Square is a popular software solution for small businesses in the retail, hospitality, and restaurant industries. You can use the platform to handle payments, build customer relationships, and manage your team, and users praise it for its reliability, simple design, and ease of use.

But Square’s processing fees are higher than some of its competitors, and small businesses with tight margins might not be able to justify the cost. That’s especially true when you consider Square doesn’t offer other essential tools like auto-scheduling and messaging.

That’s why we’ve put together this list of the best Square alternatives for you to consider. We’ve researched them based on how they match up to Square on pricing, features, use cases, and support, so let’s begin.

Best Square alternatives

- Homebase

- PayPal Zettle

- Shopify

- Toast

- eHopper

- Clover

- LightSpeed

- QuickBooks

- Gusto

- Payanywhere

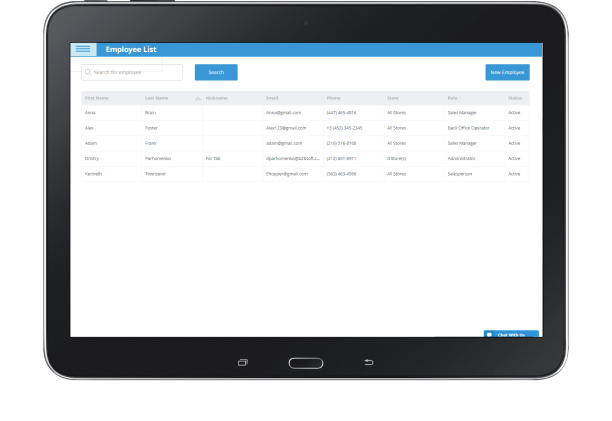

1. Homebase: Best all-in-one team management solution

Homebase is an all-in-one HR solution that focuses on small businesses across a wide range of industries like retail and hospitality. You can access many of our scheduling, time tracking, and messaging features with a free account. But if you need more flexibility and control, you can upgrade and also receive HR and payroll.

While Square offers many of the same management tools as Homebase, it lacks certain essential features like auto-scheduling and messaging that save you time and money.

