Despite their role managing corporate expenses, chief financial officers (CFOs) are more concerned about how well benefits make employees happy and healthy than the costs of plans. Since 2002, the Integrated Benefits Institute (IBI) has been surveying CFOs to help benefit professionals develop business-relevant evidence that aligns with the C-suite’s strategic priorities. This year, IBI, in partnership with CFO Magazine, surveyed more than 300 CFOs and other senior financial executives to better understand how they incorporate benefits strategy into their financial decisions. Results show that these executives take a strategic view of employee health, valuing a plan’s outcomes over its costs. In fact, less than one in five of those surveyed stated that controlling healthcare costs is the most important consideration when making benefits decisions.

“Our study highlights the value of conversations with CFOs to build the case for health as a business strategy,” says Brian Gifford, Director of Research and Analytics at IBI. “If you communicate the value of health investment as if they are strictly focused only on costs, then you run the risk of being tone deaf to what they are strategically trying to accomplish for their businesses and organizations.”

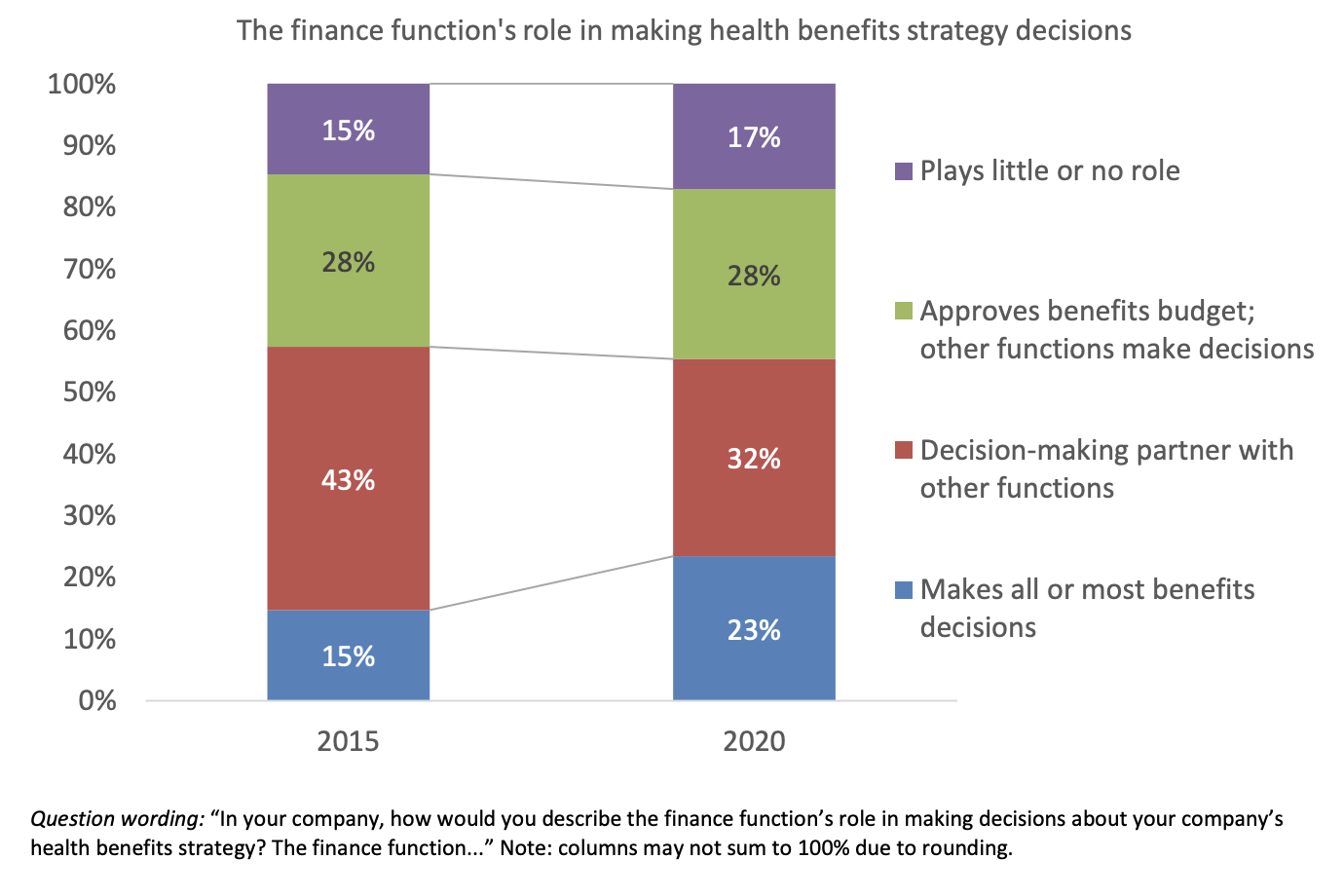

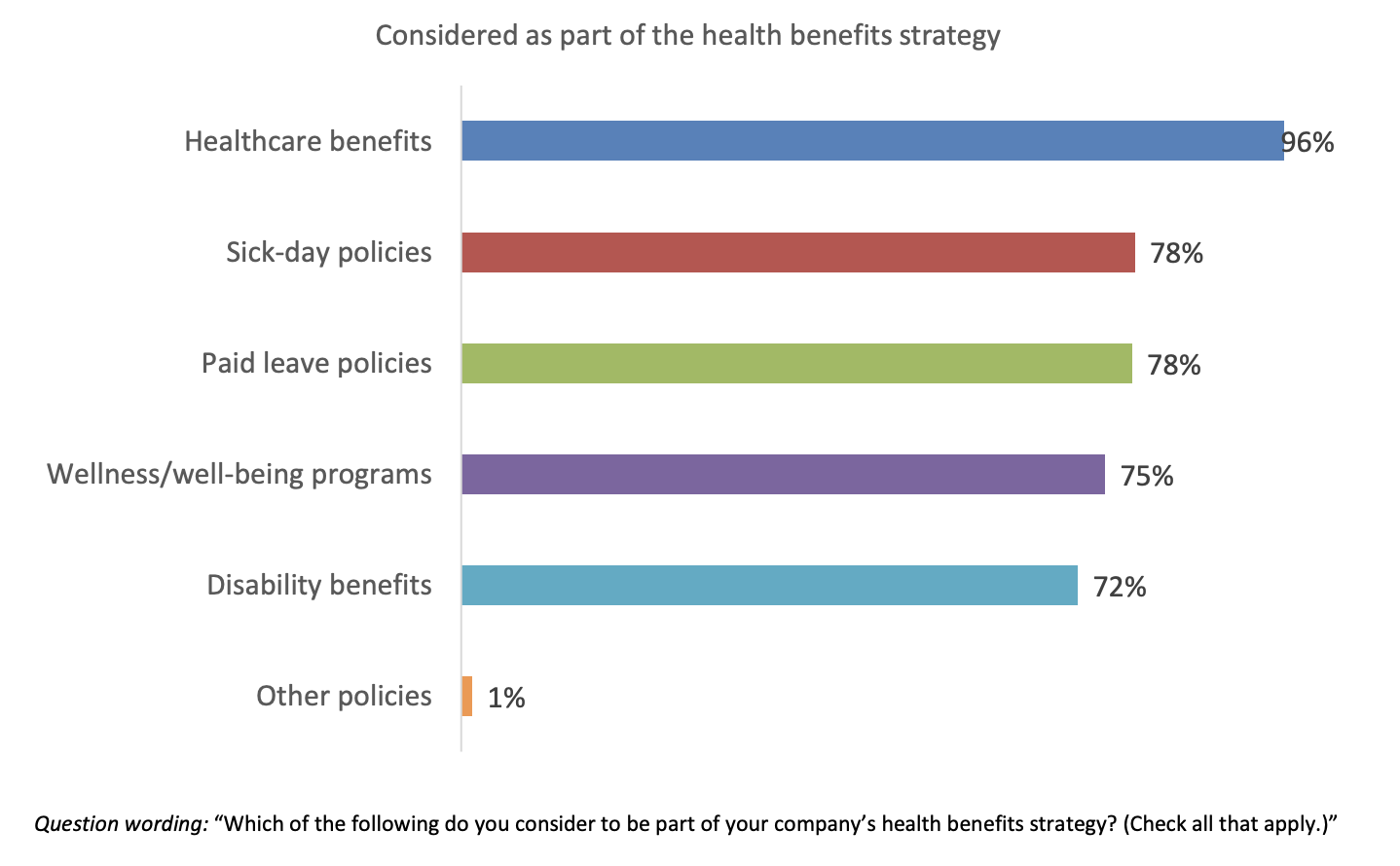

These financial executives are deeply involved in benefits strategies; more than half of CFOs surveyed make all or most benefits decisions or are involved in making these decisions in partnership with colleagues. Roughly three quarters consider time off and wellness policies as an important part of their strategy. Above all, these executives want to be convinced of a health plan’s value; those surveyed said, above all, they want to see the data on how employee health affects business success. Healthcare utilization and employee mental health conditions are also top concerns by CFOs.

