If you work in the construction industry, you know that it’s its own beast, totally unlike other industries. So when you are looking for tools to run your business, like construction payroll software, you’re going to want to make sure that those tools are tailor-made for your industry.

It isn’t easy to figure out employee types, contractor rates, salaries, paid time off, and taxes on a regular basis—especially when they’re moving targets with every project. That’s why in this article we’re explaining what payroll software is, what you should be looking for, and help you choose the best construction payroll software for your business in 2024.

What is payroll software?

Payroll software is an automated system that manages paying employees. Every business needs one if they want to pay their employees properly and on time without the stress of pens and paper and old-school calculators.

Construction businesses in particular need to invest in good payroll software because there are a lot of variables when it comes to paying people. You’ve got employees and contractors all at different pay rates; it gets complicated really fast.

So, what should you be looking for in your payroll software?

Construction payroll software: 3 key features to think about

If you’re managing payroll for a construction company, there are some key features you need to make your life easier. Not many businesses have to think about contractors and employees, and architects and plumbers, plus administrative support and accountants. That’s a lot of variables.

1. GPS-enabled time clock apps for better automation

When you have several teams at different locations, clocking in and out because a complex puzzle. A GPS time clock app is going to help you put those puzzle pieces together come payroll time.

The geolocation capabilities in a GPS time clock app will turn every single location into a time clock. Each employee will download the app on their device so they don’t have to come to a central location before heading out to sites. They can just arrive on-site and clock in before starting their day. That means way less travel time for them.

The biggest bonus? If you set up geolocation, they won’t be able to clock in until they’re within a certain distance from the work site. This means you’re keeping a handle on time theft. With labor consisting of 20%-40% of construction costs, keeping that number low while having enough hands decks is important.

What does all of this have to do with payroll? A lot. At the end of the day, you need to turn all of the punches into paychecks. With payroll software that has a GPS-enabled time clock app, you will spend less time verifying time clock punches.

2. Keeping track of pay rates, taxes, and overtime for each team member

Got a plumber, an admin assistant, and an architect all working on the same project? When you have a team full of people will different pay grades, roles, and hours, you need an impeccable tracking system. That’s where construction payroll software comes in.

Good construction software must have a way to keep pay rates, taxes, and hours all in one place so you can get a bird’s eye view of what’s going on in your company. And, so no one ends up short on payday. Once you enter someone’s pay rate, that software will store it for you for every future payday. This means less time at a calculator for you (score).

A great construction payroll software will have the added bonus of sending you notifications once your employees are getting close to overtime hours. Those overtime hours can add up quickly. When you have to stick to a strict budget, you can make the best decisions possible with the most information possible—and relay that information to your clients.

3. More automation = more time for you

There are so many steps to payroll. At each step, there is a margin for error. But if you have each step automated and in the same system, those margins for error get really tight.

When your time clock turns into timesheets which turn into payroll—and then that same system keeps all of the records you need—you not only save yourself mistakes, you save yourself massive amounts of time.

Each step of the process your construction payroll software can manage, the better—both for your stress levels and your business’s bottom line.

The 3 best construction payroll software options for 2024

At the end of the day, you want something that is going to make your life easier. So, let’s explore the three best construction payroll software out there in 2024.

1. Homebase: Best all-around construction payroll software

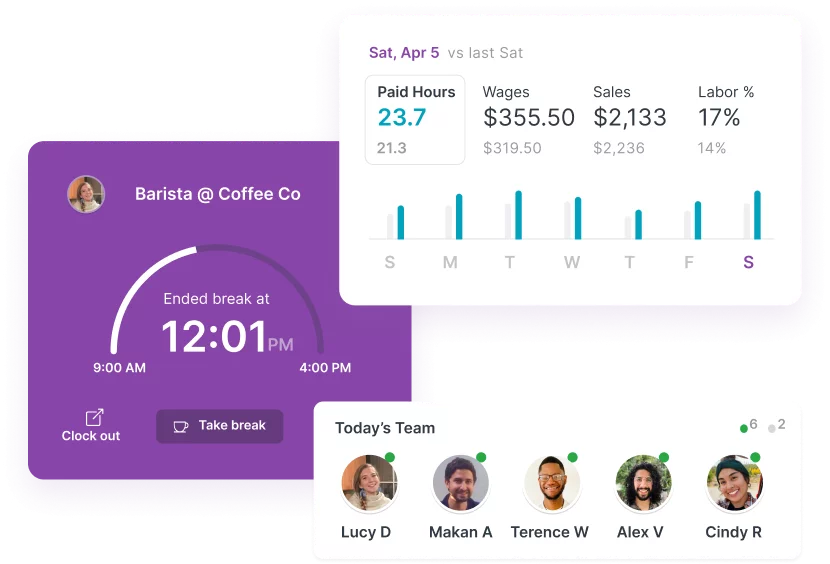

Homebase has an incredible suite of tools that all work together to make your construction business run smoothly. When it comes to automating your payroll process, it’s got it all.

