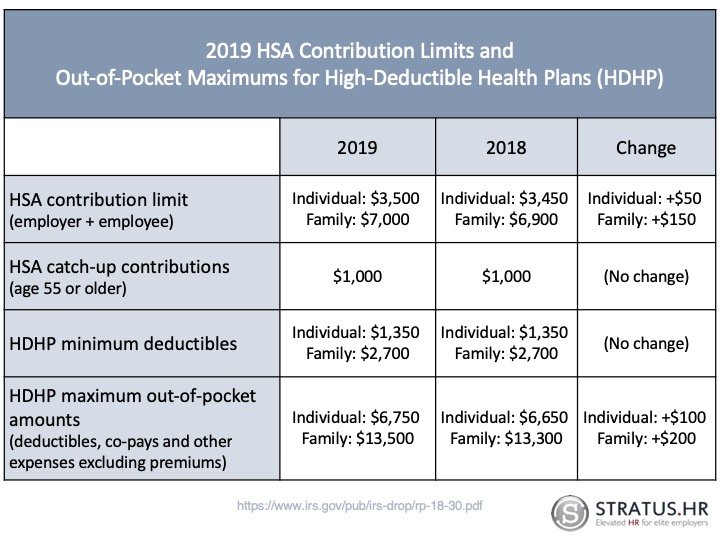

The IRS has announced the 2019 contribution limits for health flexible spending accounts (FSA), as well as limits for health savings accounts (HSA) for those with a qualifying high deductible health plan (HDHP). For 2019, Health FSA contribution limits will cap at $2,700 (an increase of $50 from 2018), and HSA limits will be at $3,500 for self or $7,000 for family (click on the side charts for more details). The Dependent Care FSA contribution limit will once again cap at $5,000 for 2019.

Flexible Spending Account (FSA or Flex Spending)

Flexible spending allows participants to set aside pre-tax dollars to apply to the upcoming calendar year’s out-of-pocket expenses related to eligible medical, dental, vision, pharmacy and dependent care. The major advantage to enrolling in FSA is lowering your taxable income.

Per IRS guidelines, up to $500 of any unused dollars left in your FSA account at the end of the year can be rolled over and used in the subsequent year for eligible expenses. The rollover amount does not count towards the annual election limit of $2,700. Any unused amount in excess of $500 will be forfeited.

Open enrollment is the only time, barring qualified life events, when eligible employees can enroll in FSA benefits for the upcoming calendar year. Flex spending dollars can be used in addition to other insurance plans. Open enrollment has an effective date of January 1, 2019. Please watch for more details about FSA open enrollment for 2019 from our Stratus.hr benefits team.

Health Savings Account (HSA)

If you are currently participating in a Qualified High Deductible Health Plan (HDHP), you are eligible to contribute pre-tax dollars to an HSA. An HSA is similar to an FSA, in that they both lower your taxable income and are used to pay for eligible health care expenses. The HSA differs from the FSA in that it has a higher maximum annual contribution ($3,500), and the money in your account accrues from year to year like a bank account and earns interest. In other words, if you don’t use it, you don’t lose it. You can also change your HSA contribution throughout the calendar year.

If you do not currently participate in an HDHP, you will not be eligible for an HSA. If you participate in an HSA, you cannot participate in an FSA, too. (Exception: you may have a limited-purpose FSA, which can be used for dental and vision expenses only, not medical expenses.)

For more information about FSAs, HSAs, open enrollment, or any other benefit-related question, please contact our benefits team at benefits@stratus.hr.

2019 HSA Contribution Limits

Note: These are federal minimums/maximums for HDHPs and may not reflect the limits of your specific HDHP.