The Six Types of Global Payroll Solutions

Peter Durant

UKG Inc., a leading provider of HR, payroll, and workforce management solutions announces entering into a definitive agreement to acquire Immedis. Read More

There are over 190 different countries in the world. Global companies may carry out business in just a few, or in dozens. In any case, managing payroll across multiple jurisdictions is made difficult by shifting payroll regulations, complex payroll taxes, and a rapidly changing world. Pursuing a unified global payroll solution for your organization can be a strategic asset.

Very few organizations have the resources to handle everything in-house. Instead, most organizations rely on one or a combination of several different types of global payroll solutions.

Some of the most common types of global payroll solutions include:

Many organizations take advantage of two or more of these solutions, creating hybrid models of all shapes and sizes. This is because no global provider can meet the needs of all organizations across all countries. Our global payroll solution is a hybrid of payroll BPO, aggregation and payroll integration and compliance, giving organizations the flexibility they need to fulfill their unique combination of payroll needs.

Payroll administration software includes any IT applications that calculate gross-net pay for employees. In-house payroll teams then use these calculations for various tasks, including processing payments, recording deductions, and other payroll data management. Payroll administration software may also include analytics and reporting to help with auditing and planning.

This type of software is the simplest global payroll solution, and essentially enables in-house teams to maximize their efforts. It does not entail active third-party human support, only help from the software. These solutions can be invaluable for companies that are on outdated systems, and wish to begin their transition to more effective global payroll.

A payroll managed service provider provides ongoing and regular support for various payroll services. They may carry out disbursement, payroll calculation, security, and tax reporting for their clients.

Providers vary based on their proximity to their clients. Some may carry out operations within a client’s office, while others provide support through a third-party data center.

Compared to payroll administration software, payroll managed services provide a human touch that grants greater power and flexibility.

Payroll BPO providers are third parties who take on the entire responsibility for various tasks related to payroll. While payroll managed service providers meet their clients at the point of payroll just to help manage things, payroll BPO providers take on the whole task of payroll processing themselves.

These processes include operations like processing, calculating, reporting payments, correcting payroll errors, and paying workers. They may even physically print and distribute paychecks.

Increasingly, the line between Payroll BPO and payroll administration software is becoming blurred. This is because many BPO firms will offer their own native software, with which they can help facilitate calculations in addition to taking on entire tasks by themselves.

Aggregation is a strategy pursued by companies who have existing payroll partners in multiple different countries. Instead of outsourcing to a single provider, they instead aggregate all of the payroll partners into a single platform. Having this platform lets them unify data into a single interface, simplifying planning, reporting, and analytics.

Payroll aggregation is most effective for companies that have a footprint in a high number of countries, but a low density of workers in each country. Typically, aggregators allow for less than 1,000 workers per country.

Some BPO providers will provide aggregation services, but there are also vendors that specialize solely on aggregation. Typically, aggregators will handle the full spectrum of payroll services, instead of focusing on specific functions.

EOR solutions are a way for companies to carry out business in a country without forming a registered legal entity. They carry out the paperwork, payroll, and reporting necessary, while the sponsor organization actually supervises the work assignments.

This path is most often followed by companies who have a very small presence in a given country. This may be the case if they are new to the country, and are trying to test the waters before going all in with official documentation.

Some organizations need to integrate their global payroll operations, but don’t want to change their existing system of different software and outsourcing providers. It may be that no single provider can provide the exact localizations that they need, or that the organization is not yet ready to take up the difficult task of transitioning to a completely new system.

In such a situation, many organizations pursue a new model, based on Payroll Integration and Compliance Platforms. In this model, an extra layer of software provides a central interface and supplementary platform for payroll processing. The software can handle tasks such as compliance monitoring, HCM integration, and cross-border payments.

There is no best approach to global payroll. Different organizations have different needs, and may benefit from different kinds of services. They vary by size, by the number of countries they operate in, and by the existing payroll systems they rely on.

Many companies wind up pursuing some form of hybrid model, taking advantage of two or more of the above solutions. This is because business situations are rarely so cut-and-dry that a single solution will cover everything.

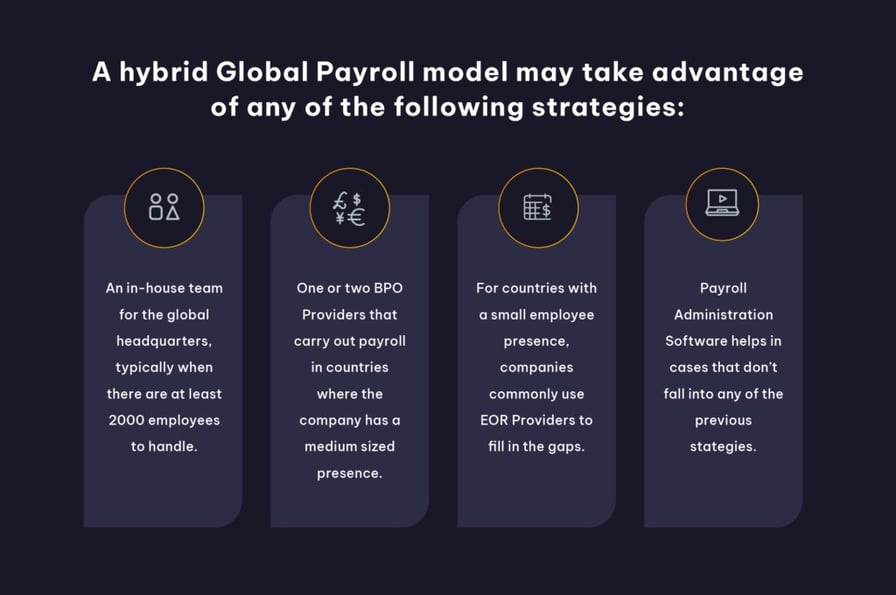

A hybrid model may take advantage of any of the following strategies:

One View delivers payroll solutions designed for today’s global enterprise. We offer the world’s leading cloud-based payroll platform.

Our services offer a combination of Payroll BPO and Consolidation. They take the complications of global payroll and tax compliance off your hands, while allowing you to consolidate your existing payroll providers into a centralized platform.

Interested in learning more? We’d love to chat!

Immedis Blog

.jpg)