Prepare Yourself for an ACA Audit

Tango Health

JANUARY 24, 2022

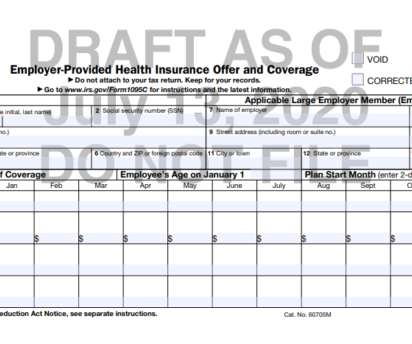

Employers and health plan sponsors have numerous obligations under the Affordable Care Act (ACA). Starting in 2015, the ACA required large employers to provide affordable health coverage that meets minimum standards to their full-time employees, or else, face penalties. Employers must also demonstrate compliance with new disclosure and reporting requirements under specific IRS codes.

Let's personalize your content