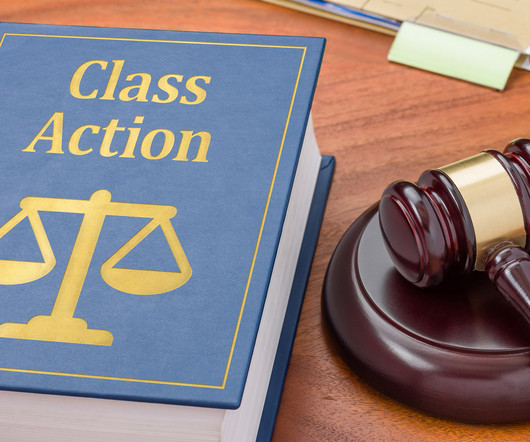

Watch Out California Employers: SB 1162 On Track To Become Law

Trusaic

AUGUST 16, 2022

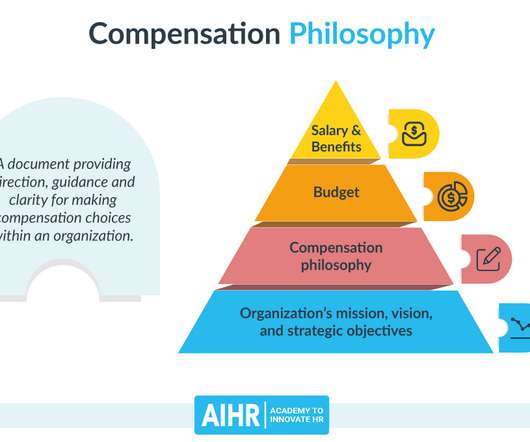

Still, SB 1162 requires employers to report median and mean hourly rates within each job category and for each combination of gender race/ethnicity, strengthening the DFEH’s ability to identify pay discrimination in employer compensation systems. . What organizations should do to prepare.

Let's personalize your content