Variable Compensation: All HR Needs to Know

Finding the right mix of pay, benefits, and other incentives is essential to attracting and retaining top performers, especially in a tight labor market. Variable compensation can be a useful tool for rewarding employees’ performance to provide measurable results for your business. Let’s dive into all you need to know about variable compensation.

Contents

What is variable compensation?

Examples of variable compensation

Advantages of variable compensation

Disadvantages of variable compensation

How to implement a variable compensation plan

What is variable compensation?

Variable compensation, also known as variable pay, is supplementary compensation typically tied to performance goals measured by specific metrics. These goals can be individual, project-based, team-based, or companywide.

Pay plans are structured with pre-determined performance targets appraised within a certain period and paid out if benchmarks are met. There can also be a range of payouts based on how close the results are to the target.

Historically, variable pay programs have been implemented for sales teams. However, they are used increasingly to incentivize other departments or the entire organization. In fact, recent data shows that 77% of U.S. businesses have variable pay programs in place, with an additional 9% planning to adopt one.

HR’s role in a variable pay plan

HR representatives should be intricately involved in defining, structuring, and overseeing the variable pay plan. That way, you can link it to your people and overall compensation strategies and that it’s competitive and impartial.

HR’s participation may include:

- Establishing which roles will be eligible

- Determining reliable metrics and target levels to use for each category of employee

- Ensuring the criteria are meaningful, clear, and achievable

- Planning the rewards funding and budgets

- Settling on the timing and processing of rewards

- Communicating the plan to employees and celebrating when results are achieved

- Reviewing the program periodically and making necessary adjustments.

Examples of variable compensation

Generally, there are two types of variable compensation. Short-term variable compensation is a measurable financial award paid out within one year. Long-term variable compensation is equity built over overlapping cycles and awarded in the future. You can pay this equity in cash or company stock. This form of variable pay is often part of executive compensation packages.

These are the most common examples of variable compensation:

- Bonus: A one-time lump sum based on individual or team performance.

- Sales commission: A payment for selling a product or service based on a percentage of the revenue.

- Referral bonus: A financial reward for recommending a job candidate who gets hired and remains in a position for a specific period of time.

- Stock options: The opportunity for employees to buy or sell the company’s stock at a particular price and date.

Advantages of variable compensation

A variable pay plan can offer several positive outcomes that will benefit your organization. Let’s go over the main advantages:

- Driving improved productivity and performance: When increased productivity is rewarded, employees see the importance of improving their performance. They also feel more engaged and motivated to contribute to the organization’s success.

- Providing clear performance expectations: Business objectives can sometimes seem like intangible goals to employees. Setting challenging yet achievable targets shows people how they can meet these objectives and win. With clarity about what they’re working toward and what they’ll get out of it, employees tend to be more disciplined about their duties. They take more personal responsibility for their work and require less supervision.

- Showing appreciation for good work: A variable compensation policy rewards good performance, thus showing appreciation for a job well done. This helps increase morale, foster loyalty, and build trust between employees and management.

- Lowering fixed costs: Variable pay programs allow you to lower base salaries because you’re offering employees the prospect of earning additional money. This helps you reduce fixed labor costs. Moreover, since employees are rewarded through business profits, this extra pay isn’t part of your operational expenses.

- Tying compensation to revenue and financial performance: When your employees perform well, they bring revenue to your organization and help you achieve your financial goals. Then, you can invest some of the money to reward your employees. Employees who make more money when the company performs better are likely to take their duties seriously. They begin to see how their current effort and decisions impact outcomes and profitability down the road.

- Improving employee retention: A well-structured variable compensation plan is a great tool to retain your employees, especially top performers. Your organization’s employees will recognize that increasing productivity could result in greater rewards.

- Attracting top talent: Income is considered in any job seeker’s decision-making. By offering a variable pay plan, your organization could entice top candidates who may be attracted to earning more than just a base salary.

Disadvantages of variable compensation

Despite the many benefits of variable pay programs, drawbacks can occur if the plan isn’t designed correctly.

Here are a few potential hazards you should be aware of:

- A lack of transparency: Variable pay programs must be well-defined and communicated clearly and consistently. Employees need to know the following:

- The amount of the incentive

- What do they need to do to earn the incentive

- How their role contributes to reaching the target

- The status of their metrics throughout the measurement period

- What they can do to fill in any gaps in their performance

- When there’s a lack of transparency, people might not understand the criteria and expectations They may also be tempted to take shortcuts that undermine other business goals.

