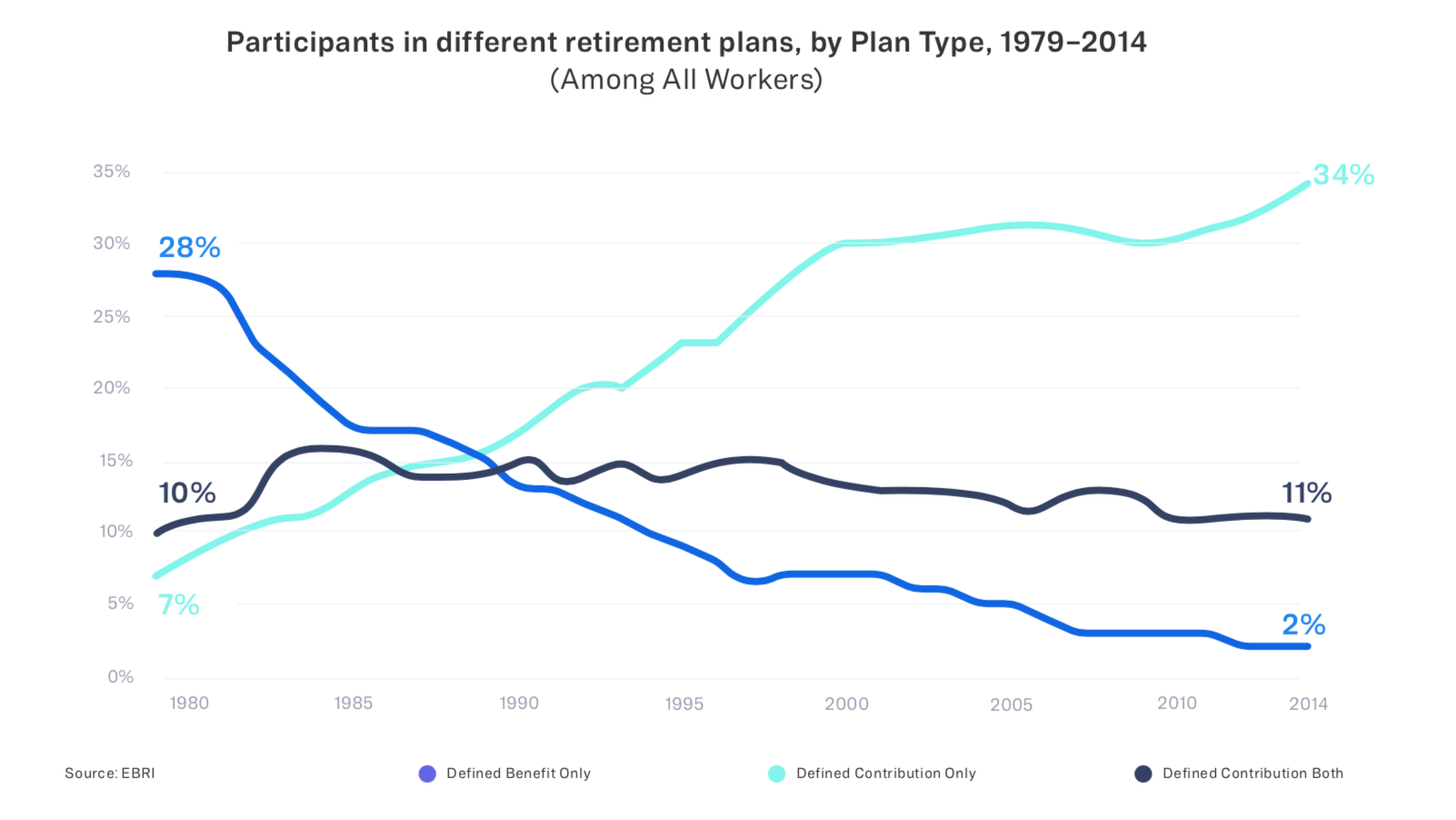

Defined contribution plans, including 401(k) plans, provide employees more flexibility to take control of their own retirement contributions than definied benefit pension plans.They also give participants more control over investment decisions. And, best of all, the employee accounts are portable. If an employee leaves the company (or if the company fails), their account can easily be rolled over into another 401(k), or an Individual Retirement Account.

Why accountants and bookkeepers should offer help with retirement plans

Offering retirement plans (or at least some good advice about them) is another way for you to be useful to your clients. At the very least, you’ll be showing off the expertise that brings clients to you in the first place. But some accountants find that they are able to include establishing and maintaining client 401(k) plans in their billable services.

For an example of how a 401(k) provider can help accountants or bookkeepers manage multiple 401(k) plans on behalf of different clients, take a look at our 401(k) plans for accountants.

Let’s dive deeper

Move on to parts two and three of this series to get detailed information about how to help your clients with their retirement plans:

- Part 2: How to help clients choose the right 401(k) provider

- Part 3: Quick answers to your clients’ 401(k) questions

This content is provided for informational purposes only and is not intended to be construed as tax advice. As a tax professional, it is your responsibility to ensure you understand tax regulations and take your clients’ unique circumstances into account when furnishing tax advice.