13 Best Compensation Courses For HR, Business Owners And Managers 2023

HR Tech Girl

DECEMBER 22, 2022

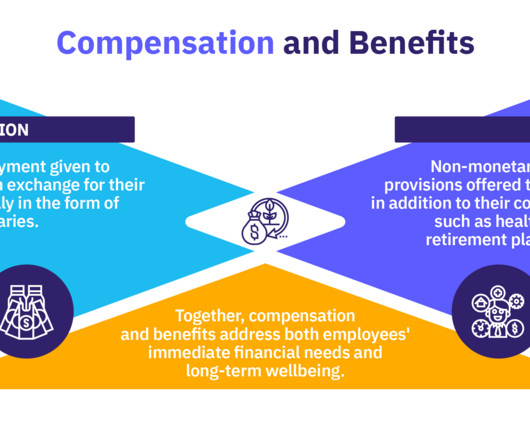

A great way to deepen our understanding as HR professionals and business leaders is take a compensation course. Why take a compensation course? 13 Best Compensation Courses. They offer an introductory course on Compensation and Benefits ideal for business owners and HR professionals. HRCI Compensation and Benefits.

Let's personalize your content