How incentive theory drives motivation and behavior in the workplace

Achievers

NOVEMBER 29, 2024

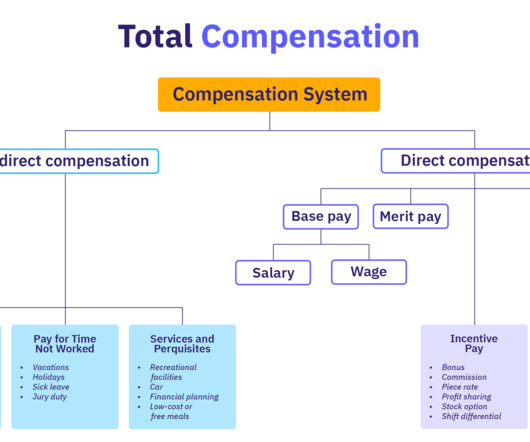

Incentive theory offers valuable insights into what drives employee motivation in the workplace. Whether it’s a financial perk, professional growth opportunity , or simple recognition, incentives help create a culture where employees feel valued and motivated to contribute their best. What is incentive theory?

Let's personalize your content