HR’s Guide to the Form W-2

If you’ve been in HR for any number of years, you know year-end payroll can be a challenge. Much of that is due to the the Form W-2, formally known as the IRS Wage and Tax Statement. Don't scratch your head just yet. This guide breaks down everything you and your employees need to know to have a smooth filing season.

What is the Form W-2?

This critical IRS document summarizes employees’ annual compensation and deducted taxes, and it is the primary form used when individuals file their annual tax returns. It might also be used by third parties to validate someone’s earnings, like in the case of applying for an apartment or mortgage. In other words, getting the form right matters—which is why over two-thirds of midsize companies just outsource the task altogether.

What does the Form W-2 look like?

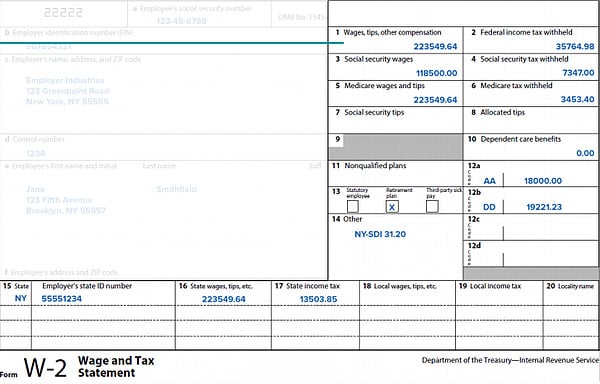

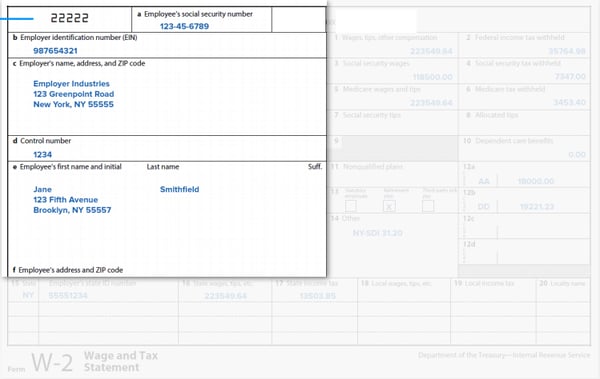

The W-2 form has two distinct sections for your employees to fill out. The first section consists of lettered boxes for employee personal information and employer information. These boxes are lettered "a" through "f." You can view this section below.

The rest of the W-2 is populated with financial information and IRS codes. This section is made up of numbered boxes spanning "1" to "20". Be sure that your employees enter their information accurately when completing their tax returns. State and local tax information can be found at the bottom of the form. For a more detailed break down of each individual box, download our full Guide to the Form W-2.

When is the Form W-2 due?

All Form W-2s must be filed and distributed to employees by January 31, or the next business day should the date fall on a weekend or holiday. When the deadline comes, don’t be surprised if employees start mistaking you for a tax advisor. Whether their questions concern specific numbers or the seemingly random codes that populate Box 12, individuals will likely come to you first.

Get ahead of those employee questions with Namely’s Guide to the Form W-2. From Box A to 20, we’ve broken down what each section of the form means and all the nuances you need to consider. Field questions like a certified pro—without giving any tax advice, of course.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoYou May Also Like

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!