Employee Cost: How to Calculate the Cost of an Employee?

HR Lineup

MARCH 29, 2024

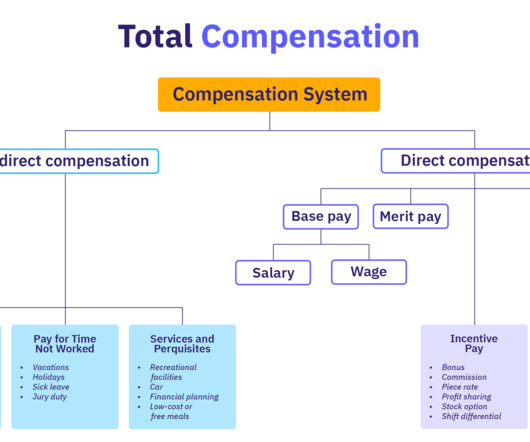

Bonuses and Commissions: Additional incentives provided to employees based on performance, sales targets, or other predefined criteria. Benefits: These encompass various perks and protections offered to employees, including health insurance , retirement plans, paid time off, and other fringe benefits.

Let's personalize your content