Top 5 employee tracking software solutions compared

Homebase

DECEMBER 15, 2022

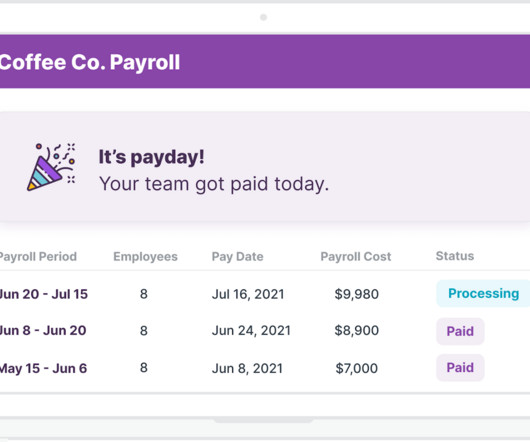

Here’s where vacation tracking software comes in: these tools reduce the costs and manual administrative tasks associated with vacation scheduling by automating the whole process, from putting in leave requests and approvals to preparing PTO reports and processing payroll. . The best part? Source: [link]. Approvals or denials?

Let's personalize your content