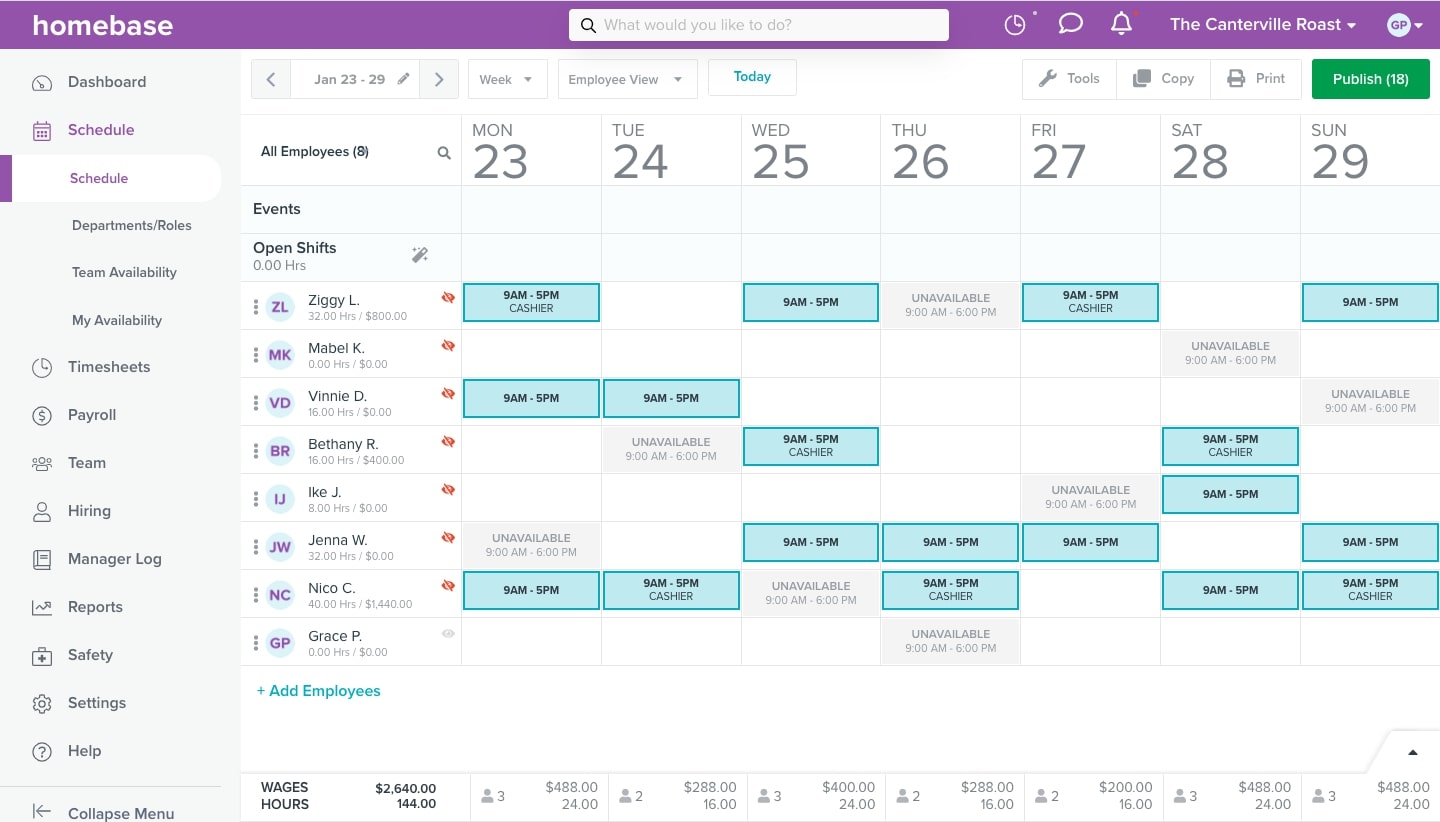

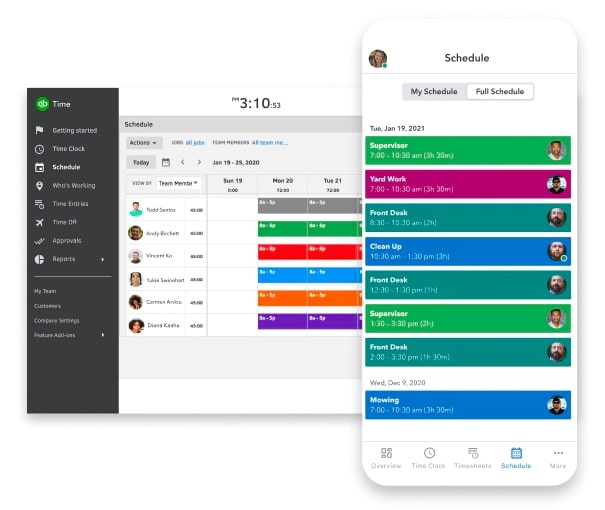

Scheduling

Scheduling is probably one of the most time-consuming tasks on your to-do list. That’s why you need as many features to streamline the process as possible. Like Square, Homebase lets you save time by letting staff claim open shifts and arrange trades and covers via our app. But Homebase also offers auto-scheduling capabilities to create error-free timetables based on team availability and past timetables in virtually no time.

Time clock and timesheets

As well as making money through sales, your business also needs to cut unnecessary costs where it can. That includes labor leakage from employees arriving early, leaving late, or even clocking in for each other — also known as buddy punching. Although Homebase and Square both have time clock tools, only our platform has GPS verification, which means you can track your team’s hours accurately and prevent time theft.

