“It’s getting harder to distinguish existing HR Tech tools (assessments, for example) with their intelligent or AI offspring. The newly energized tools work smarter, faster, and cheaper, but perform the same function.” - John Sumser

What Does HR Really Think About

Technology Replacing People?

(Survey says read more.)

We surveyed 542 HR executives and subject matter experts about new and existing projects involving AI and intelligent tools. We covered 26 different technologies using a 28-question instrument that spanned a robust set of topics. Today we’ll look at a favorite recurring question (will machines or technology replace people) along with the broader subject of how HR teams are evaluating new technologies in their stack.

Where do things stand with AI and machines replacing people?

Chart: Will you be able to replace people with intelligent tools?

It’s getting harder to distinguish existing HR Tech tools (assessments, for example) with their intelligent or AI offspring. The newly energized tools work smarter, faster, and cheaper, but perform the same function.

The actual cost of ownership go as high as three or four times the cost of the tool from the vendor.

During our survey period (which was pre-pandemic) the people who are evaluating intelligent tools for purchase don’t see them replacing existing workers. Solidly, 60% of respondents were clear that jobs would not be lost as the result of new technology. While this dynamic could change because of pandemic-related economic strife, it can be interpreted to mean that current buyers are not really looking for cost savings as the ROI (because, saving money means reducing headcount in HR).

Evaluating New Technology for the HR Stack

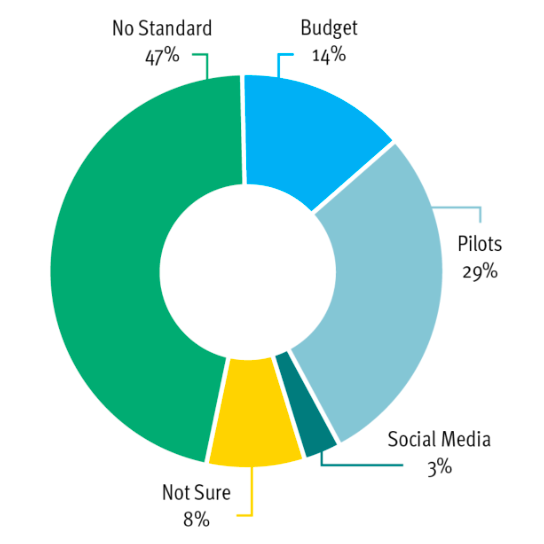

Chart: How do you investigate new technology?

For all of the investment vendors make in social media, it appears that only 3% of buyers learn about new technology exclusively that way. Only 13% of buyers have an investment budget set aside. The remaining parts of the market either have no standard method for investigating new technology or use pilot programs to try things out.

It’s interesting to note that the majority of projects that were attempted and then discontinued came in the form of pilots. For vendors, this suggests that pilots are no guarantee of a further deal. For buyers, it suggests that just having a pilot program isn’t enough.

There is a distinct and important difference between what a new technology actually costs to implement and what the vendor charges. Pilot programs offer the opportunity to understand the implications of a full adoption. It looks like the full freight (vendor price, productivity losses, reorganizations, and new employee types) make the actual cost of ownership go as high as three or four times the cost of the tool from the vendor.

Considering all of the costs of implementation is the only way to know whether that a new technology will deliver the promised value. Yet, vendors tend to see pilots as the first step in saying yes while buyers see it as the first step in saying no. Reports abound of high-pressure tactics from sales reps during pilots.

The Survey

The survey was designed to investigate three primary areas:

- Which intelligent tools and technologies are actually being used and evaluated

- How new technology is acquired and evaluated in HR Departments

- The degree to which survey participants see new technology replacing existing workers

Over the course of a 90-day period, we collected survey responses from 542 individuals using a 28-question instrument. We used email lists to target HR executives. We did not purchase any responses. The breakdown of participants was as follows:

- CHRO and Vice President of HR: 30%

- Director Talent Acquisition: 12%

- Recruiting: 17%

- L&D: 9%

- People Analytics 4%

- Other 28%

Broad Survey Findings

- It’s very early in the adoption cycle. Almost all current customers qualify as early adopters.

- Depending on the technology, between 30% and 70% of the potential market either doesn’t see the value in the tool or don’t even know what it is.

- High failure rates in some areas suggest that its prudent to move slowly and ask a lot of questions.

- There is growth already programmed into the market. That growth is dwarfed by the part of the market that doesn’t understand or can’t see the value. Massive education is required.

- Intelligent tools require new and different kinds of management including data governance. Most HR Departments are unprepared.

- The speed of market adoption and product refinement is astonishing. Most HR Tech markets grew at single digit rates in their first several years. It looks like intelligent tools are accelerating.