- Fostering unhealthy competition: If you reward individual performance but still expect people to work as a team, it might lead to contentious competition and withholding of knowledge and information. If employees become resentful of the high performers, tension will build and erode an otherwise positive work environment. Work situations that rely heavily on collaboration and teamwork are probably better suited for team-based or companywide incentives.

- Unrealistic expectations: An effective variable compensation plan must have attainable targets. When the bar is set too high, it puts excessive pressure on employees. This can end up being a deterrent.

How to implement a variable compensation plan

Putting a variable pay plan into place can be complex. There are many factors you need to consider to have a successful implementation.

Here are some pointers to help you get and keep your program going in the right direction:

1. Simplicity is key

Make your plan simple, consistent, and clear without ambiguities. Describe the nature of work that needs to be done and what the reward will be.

Explain the conditions and rules in a concisely written document that doesn’t leave any matters up to interpretation. Make sure that time periods, metrics, and incentive amounts are distinctly defined and understandable.

2. Set realistic and attainable goals

Employers and their employees need to be on the same page about what measure of performance it takes to earn variable pay. Incentive plans need a reasonable definition of success that comprises factors that employees have some control over. Then they’ll see themselves as capable of working toward it.

Basing performance goals on vague or unrealistic criteria will work in opposition of your plan by demotivating your employees. For example, let’s say that last quarter, your sales representatives made deals worth $10,000 on average. If you set the threshold for the next bonus at $30,000, it may seem unrealistic. A number around $12,500-15,000 could be a more reasonable goal.

3. Make it competitive

Your variable pay plan needs to address what employees are looking for and what makes sense for your industry. The benefits you’re presenting should match or exceed what your competition offers.

Gather information about what your competitors are doing and the benchmarks for similar positions and levels. Making data-based decisions helps you compete for talent with a solid variable compensation structure.

4. Take company culture into account

Your compensation strategy will depend on your company culture. For instance, if teamwork is your core value, it would make sense to base variable compensation on the team rather than individual performance.

Also, variable compensation doesn’t work for all teams, so you’ll need to see where it makes sense to implement it. In some cases, it might be advantageous to reward the entire staff for meeting business growth goals. You can structure the bonus to pay varying percentages by team or level of employee. Then you can reward everyone according to how directly their roles impact growth.

International organizations may have cultural and social differences at multiple locations. Evaluate whether incentive pay should be adjusted or is feasible for these situations.

5. Focus on communication and transparency

As we’ve mentioned, make the policy clear and accessible within a written format. Consistently communicate how the policy works, when the payouts are, etc.

Remind managers to stay on top of their staff’s progress and keep everyone informed about how the numbers look throughout the measurement period. Boost morale by offering encouragement during downtimes and pointing out and praising when milestones are reached.

6. Manage employee expectations

Part of communicating your plan well is being transparent with candidates and new hires about what earnings they can realistically expect. Be careful about overstating what the plan offers and making promises that most likely can’t be kept.

There should be a thorough explanation of how the plan works during onboarding. This will prevent employees from forming impractical expectations and feeling disappointed and misled.

7. Keep your plan up to date

You need to reevaluate your variable compensation plan regularly to monitor its effectiveness based on company performance, product offering, and the state of the market. That way, you’re making sure you’re rewarding your employees fairly.

It’s also a good idea to collect feedback from employees to learn how they feel about the plan. Are they more motivated? Is the reward worth their effort? Do they have input on how to improve it? The more satisfied employees are with the plan, the more valuable of a tool it is.

Summing it up

If implemented well, variable pay can motivate employees to perform at their best and support business goals. Your team members are more engaged in their work and feel more ownership over their compensation.

By creating a clear variable compensation plan and communicating it effectively, you’re ensuring your employees know what you expect from them and what they can expect from you. Designating a distinct path from performance to reward can secure improved productivity and better results for your organization.

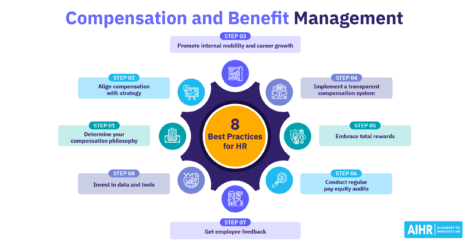

Also, as employee expectations and the labor market continue to change, HR professionals must future-proof their compensation and benefits strategies. To assist you in becoming a total rewards expert, AIHR offers a Compensation and Benefits Certificate Program aimed at developing your strategic thinking and analytics.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online