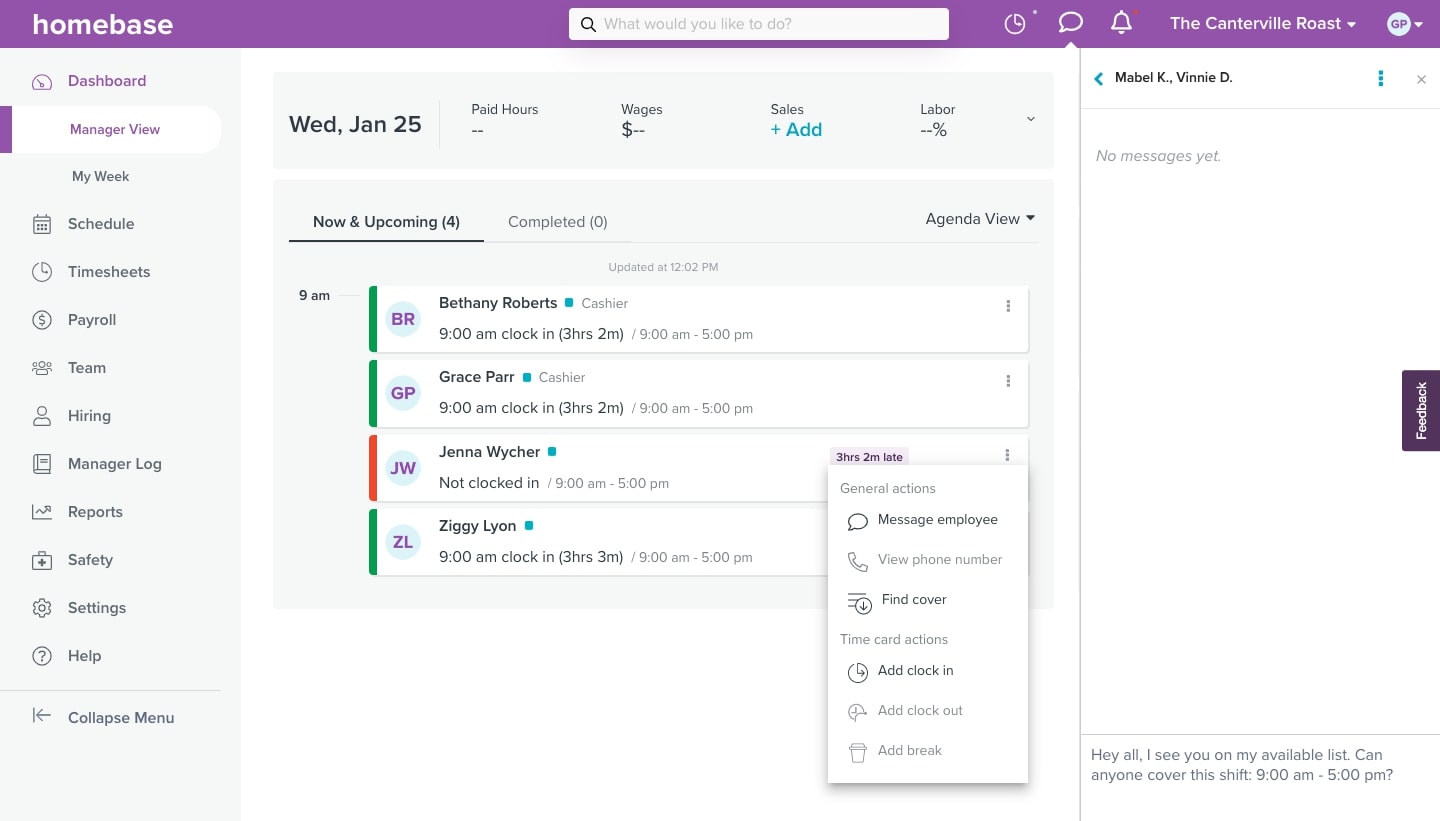

Team messaging

On occasion, you’ll need to contact team members instantly to arrange last-minute schedule changes or help solve problems while you’re off-site. But using chat apps like Facebook Messenger and Whatsapp means switching between different platforms. Homebase has its own built-in messaging feature so you can contact employees straight from the platform.

