Thinking of outsourcing your payroll? You’re not alone. Research indicates that a little less than half of all businesses in the U.S. already put their company payrolls in the hands of others.

Although “time” is usually the top reason for choosing to outsource (sound familiar?), there are plenty of other reasons companies hand off this essential duty to someone else. Still, outsourcing your company’s payroll doesn’t magically usher in unicorns and rainbows. As someone who has worked in the payroll outsourcing world for nearly 20 years, I can attest that payroll outsourcing can come with some potential risks to keep in mind.

Data security

Pros: Most outsourced payroll services and cloud-based applications go to great lengths to ensure your employee data is secure -- because nothing says “gotta go” like a client data security breach. (By the way, security breaches are more likely to occur when a well-meaning, internal employee uses a software application resident on his or her laptop and leaves the device or the program unsecured … in Starbucks.)

Cons: Of course, there are exceptions. For example, payroll and HR outsourcing giant ADP fell victim to a data security breach that affected the employee data of dozens of its clients. While the breach occurred outside of ADP’s secure system, it was facilitated because policies didn’t include strong data security enforcement.

In general, if your payroll provider isn’t taking measures like the following, your employee data is no safer than that laptop in the coffee shop.

- Generate a unique code for each new employee to set up an online profile

- Provide instructions for setting up an employee profile privately rather than listing them online

- Require strong passwords

- Encrypt confidential information

- Install patches (this should not be the responsibility of the client)

- Conduct security audits through an outside vendor

Advice: Ask questions about how data is secured, whether you’re planning to outsource to a large company or a single person. At Stratus.hr, for example, we encrypt ALL client employee data, do all of the updates ourselves, and we’re SSAE 16 SOC 1 Type 2 certified -- which means we’re audited by an independent firm to verify that our systems and controls are secured. (This audit also tells us if there are areas for improvement.) Also, stay away from any solution that stores personal employee data on a desktop rather than in the Cloud. Not only will Cloud security be better, you’ll get other benefits, too, like the ability to access the data and review payroll yourself wherever you are.

State, local and federal regulation compliance

Pros: Any good payroll professional should know which regulations apply to you and your employees, such as tax cutoffs. They should also know which payroll deductions are allowed, how bonuses affect taxes, what you can pay a teen, and more.

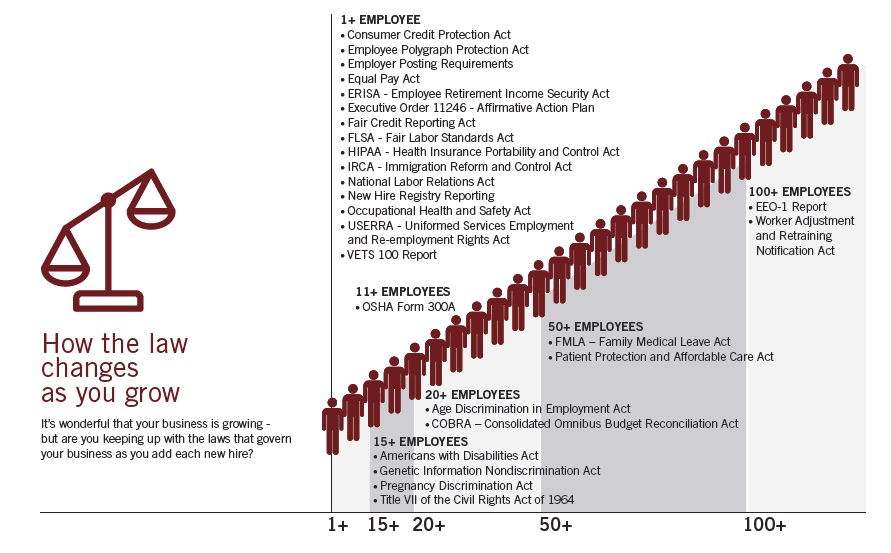

If you work with a PEO (Professional Employer Organization) for your payroll outsourcing provider, you should receive notifications of when you reach regulation thresholds and whether or not they directly affect payroll.

Cons: Giant payroll processors have a ton of people you can talk to but none provides the individual attention that’s required to keep you in compliance. In other words, if you work with a really big payroll outsourcing service, you’re still going to need to keep a close eye on everything.

Advice: Find out how each payroll provider you’re considering works. At Stratus.hr, for example, we provide HR outsourcing for a lot of clients and provide services like we’re their in-house HR and payroll departments. I personally process payroll for clients and work one-on-one with them to make sure everything is in order (all of our payroll, benefits and HR reps do this, too). So, yes, I know when there’s a regulation that needs to be addressed or when an individual employee request is going to require a change to payroll.

Costs of outsourcing payroll

Pros: You will pay less when you outsource your payroll since you’re not paying for a full-time person to run your payroll in-house. Outsourcing also beats running payroll yourself, which can get very costly very quickly in both time and potential for errors.

Cons: In terms of cost, some payroll providers nickel and dime you for everything. (You need to run an extra check because somebody missed their time punch? Extra charge. You’re changing your PTO plan? Extra charge.) Check the fine print of their service fees. You’ll also want to ensure the organization stays on top of the regulations that you need to meet or else you’ll be paying fines for noncompliance. Then there’s also the concern about getting the level of service you want for the price you’re paying. In any of these instances, you may wind up spending extra to get those additional services through another resource and/or have to settle with a frustrating provider that is simply the “best bang for your buck.” (Or so you thought.)

Advice: Do some quick math -- how much time is your existing staff spending on payroll? Consider the costs of hiring a full-time (or even part-time) payroll professional, with or without all of the recruiting and potential turnover costs. Then get a quote to compare expected wages v service fee. If you’re still not sure, compare the services you’d get from a team of professionals at the outsourced price versus what an individual employee can do. Although I may be biased, I know first-hand that my clients need more than just my payroll expertise, which is why our full-service HR team is such a perfect fit for growing businesses.

Answering questions about payroll

Pros: Ever notice that paychecks seem to breed questions? Fortunately, when you outsource your payroll, you won’t be the one who has to answer all of them. Most large payroll providers, including Stratus.hr, also provide employees with an online, self-service portal where they can view their check stubs, make withholding changes, update their direct deposit account(s), and get the majority of their payroll and HR questions answered on their own time.

Cons: Sometimes a self-serve HR system isn’t enough. And there’s nothing more frustrating than telling an employee with a paycheck problem to call a number that leads to a phone tree that’s staffed by someone who has never heard of him or her and who has to get all of the background information again, open a case, and do some research before returning with an answer. Or worse, when the payroll provider is "not authorized to answer employees’ payroll questions" and kicks the question back to you.

Advice: Choose a payroll provider that gives your employees a self-serve HR system along with a dedicated rep for any questions that need a human touch. It’s how we operate at Stratus.hr -- all of us who work with payroll know the names of the people whose paychecks we’ve worked on, which means it’s pretty easy for us to get an individual answer about any question quickly, assuming they can verify who they are. Stratus.hr also has a handy “chat feature” built into our website for employees to instantly chat with one of our representatives, making it really easy and convenient for them to communicate with our team.

Bottom line: consider the pros and cons of payroll outsourcing and then decide if it’s right for you. Outsourcing isn’t the right decision for every company, but it certainly works great for my clients.

At Stratus.hr, we ensure the companies we work with are compliant with all applicable regulations as they grow - because nobody likes paying fines.

Stratus.hr has a “chat feature” built into the website for anyone to instantly chat with one of our representatives.

Is outsourcing right for your business? Find out today! Book a consultation and let Stratus.hr give you a free quote customized to your specific needs.

Image credits