Does your business have a contract with the government? If so, you may be responsible for following specific federal regulations, like reporting on your efforts to employ veterans. How much do you know about your VETS reporting responsibilities?

What is VETS reporting?

The Vietnam Era Veterans’ Readjustment Assistance Act of 1974 (VEVRAA) established VETS reporting as an affirmative action effort to prevent discrimination and encourage employers to hire veterans. VETS reporting requires employers with qualifying federal government contracts to report employee information—including which employees are protected veteran—annually using the VETS-4212 Report.

“Protected veterans” include those who are:

- Active duty wartime or campaign badge veterans

- Armed forces service medal veterans

- Disabled veterans

- Recently separated veterans

The VETS-4212 Report breaks down employees by job category and veteran status. It also asks employers to report new hires during the previous 12 months. Prior to 2014, the VETS-4212 Report was known as the VETS-100A Report.

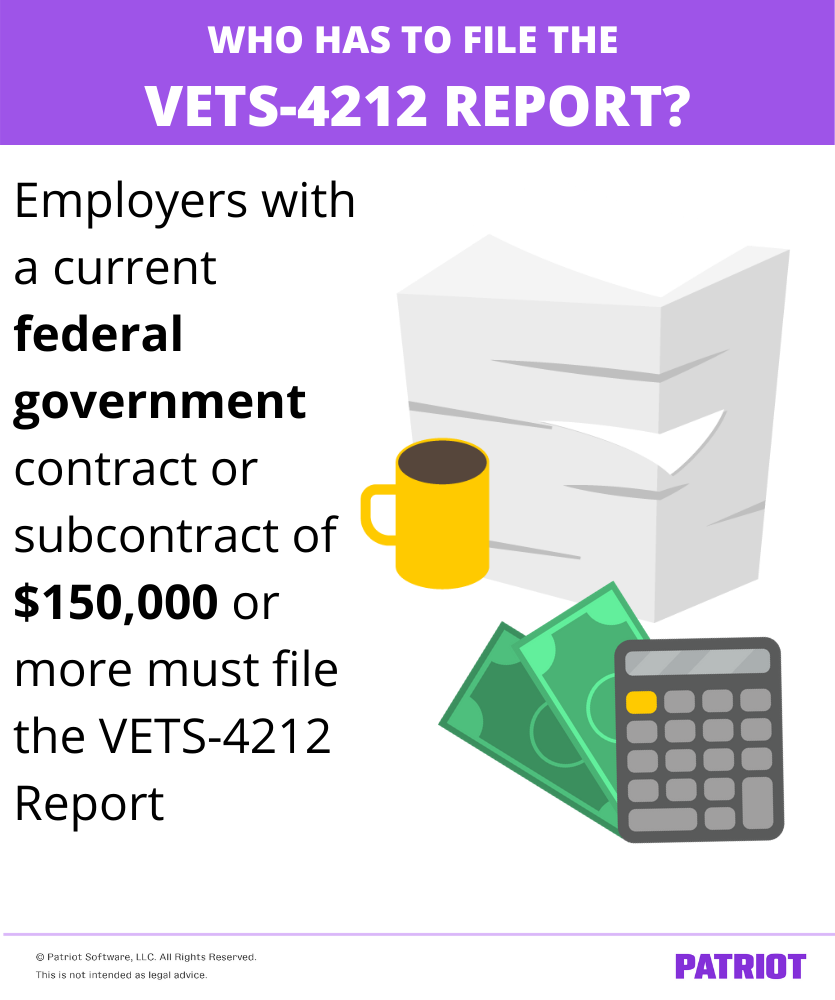

Who has to file the report?

Not all employers have to report on veteran employees. You must file the VETS-4212 Report if you have a current federal government contract or subcontract worth $150,000 or more. This includes both prime contractors (businesses that are the direct contract recipients) and subcontractors (businesses contracted by businesses with a federal contract).

Services your contract may revolve around include:

- Utility

- Construction

- Transportation

- Research

- Insurance

- Fund depository

If your contract worth $150,000 or more ends before July 1 of the previous year, you can stop filing a VETS-4212 report.

What happens if you don’t do VETS-4212 reporting? Although you won’t be fined, the agency you have your contract through will be banned from entering into a future contract with you.

How to file the VETS-4212 Report

So, do the VETS reporting requirements apply to you? Here’s how to do it.

What does the form ask for?

You might be wondering what kind of information the form asks. Here’s the good news: the VETS-4212 Report is a short, one-page form.

Take a look at what you need to enter on the form for VETS reporting:

- Type of reporting organization (prime contractor or subcontractor)

- Type of form (single establishment or multiple establishments)

- Company information (e.g., address, name, hiring location)

- 12-month period ending

- North American Industry Classification System (NAICS) Code

- Data Universal Numbering System (DUNS) Number

- Federal Employer Identification Number (FEIN)

- Number of employees, split up by job category

- Number of protected veterans

- Total employees

- Number of new hires in the previous 12 months, split up by job category

- Number of protected veterans

- Total new hires

- Maximum and minimum number of permanent employees

Job categories are broken down by executives, managers, professionals, technicians, sales workers, administrative support workers, craft workers, operatives, laborers/helpers, and service workers.

When is the VETS-4212 form due?

File the VETS-4212 Report between August 1 and September 30. Turn in the form before the end of this annual filing period.

How do I submit the form?

You can submit the VETS-4212 Report either online or by using a paper form.

If you want to file electronically, you can either:

- File online using the Reporting Application

- Use a batch upload (the DOL encourages this if you have more than 10 hiring locations)

If you want to file a paper form, you can download a PDF of the form, fill it out, and:

- Email to vets4212-customersupport@dolncc.dol.gov

- Mail to:

- VETS-4212 Submission

- Veterans’ Employment and Training Service Center

- Department of Labor National Contact Center (DOL-NCC)

- 7425 Boston Blvd

- Springfield, VA 22153

How can I make this easier on myself?

When it comes to filing federal documents, scrambling at the last minute is never fun. To simplify your VETS reporting responsibilities, keep detailed employee records, including:

- New hire start date

- Job categories

- Veteran status

Also, keep business-specific information, like your NAICS, EIN, and DUNS number, in a secure and accessible location.

Want to make VETS reporting even easier? Patriot’s Human Resources software add-on lets you add a new hire’s veteran status directly in your account. And, you can run a Demographics Report to get the data you need to enter on the VETS-4212 Report. Start your free trial and experience our payroll software and HR software add-on today!

This is not intended as legal advice; for more information, please click here.