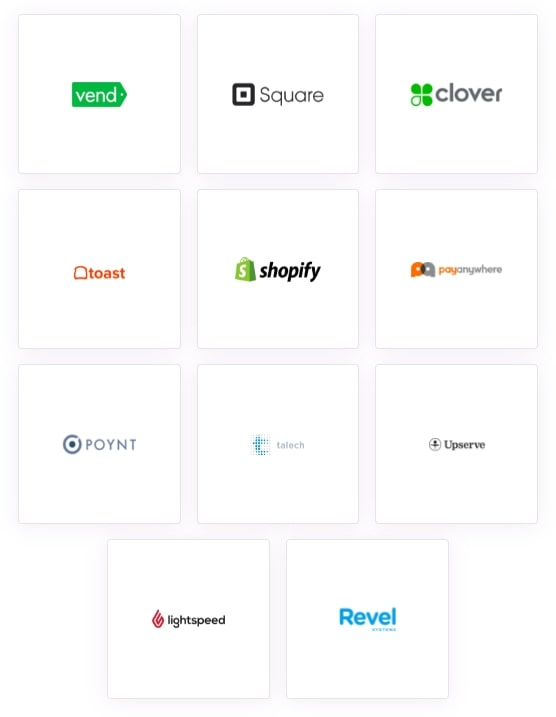

Point-of-sale integrations

Although Homebase doesn’t have a native POS product, it integrates with many popular POS providers. That means you can easily sync your schedule with your till and get useful analytics like your labor-to-sales ratio. That’s vital to make sure you’re adequately staffed but aren’t cutting too deeply into your labor budget.

Pricing

Homebase has a free plan with all the basic scheduling, time tracking, and communication tools. Aside from that, it has three monthly plans that are priced per location, so your costs won’t increase as you hire:

- Essentials for $24.95 per month to add extra tools like shift notes and GPS tracking for the time clock.

- Plus for $59.95 per month for onboarding tools and document management.

- All-in-one for $99.95 per month to get the full range of HR and compliance tools, including live access to qualified professionals for advice and support.

You can also add Homebase’s payroll product as a separate add-on for $39 per month plus $6 per employee. That way, you can choose whether you want to switch to Homebase or keep using the tool you’re familiar with.

You can also save 20% when you commit to an annual plan with Homebase.

2. PayPal Zettle: Best for international payments

Zettle is a subsidiary of PayPal that offers payment processing, point of sale (POS) systems, and tools to help you manage business operations like risk management and data analytics. Like Square, it also has a range of till equipment and doesn’t charge a monthly rate for credit card transactions. However, Zettle caters to a more international market than Square, which has mostly US customers.

Features

- Payment processing: Easily accept a variety of payment methods, including online checkout, POS, and invoices.

- Financial services: Grow your business by applying for cards and loans.

- Operational tools: Manage some of your daily challenges like returns, disputes, and shipping using artificial intelligence and automations.

Pricing

In terms of payment processing, Zettle charges 2.29% plus $0.09 for in-person sales and 3.49% plus $0.09 for keyed-in sales. This is lower than Square, and there’s no monthly fee for US dollars either. Other currencies may be subjected to a fixed fee rate.

Otherwise, Zettle has a custom paid plan for its financial services and management tools.