Features:

- Time clock app for on-site and field teams | A downloadable time clock app for personal devices, verify clock-in locations, snap photos when each team member arrives on-site, and create login PINs—all big pluses when you can’t be everywhere at the same time.

- Easy timesheets | Streamline your payroll preparation process. Calculate total hours and overtime hours while keeping track of multiple wage rates. Homebase turns those clock-ins and outs into timesheets with the touch of a couple buttons.

- Helps you stay compliant | Homebase can help you track breaks, calculate overtime, and store time cards so you are always compliant with federal, state, and city rules. Also, track employee certifications and get alerts when they expire so you know everyone on your job site is up-to-date and certified in their field.

- Team communication | With everyone on your team spread out, keeping them in sync—and all communication in one place—is important. Send updates and receive check-ins from crews all over the city. No more hunting down messages across many apps.

Cons:

Homebase has many great features, but it doesn’t have an option to track time on specific projects, which can be helpful for a construction business.

Cost:

- Homebase Payroll costs a $39/month base fee and $6/month per active employee.

- Users save 20% when they commit to an annual plan.

2. Quickbooks Payroll: The most robust payroll system

Quickbooks was created to track invoices and expenses. It got its start in payroll and is probably one of the first names that comes to mind. So when it comes to the best of the best, it is up there.

Features:

- Auto-payroll feature | A business’ payments can be scheduled automatically and it can automate forms and taxes.

- Same-day deposit -|This feature streamlines and automates payments so that you never pay an employee late ever again.

- Income and expense tracking | This was the key feature of Quickbooks for years and why small businesses loved this tool. Being able to track invoices and expenses means you can keep an eye on your cash flow throughout the year.

- Comprehensive reports for sales and tax tracking | Quickbooks really takes the cake when it comes to reporting. Any report you need to pull—tax tracking, sales reports, expense reports, payroll reports—it’s got it all.

Cons:

Some businesses have reported that Quickbooks is overwhelming with all of its features and has a high learning curve. If you need something that’s going to make payroll easier, this one may not be the right choice.

Cost:

- Between $45/month plus $4/month/person and $125/month plus $10/month/person

- The first three months are discounted by 50%.

3. ADP: Payroll and HR in one place

ADP Run is a strong choice because of its HR and payroll software bundles. If you plan to grow over the years, ADP’s HR solutions can grow with you, which means you won’t have to worry about switching as your business gets bigger.

Features:

- Pay rates and union payroll codes | This is a huge advantage because if you’re working with different labor unions, since their rates and codes are going to be a big part of payroll.

- Time tracking with GPS capabilities | You can use ADP for your time clock app so that every employee has a time clock in their pocket. A big advantage when working at multiple sites.

- Job tracking | ADP can track multiple jobs which is a great addition for any construction business that wants to keep an eye on labor for each of its projects.

- HR tools and support | This is ADP’s biggest selling point for many businesses who want HR support but not an entire HR department. They help with recruiting and background checks.

Cons:

Every tool is an add-on or a new level, so pricing goes up quickly. For their payroll to be certified, it needs to be paired with Points North Integration–which means using and paying for another program.

Cost:

- Essential Plan is $49 base + $2.50 per employee per weekly pay run

- Everything above and beyond the basic plan needs a custom quote. And it adds up quickly.

Certified Payroll Reporting: A Necessity for Compliance

In construction, especially on projects funded by the government, following prevailing wage laws is a must. These laws ensure that workers get paid at least a certain wage based on their job type and where they’re working. To make sure these rules are followed, certified payroll reports are required. These reports are detailed records of what’s been paid out, how many hours were worked, job titles, deductions, and other important details. For those handling the complicated parts of construction payroll, having software that can crank out accurate and rule-abiding certified payroll reports is crucial. Using this kind of software not only makes the job easier but also cuts down the chances of making mistakes that could lead to big fines.

Want a well-rounded construction payroll software for 2024?

Homebase covers all of your payroll needs with scheduling, time clocks, timesheets, and payroll system all rolled into one. Get started today

Construction payroll software FAQs

What is construction payroll software?

Construction payroll software is an automated system that manages paying construction employees — full-time, part-time, contractor, or otherwise.

What should I look for in construction payroll software?

The things you should look for in construction payroll software are a suite of tools that all work together seamlessly, GPS and geolocation capabilities, and multiple pay rate options to be stored. This is going to make payday easiest for you.