Payroll & Tax Compliance: Pointers for Businesses in California

PCS

JANUARY 5, 2022

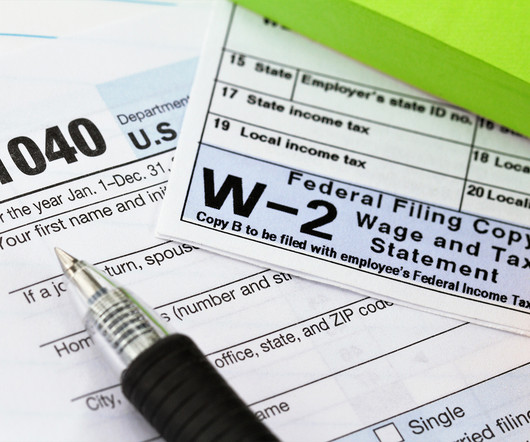

When it comes to state tax legislation, employers must be knowledgeable about payroll and tax compliance. Payroll Taxes. Payroll taxes refer to duties that federal, state, and local governments collect from companies. Payroll taxes refer to duties that federal, state, and local governments collect from companies.

Let's personalize your content