The potential savings a company can reap from cheaper plans and less extensive benefits is only one factor when it comes to measuring a wellness program’s full value. Today, savvy executives understand that poor employee health negatively affects productivity, talent retention, and employee morale, cutting into company revenue and undermining any cost savings made from less effective programs and benefits. When making the case for wellness program offerings, it is important that non-financial goals and metrics that align with a company’s health and productivity strategy need to be communicated to CFOs and senior leaders.

Align Wellness Benefits With Company Goals

It is no secret that unhealthy employees are a big financial liability. Poor health leads to more sick days and time off, impaired focus and under-performance, greater employee turnover, and higher healthcare costs. Likewise, healthier employees are more productive and lead to greater profits—and it isn’t just physical health that leads to these benefits. Competitive programs attract top talent, improve talent retention, and support happy employees that make better use of their time.

Cost alone fails to give an in-depth view of how engaging, effective, or relevant particular benefits and plans may be for employees. When making benefits decisions, it is important to present financial executives with data that links how certain plans can support specific company goals. While robust and holistic programs are important, programs create the most value when they cater to a workforce’s particular needs; so, in addition to an employer’s goals, address the specific health or wellness challenges affecting employees in order to create the most engaging benefits.

In short, CFOs recognize the value in a thriving workforce, and as a result, they are willing to invest in the resources necessary to develop a team that will allow the company to succeed in an increasingly competitive environment. Knowing this, human resource professionals should advocate for benefit plans that cultivate a culture of health rather than ones that offer the lowest price or “check the box” for a perceive requirement.