Payroll has a lot of moving gears. From collecting time cards to withholding taxes, it can be, well, a lot. To simplify your payroll responsibilities and put more time back into your day for other tasks, you may consider getting payroll software. But, what’re the kinds of payroll system features you need to look out for while shopping around for software? Get the rundown of the must-have payroll features and benefits for your business below.

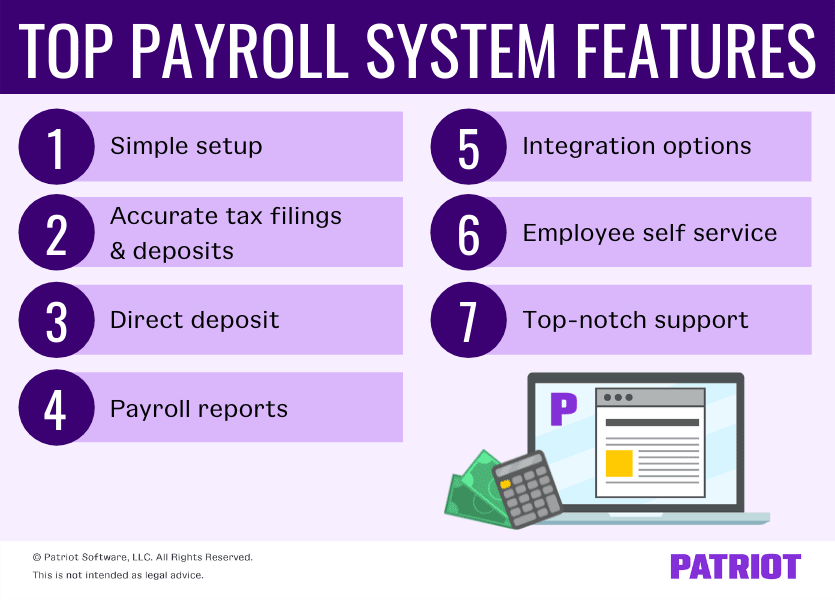

Must-have payroll system features

Researching payroll software can be exhausting, especially if you’re a new employer or aren’t too familiar with software platforms. Not sure what kinds of payroll management software features to watch out for while looking for software? Keep these seven features in mind (and on your wishlist).

1. Simple setup

As a business owner, you know time is oh-so-precious. So, why would you want to spend loads of time setting up software? When searching for payroll software, look for one that offers a simple setup.

Simplified payroll setup may come in the form of:

- An easy-to-use startup wizard

- Free payroll setup

- Importing capabilities

When researching payroll software companies, look into their setup options. Do they have an option for someone else to set up your payroll account for you? What is it like to set up an account with them? Ask these questions and look at customer reviews to see what others have to say about the setup process.

| Looking for payroll software with a simple setup process? Stop your search and start a free trial with Patriot’s online payroll. With an easy-to-use startup wizard, free setup, and expert support, what’s not to love? Get your free 30-day trial today! |

2. Accurate tax filings and deposits

One of the major pain points of running payroll is dealing with payroll tax withholdings and filings. To streamline your payroll even further, consider finding software that offers a feature where the company does the filings and deposits for you (aka full-service payroll software).

If you want software that handles calculations and collects, files, and deposits your payroll taxes on your behalf, look for software that:

- Handles federal, state, and local payroll taxes (collecting, filing, and remitting)

- Does year-end W-2 and W-3 filings

- Has guaranteed accurate tax calculations, deposits, and filings

- Does automatic tax updates

Check to see what’s included in the payroll company’s full service package. In some cases, they may not charge any additional fees for year-end filing.

If you’re not interested in going the full service route, look for basic payroll software. Compare things like features, costs, and reports.

3. Direct deposit

In this day and age, direct deposit has taken over the workplace. For many businesses, long gone are the days for paper checks and cash. And if you’re like most employers, you (and your employees) likely prefer direct deposit, too. So when looking for software, check out your direct deposit options.

Most payroll companies have some type of direct deposit option. Take a look at the following when it comes to direct deposit:

- Timing options (e.g., 4-day)

- Additional fees

- Expedited direct deposit options (e.g., 2-day)

- Direct deposit limits

Also, be sure to look into if the payroll software has any free direct deposit options. Ask each provider how much their direct deposit costs and what kinds of fees are associated with it.

4. Payroll reports

Another feature to add to your ultimate wishlist is robust, accurate, and easy-to-access payroll reports.

The last thing you want to do is go to find payroll information, have to dig for it, and can’t find the information you need. Instead of scrambling to put together reports and gather information, find software that offers a variety of reports that you can access with a few clicks.

Check to see if the payroll provider offers the following reports:

- Payroll details

- Payroll register

- Check payment detail

- Payroll tax liabilities

- Forms W-2 and W-3

- Form 940

- Form 941

If you use a full-service payroll that handles taxes and filings, make sure you can also access reports on:

- Tax collections

- Tax deposits

- Tax filings

Explore how you can break down reports, too (e.g., by employee). And, find out if there’s a way for you to test out the reports to see how they work and what they look like before you make any moves (e.g., free trial).

5. Integration options

You’ve got a lot of things on your plate along with running payroll, like collecting timesheets, managing employee documents, and handling accounting tasks. That’s why you need payroll software that can seamlessly integrate with other platforms and software.

Here are some things you may want to integrate with:

- Accounting software

- Time and attendance software

- HR software

- Workers’ compensation

Ask each payroll company which platforms they integrate with and if there are any additional costs to integrate. Consider seeing what other kinds of software the provider offers besides payroll. That way, you can keep all of your software under one login and have all of your information in one spot.

6. Employee self service

Another feature you should look for in payroll software is an employee self service portal (bonus if it’s free!). Employee self service, or ESS, allows employees to make changes to personal information, view pay stubs, and review benefits details.

With an ESS, employees may also be able to view their W-2s at year-end, track their time cards, and print payroll information (e.g., year-to-date report).

While looking for software, determine whether or not they offer a portal, how much it costs (if anything), and what its capabilities are.

7. Top-notch support

Having excellent support is a must when purchasing payroll software, especially if you’re new to the payroll world.

When looking at support, consider aspects like hours of operation, where the support team is located, and how you can get in contact with them (e.g., email, phone, etc.). And, find out whether support is free or if it comes with a price tag.

Take a look at reviews to see other customers’ experiences with the support team. If you see more negative comments than positive about the company’s support, it may be best to go in a different direction.

If you really want to get a good idea of the support level, test the waters by calling them to ask questions about the payroll software. That way, you can find out firsthand how long it takes to get ahold of a representative and their level of expertise.

Other things to look for in payroll software

There are likely plenty of things you’d like to add to your payroll system wishlist. Here are a few more perks you should look out for:

- Low pricing

- No contracts

- No hidden fees

- Customizable payroll

- Quick payroll processing (e.g., three-step payroll process)

- Strong security

- On-the-go capabilities (e.g., mobile-friendly software)

To help decide which payroll application features and factors are a must for your small business, make a list to refer to when shopping around. Once you find a few potential software companies, weigh your pros and cons to narrow down which is the best fit.

This article has been updated from its original publication date of December 16, 2015.

This is not intended as legal advice; for more information, please click here.