Arguably there is no more central issue in global payroll than compliance. While adhering to these regulations can present a challenge, the ultimate gain is the assurance of trust and protection of personal information. A trust that is an essential building block for developing employee loyalty. Payroll is after all responsible for making sure that people receive the correct pay and on time- a challenge that is getting more difficult with payments fraud on the rise. The US Federal Trade Commission warns that post-Covid scams will be rife, with criminals trying to access sensitive data and payment information under the guise of updating systems. To dedicated payroll companies, consumer and employee security is paramount and consequently, tightly secure authentication processes are in place to protect clients and employees.

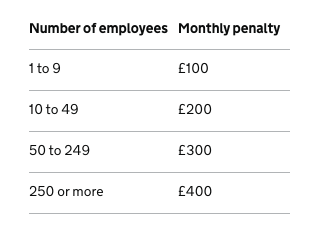

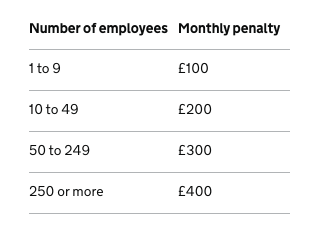

Payroll is also responsible for making sure that correct deductions are made as they apply to each country and that employees have transparency regarding these deductions through their payslip. From the organization’s perspective, payroll must ensure that all its state and local tax obligations are met. For example, in the UK if an employer does not submit their payroll information on time, they face the following fines:

In the US, the penalties for failing to deposit payroll taxes on time are charged at a percentage of your gross payroll deposit.

Other areas that present a challenge to ensuring compliance

- Expansion into new markets

Increasing globalization and digitalization brings further considerations into play. The payroll team might find itself extended across multiple geographies. A company with employees in a dozen countries will obviously encounter differing laws and state and local rules relating to taxes, benefits, and deductions, as well as security and data protection laws—which get costly if breaches occur. As the seasons change, so do regulatory conditions. Keeping up with every amendment and modification in every jurisdiction relevant to your business is time-consuming and specialised work. While a company is well placed to take care of payroll, their compliance, and by that, I mean their adherence to the rules of a particular country, impacts the trust factor of that company. In a world where cross-border mergers and acquisitions are increasingly common, 10,000 M&A deals were completed in the first four months of 2021, an organization can quickly find that its strategic priorities lead it to take over a company in a territory where it has no prior experience. These deals take place every day, accompanied by high-level launches and marketing campaigns, but in their wake they leave administrators with a significant new responsibility, one that comes with new perils, as failure to meet the requirements, quirks and exceptions of the new market can lead to expensive mistakes. In these instances, payroll must strive to ensure seamless functionality and operations, continued compliance and smooth severance and payroll processes.

The post-Covid landscape promises an even more globalized workforce. Companies wishing to avail of a wider global talent pool need to assess the administrative complexities of calculating and reporting payroll. In the United States, state taxes vary state to state, so a company with employees in California and Nevada (which is one of a handful of states which levy no state taxes) will have different regulations.

- Range of complexity differs per country

In terms of complexity, some countries have tighter rules and regulations, deeming them more complex places to conduct business. And while we may not seek out complexity if it can be avoided, they can be highly evolved in terms of the employee protections and in their adherence to data protection regulations. The flip side is that some countries, appearing to have fewer restrictions and complexities, attract businesses due to their easy start up process, but then problems arise, particularly in the increasingly complex area of data protection--which can lead to costly fines and reputational damage.

There are cultural and historical factors at play when it comes to a global workforce. France’s labor laws dictate a 35-hour workweek, with some industry exceptions, while in Spain there is a cap of 80 hours per annum in overtime. In Singapore, employee religion is required data to determine if a payment to the Mosque Building and Mendaki Fund (MBMF) is deducted.

Apart from the large volume of country specific legislation, there are also strict data privacy laws such as GDPR and the California Consumer Privacy Act to contend with. Businesses are required to have strict access controls on employee data. In 2020, H&M paid a hefty price, both financially and reputationally, when charged a €35 million fine for serious breaches of the GDPR principle of data minimization. It was the second-largest fine by any company under GDPR rules since Google’s €50 million fine the previous year. The German data protection watchdog’s year-long investigation found that H&M kept "excessive" records on the families, religions and illnesses of its workforce. The watchdog justified the size of the fine as a means of preventing future violations of privacy.

How Immedis assists payroll teams meet compliance complexities

The Immedis platform offers Country Specific Information (CSI), a detailed payroll database of employee information fields required to fulfill compliance requirements in any of the 150 countries we service. Using AI, data is continuously checked so that issues are quickly flagged, and payroll teams can fix any which arise. We make it our business to be current with all local legislation, so that our customers can be assured they are compliant and turn their attention to their core business.

Take a look at how it works.