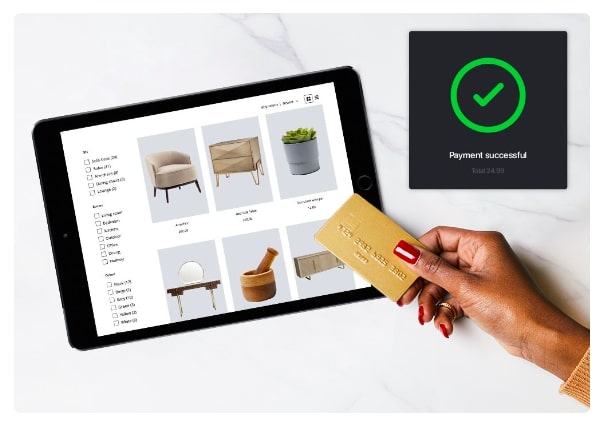

3. Shopify: Best for e-commerce

Similar to Square, Shopify caters to businesses of all sizes and industries. Both offer payment processing services and sell equipment like point-of-sale (POS) systems. But where Square is primarily designed for processing payments, Shopify focuses more on e-commerce with tools for building, designing, and operating your online store.

Features

- Start-up tools: Create and customize your own website and build an easily recognizable brand.

- Payment processing: Sell products across multiple channels, for example, in a physical store, on social media, and in online marketplaces.

- Marketing tools: Reach your online audience using Shopify’s range of content marketing, advertising, and social-selling features.

Pricing

Shopify has three plans with different rates and processing fees. As you can see, the higher the cost of the plan, the lower the fee percentage:

- Basic for $39 per month with fees of 2.9%, plus $0.30 online and 2.7% in person.

- Shopify for $105 per month with fees of 2.6% plus $0.30 online and 2.5% in person.

- Advanced for $399 per month with fees of 2.4%, plus $0.30 online and 2.4% in person. With this plan, you can add 15 staff accounts and get custom reports.

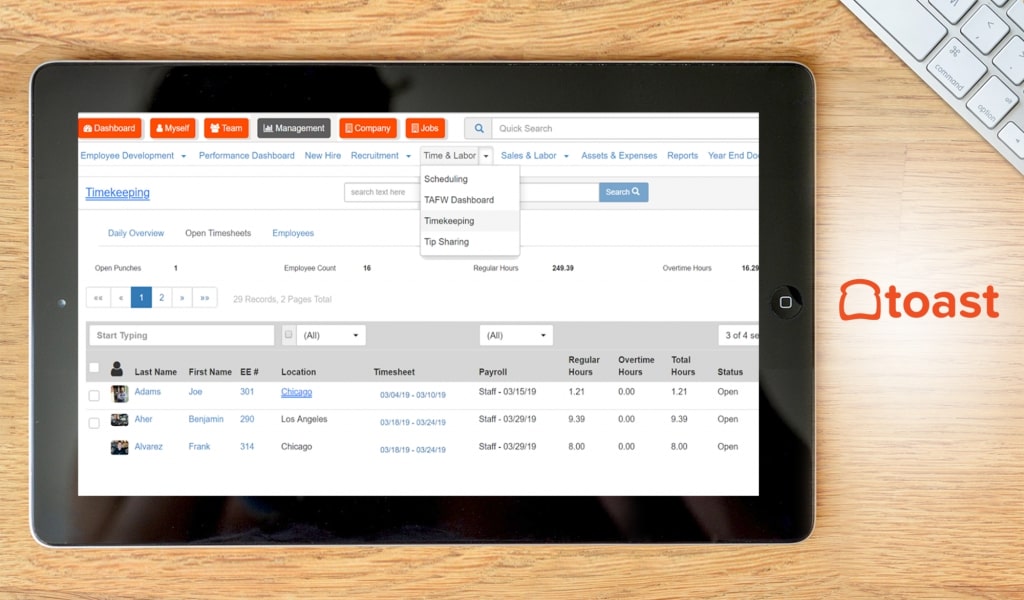

4. Toast: Best for tip management

Toast is a restaurant management software with payment processing, employee administration, and marketing tools. Many features target challenges specific to businesses that serve food and beverages, like automatic tip splitting and payment via QR codes on menus. Square offers a plan for restaurants but doesn’t provide the same industry-specific features.

