As you have likely heard, the Department of Labor recently made a final ruling on the Fair Labor Standards Act regarding overtime standards. This ruling will affect about 4 million employees and in turn, the organizations they work for. So how might you be affected by this new standard? We’ve compiled a few articles and resources to help you get caught up on the news and learn what lies ahead:

Final Rule on Overtime Issued by U.S. Department of Labor

“Effective December 1, 2016, employers will be subject to new overtime rules issued by the DOL. To be ineligible for overtime, employees must be paid a predetermined fixed salary of at least $913 per week ($47,476 per year). If the employee’s salary does not meet this threshold, the employee must be paid overtime for any hours worked over 40 hours per week.” - National Law Review

If you haven’t had time to read much about the new standard, this article from the National Law Review breaks down the basics and outlines the important key takeaways from the ruling like the salary threshold employees must meet to be exempt from overtime payment as well as the importance of properly categorizing employees in terms of executive, administrative or professional according to the duties they perform.

Don't be afraid to approach the DOL's overtime ruling. Read these quick explainers:

Read more: Overtime Lawsuit Possibilities (Fortune)

3 Things You Need to Know About the New U.S. FLSA Overtime Rules

“There are a couple ways that companies plan to address the changes to the FLSA salary floor. Some will reclassify employees whose pay falls shy of the $47,476 annual threshold as non-exempt workers, choosing to pay those workers appropriate overtime wages, as well as ensure meal and rest breaks.” - PayScale

Once you’ve read up on the details of the recent overtime ruling, you may want to consider your options in order to meet compliance. In this post from PayScale, the author outlines points from the ruling and goes on to give employers options on what to do next and how to make those transitions smoothly such as communicating changes to employees and managers as well as updating policies to reflect the new changes.

If you read anything about the overtime policy, let it be these 3 steps:

DOL Overtime Ruling Will Change Recruiting

“Entry-level management positions are going to disappear and those employees will fall back into hourly jobs,” said National Federation of Independent Business President and CEO Juanita Duggan in a news release. “Small businesses everywhere will be affected, but most of the damage will occur in places where the cost of living and the wage scale is much lower than it is in Washington, D.C., or Manhattan, or San Francisco.” - Roy Maurer, SHRMblog

As companies gather more information on this ruling and what it will mean going forward, many fear for the impacts it will have on recruitment and bringing in top talent. Roy Maurer, online editor/manager for SHRM explores the effects many feel the ruling will bring to recruitment such as “selling” previously salaried roles with exempt-level benefits and perks as hourly jobs, minus those extra incentives.

Check this: The Surprising Upside to DOL Overtime Rule

Employers Ponder Benefit Changes Under New DOL Overtime Rule

“Will Hansen, the ERISA Industry Committee's senior vice president of retirement policy, addressed the rule’s implications for sponsors of Section 401(k) plans. He noted, for example, that a 401(k) plan may define “compensation” to include or exclude overtime pay. Sponsors of 401(k) plans may also have different eligibility and contribution rates depending on whether an employee is paid by the hour or is on salary.” - Joe Lustig, Bloomberg BNA

Not only will compensation need to be reevaluated but benefits may also need to be adjusted with the new overtime ruling, as the Bloomberg BNA points out. The article informs businesses that this is a great time to take a look into the current benefits they offer and the costs associated with each and even gives the steps to take to conduct an hours and compensation audit.

Now is a great time to conduct an hours and compensation audit. #OvertimeRules

Now is a great time to conduct an hours and compensation audit. #OvertimeRules

Bonus: FLSA Overtime Calculator

Trying to decide which route to take in reaction to the new ruling? This overtime calculator from ADP will help you compare the estimated of the two options side by side and decide which is best for you and your organization.

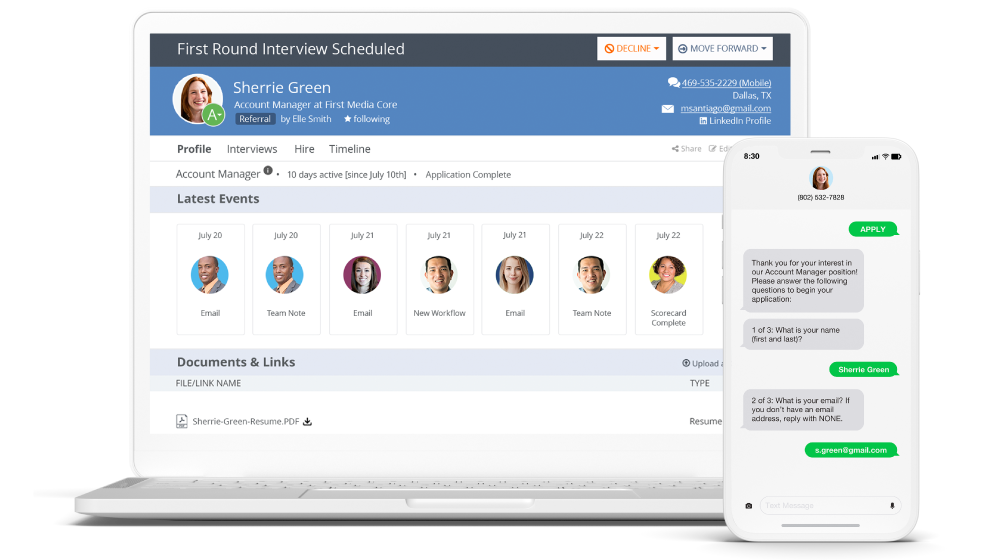

As organizations dive into more information about the new ruling and decide which path to take for their employees, it may be time to consider and audit the talent management practices used in the company as well. Taking the time to evaluate employee performance and associating it with the cost each path may result it may give leaders a better idea of which could be more valuable to the employees as well as the organization itself. You can start your talent management journey with us by touring our solutions today!

Recent Posts:

.png)