How Internal Talent Mobility Boosts Engagement, Development, and Retention

Netchex HR Blog

JULY 11, 2024

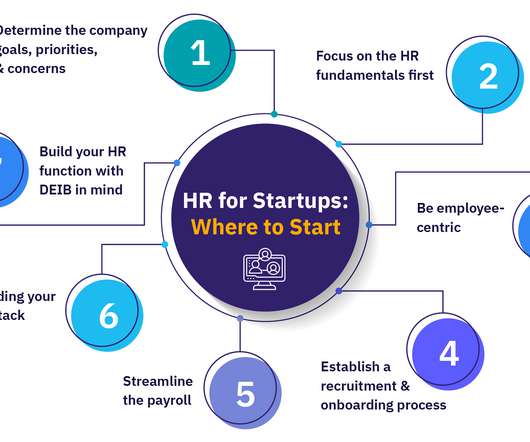

Look for essential features in payroll software that let you manage incremental raises, overtime, and bonus incentives. Use year-round DEI policies to make sure you’re bringing a wide range of perspectives to the table. Use performance management software to help employees see their own progress toward goals.

Let's personalize your content