Fortune 500 companies and small start-ups operating out of the spare bedroom have one thing in common – the need to process payroll, calculate taxes and maintain records in a reliable way.

What are payroll services?

“Isn’t payroll easy? It’s just adding numbers and writing checks, right?”

That’s not even close to being correct (and not something you’d want to say around your payroll department). Think of payroll as a series of challenging, high-stakes tasks. In fact, payroll teams have multiple responsibilities, including:

- Filing tax and voluntary deduction reports

- Processing levies and garnishments

- Computing wage and overtime payments

- Calculating state, federal and employment taxes

- Maintaining compliance

- Entering new hires into the payroll system

- Recording and calculating payroll deductions

- Processing requests for paycheck advances

Processing payroll is a time-consuming burden for any business. It can be particularly onerous for smaller HR teams that would rather be focused on more strategic initiatives like modernizing their recruiting process or updating health & wellness benefits.

Do I need an entire payroll team?

Typically, there are 3 options for running payroll:

- Hire a professional employer organization (PEO)

- Manage payroll yourself

- Partner with an HR & payroll provider

Deciding which option is best for your organization can seem overwhelming, especially if you’re looking to streamline costs and mitigate processing risks. Fortunately, though, you don’t have to go at it alone.

Before we dig deeper into payroll solution providers, let’s explore why you may need help.

How much does payroll cost per employee?

It all depends on the efficiency of your systems. Here are a few examples of what drives up the payroll costs.

- The U.S. Bureau of Labor and Statistics estimates that companies have a payroll error rate of 1.2% each pay period. If you had 100 employees making an average of $900 a week at the end of the year, those “small” errors would have cost you $56,647.

- Part of the payroll process business owners must be aware of is paying payroll taxes. Companies that pay an incorrect amount on their payroll taxes (or don’t pay them at all) can face penalties and graduated accruing fees of up to 15% until the issues have been corrected.

- According to the IRS, 40% of medium and small-sized businesses are fined for failing to deposit withholdings, miscalculating taxes or submitting incorrect filings.

- A survey of employers found that their payroll teams were spending an average of five hours a week just calculating, filing and paying payroll taxes alone. That’s in addition to the time spent validating timesheets, entering hours and managing payments.

Understanding the true cost of payroll processing can help you make an informed decision about how your payroll process should be managed (and by who).

As if the payroll process wasn’t at times arduous enough, the pandemic turned much of what we knew upside down. Some companies lowered their workforces, the U.S. Congress introduced bills for a suspension of payroll taxes, and relief funds were made available.

There were similar changes at the state and local levels as well.

All of this was an attempt to help businesses survive and grow on the other side. That is, IF your payroll team was fluid enough to adjust to these changes.

Who’s managing your payroll processes?

Let’s look closer at the three ways your payroll needs can be managed.

1. Professional Employer Organizations

Outsourcing payroll to a Professional Employer Organizations (PEO) can be a great option if you want to be completely hands-off with your payroll processing and management. But there are some concerns you should address. For one, this is the most expensive option available to you. Also, when working with a PEO, it’s not a simple vendor agreement, as it would be with other outsourced tasks, they become your co-employer and typically require you to sign a long-term contract.

How much is it going to cost? Like all questions about payroll pricing, it can vary.

