Though your benefits package may be quite substantial, your employees may not know or understand the real value of the benefits you offer. And they may continue to remain unaware of the “hidden” benefits they are receiving even as healthcare costs rise, and you, the employer, absorb the increases.

In an effort to show employees the true value of their compensation, benefits factored in, many employers are providing total compensation statements.

What is a total compensation statement?

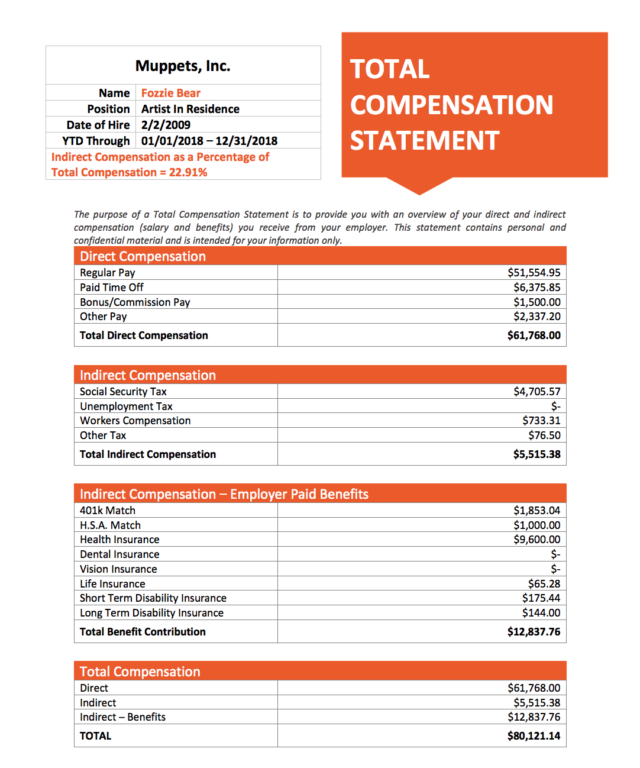

A total compensation statement communicates the entire value of an employee’s compensation package, including wages, which they already see in pay stubs, along with the hidden cost of the benefits that employers provide. It shares the full picture of compensation with employees who may not realize the true measure of what they’re being compensated from their employers.

A total compensation statement shares the full picture of compensation with employees who may not realize the true measure of what they’re being compensated from their employers. Click To TweetBelow is a total compensation statement template you can use to build your own forms. Typically, a total compensation statement is sent to employees once a year.

What’s included in a total compensation statement?

A total compensation statement includes the monetary cost of all forms of compensation on the part of the employer. This includes gross wages and extra financial compensation, such as bonuses or commissions, as well as the employer-paid portion of retirement plan contributions, insurance premiums, and paid time off benefits.

Processing payroll doesn’t have to be complicated or expensive—but if you’re doing it the wrong way, it can be both. Learn how to simplify the process: Download The Small Business Guide To Payroll today.

Following are items that would be listed on a total compensation statement:

- Salary/hourly wages

- Bonuses

- Commissions

- 401(k) matching contributions

- Social Security contributions

- Paid time off, including vacation, sick, and personal time

- Insurance, including health, dental, vision, life, disability, etc.

Outlining the total cost of all these benefits can be eye-opening for your employees. A total compensation statement will show the bigger picture and usually contains the following three categories:

1. Direct Compensation

- Base pay/overtime

- Commission/bonuses/incentive pay

2. Indirect Compensation: Taxes

- Social security tax

- Unemployment tax

- Workers’ Compensation insurance

3. Indirect Compensation: Benefits

- Health, dental, and vision insurance

- Life and disability insurance

- Health Savings Accounts (HSA)

- Retirement plan contributions (401k)

- Accrued paid time off (PTO/Vacation time)

- Educational assistance

- Relocation expenses

The indirect compensation categories typically include a column for the employee and employer contribution amounts, as many of these costs are a shared responsibility. This summary of indirect compensation is often referred to as the ‘hidden paycheck.’ These are real dollars that, without the employer’s contribution, could in fact be added to the employee’s responsibility. Don’t assume that employees know the total dollar value of your benefits—show them the big picture.

How does a total compensation statement provide value?

Although total compensation statements are not legally required, knowing the full value of their compensation packages can help increase employee morale and loyalty.

These statements can also serve as a basic—and extremely useful—retention tool. Here’s proof, as cited from a 2017 PayScale Compensation Best Practices Report:

Spending too much time on HR paperwork?

Completing paperwork (like total compensation statements) is important—but it probably isn’t the best use of your time and your skill set. We can help you by taking care of HR, benefits, payroll, and other tasks—so you can get back to working on your company.

Contacting Genesis is a great first step toward seeing if we could be a good fit for your company. You’ll learn how choosing us as your PEO can help you get back time and move your team members from completing time-consuming HR tasks to working on projects that will help your company grow.

Interested? Just fill out the form here, and we’ll be in touch with you soon!