Features

- Restaurant management: Streamline internal operations from ordering to bill payments. Ensure no orders get lost on their way to or from the kitchen.

- Employee management: Schedule, track, and pay your team all from the same platform.

- Delivery tools: Enable online ordering, delivery, and take-out options for your customers.

- Marketing: Set up loyalty, rewards, and gift card programs to drive repeat visits.

- Customer support: Toast offers 24/7 support for setup problems or challenges.

Pricing

Toast’s processing fees are around 2.69%, and there are three paid plans available:

- Core for $69 per month to access payment processing, reporting, and analytics.

- Growth for $165 per month for ordering and delivery features.

There’s also a free plan for the basics and a custom priced plan for inventory, benefits, and employee management. Like Homebase, Toast offers payroll as a separate (more costly!)add-on of $110 monthly plus $4 per employee.

5. eHopper: Best value for micro businesses

Business owners who are just starting out may be particularly budget conscious. eHopper is somewhat unique in that it doesn’t charge a monthly rate or processing fees. Instead, users can take advantage of the free plan and choose whether to buy point-of-sale equipment separately.

Features

- Payment processing: Accept up to 500 credit card payments a month with no processing fees.

- Restaurant tools: eHopper offers features for restaurants, like online order management and advertising.

Pricing

eHopper offers a free plan that’s well-suited to businesses that expect to process a low volume of monthly payments. Unlimited transactions are available with the paid plan at $29.99 per month, though its features are more basic than most other platforms.

6. Clover: Best for banks and insurance companies

Clover is a POS software solution designed with small to medium-sized businesses in mind. Its support for a wide range of payment methods — like paper checks — can be valuable for those in banking or insurance. It also has a range of features targeted at retail and restaurants.

Features

- Employee management: Similar to Homebase, Clover lets you schedule, track staff hours, and hire new team members.

- Payment processing: Accept anything from cards to contactless payments and checks.

- Customer engagement: Collect data on your customers via their card payments, build profiles, and tailor your marketing campaigns to them.

Pricing

Clover offers custom paid plans based on your specific business needs. Processing fees range from 2.3% plus $0.10 to 3.5% plus $0.10.

7. Lightspeed: Best for high-inventory retail businesses

Small businesses with high-inventory online stores may find Lightspeed interesting. The eCommerce site offers a selection of payment processing, online sales, and marketing tools. You can also integrate with your choice of payroll software, including Homebase.

If you’re in the retail, restaurant, or golf industry, Lightspeed also has a specialist product line for you.

Features

- Payment processing: Carry out all your business transactions effortlessly.

- Retail tools: Track and manage inventory across categories like color and size.

- Restaurant tools: Let customers order from anywhere and display their orders on your storefront and kitchen boards.

Pricing

Lightspeed charges 2.6% plus $0.10 for card transactions and 2.6% plus $0.30 for online payments. It also has three paid plans that all include a POS device and a register:

- Lean for $139 per month, which includes payment tools.

- Standard for $199 per month to access eCommerce and accounting features.

- Advanced for $319 per month, which includes customer loyalty schemes and advanced reporting.

There’s also a custom priced enterprise plan that offers a dedicated customer success manager and lower rates.

8. QuickBooks: Best for small business accounting

Intuit QuickBooks started as accounting software and then branched into employee management and payment processing. Like Square, it lets you schedule staff, track hours, and run payroll, as well as accept payments. Its versatile bookkeeping tools make it popular with the accounting industry, while its GPS tracking feature can be useful for remote teams like construction crews.

Features

- Employee management: Schedule team members, run payroll, and track hours — even for traveling or remote teams like delivery crews or construction workers.

- Accounting: Track and manage your business expenses and calculate sales tax easily.

- Payment processing: Receive on or offline payments via a variety of methods.

Pricing

QuickBooks has four paid plans:

- Simple Start for $30 per month, and you get a basic range of bookkeeping features.