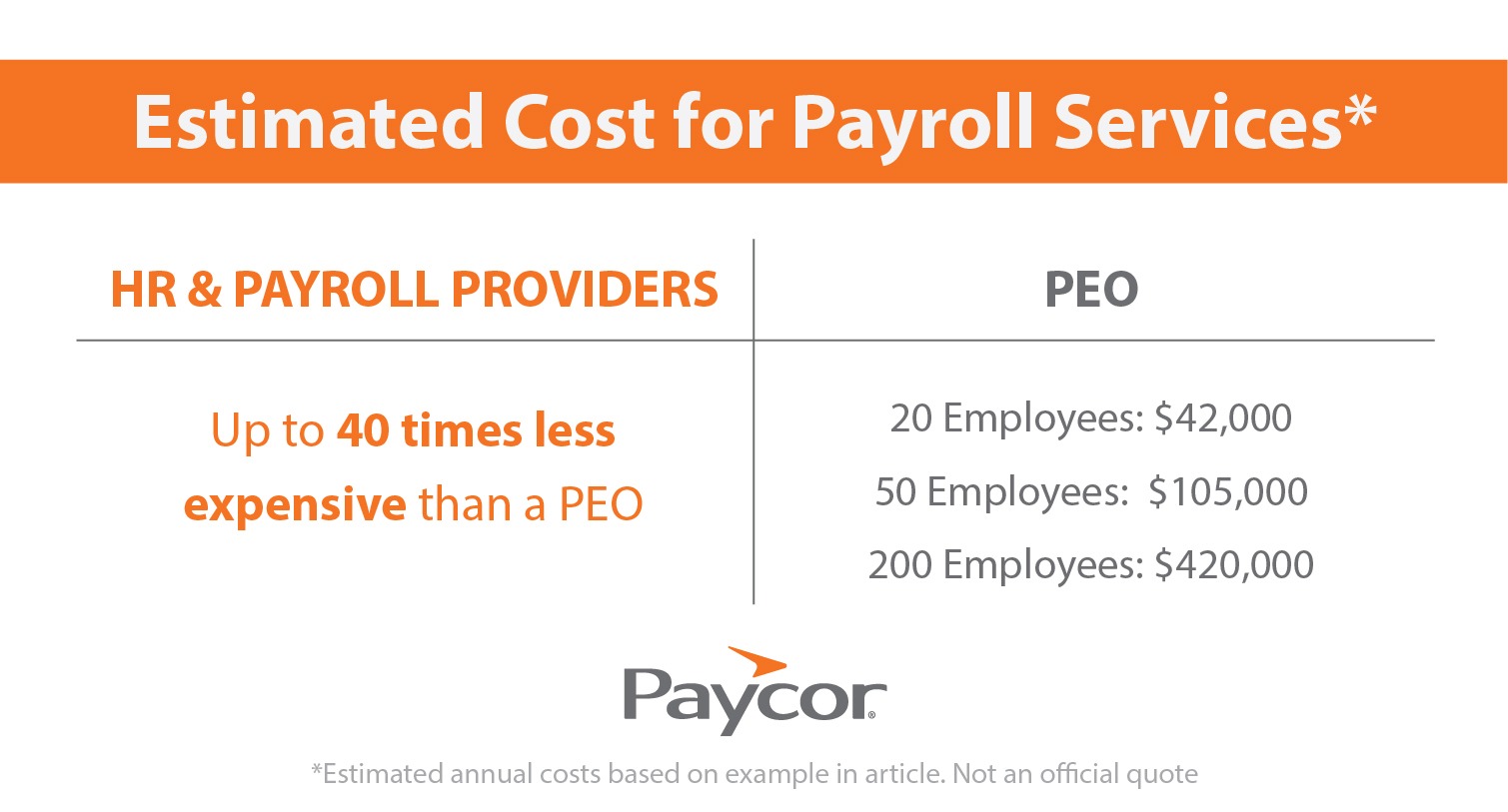

PEOs are typically paid by charging you a percentage of your total payroll, usually ranging between 2% and 10%. What does this mean for you?

Here’s an example: Let’s say you employ 20 people and you pay each of them an annual salary of $35,000. If a PEO charges you the industry average of 6% of your gross payroll, you will receive an annual bill of $42,000. The larger your organization grows, the more you pay.

Additionally, leaving a PEO could be a difficult process.

2. Managing payroll yourself

Many small and medium-sized businesses think manual, in-house payroll is a cost saver. IT’S NOT. In addition to the time burden, there are associated payroll costs and risks that most businesses don’t consider.

How much does it cost to run payroll for small businesses?

- Direct deposit & setup fees – $50 to $150

- Transaction fees – $31.50 per pay period

- Paper checks & printer fees – $60 per pay period

3. Partnering with an HR & Payroll Service Provider

When you partner with an HR & payroll software provider you’ll notice immediate benefits. From streamlining your payroll processes and calculating taxes accurately to maintaining records and free access to a dedicated team of payroll experts, it’s the perfect balance between completely outsourcing payroll to a PEO and managing payroll yourself.

An HR & payroll provider usually charges a fee per employee per pay period. But these fees are minuscule compared to a PEO, cents on the dollar. With an HR & payroll provider, you can expect to pay up to 40 times less than a PEO.That’s a small price to pay for accurate and streamlined payroll, ensuring compliance and peace of mind.

Unlike PEOs, with a payroll service provider there’s no long-term commitment. And, the larger your organization grows, the less you pay per employee.

Paycor has Perfected Payroll

For more than 30 years, Paycor has listened to leaders and used that feedback to perfect our payroll services. We’ve modernized every aspect of people management, from recruiting, onboarding and payroll to career development and retention.

Are you ready to explore how you can make your payroll processing easier?