- Essentials for $55 per month to connect two extra sales channels and access bill management.

- Plus for $85 per month, which includes inventory management.

- Advanced for $200 per month for training, batch invoices, and employee expenses.

Some of the features are also available as add-ons:

- Payroll has plans ranging from $45 to $125 per month in price.

- QuickBooks Time for scheduling and time tracking tools, which has a lower cost plan for $20 per month plus $8 per employee or a higher cost plan for $40 per month plus $10 per employee.

The processing fees range from 1-3.5% plus $0.30 cents, depending on the payment method.

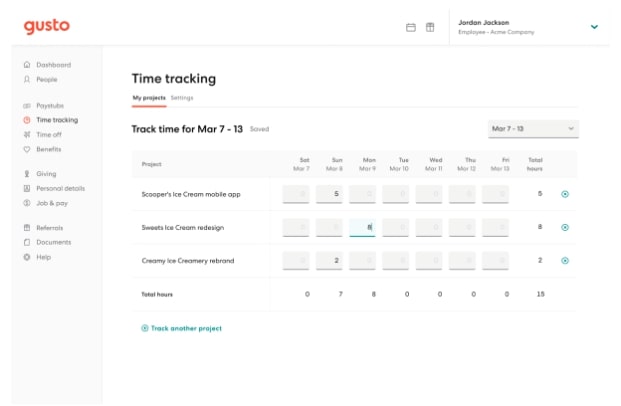

9. Gusto: Best for staff training

Formerly known as ZenPayroll, Gusto is an HR platform for businesses of all sizes. It lets you manage your team, run payroll, and arrange staff benefits. Unlike some of the other competitors on this list, Gusto doesn’t have a built-in payment processing system, but it does integrate with other popular apps that do.

Features

- Employee management: You can track staff hours with the Gusto time clock and pay your team, but it doesn’t have any scheduling features like Homebase.

- Talent management: Conduct regular performance reviews to help team members improve professionally and stay on top of any issues. You can also integrate with training apps or add Gusto Learning to access a variety of workplace courses for small businesses.

- POS integrations: Sync Gusto timesheets and payroll with your choice of POS apps like Clover and Shopify.

Pricing

Gusto has two paid monthly plans available:

- Simple for $40 per month plus $6 per employee for single-state payroll and hiring tools.

- Plus for $80 per month plus $12 per employee for multi-state payroll, leave management, and next-day payment.

Gusto also has a Premium plan with custom pricing, which includes compliance alerts, access to HR professionals, and performance reviews.

10. Payanywhere: Best for low, predictable fees

As the name suggests, US-based Payanywhere lets businesses use their POS devices from job sites, physical stores, or online shops. While it charges a slightly higher percentage for payments than Square, there aren’t any other fees that raise the cost. This makes Payanywhere an affordable option for businesses on a budget.

Features

- Payment processing: Organize a variety of payments like invoices and phone orders. Automate payment cycles to save yourself time and hassle.

- Inventory management: The free inventory tools make it easy to sell, track, and restock items.

Pricing

There’s a flat rate of 2.69% for contactless card payments and 3.49% plus $0.19 for keyed ones.

How to choose a Square alternative that suits you

Although Square is one of the leading financial service platforms on the market, its processing fees may make it unsuitable for small, budget-conscious businesses. If you need minimal features and want to prioritize your budget, choose eHopper or Payanywhere for value. And if you need a payment processor that offers more advanced, targeted features, go for Clover or Toast.

But if you use Square for its employee management tools and feel they aren’t versatile enough for your needs, Homebase is ideal. Our all-in-one platform offers scheduling and time tracking alongside communication features so you can manage your business in one digital space. Plus, we integrate with the best payment processing and POS tools, so you’ll always have fast access to everything you need.

**The information above is based on our research on Square alternatives. All user feedback referenced in the text has been sourced from independent software review platforms, such as G2 and Capterra, in March 2023.