Companies are racing to digitize their operations at a scale. On the surface, digitization efforts have been extremely useful when it comes to reducing human contact during the pandemic, but also helps businesses save time and costs, an effort that is more important than ever given the blow that the economy has taken from the pandemic.

One way companies can digitize payroll operations is through implementing a digital wallet solution that empowers employees to access their earned/unpaid pay anytime and enables payroll teams to digitally disburse off-cycle payments. But to maximize the benefits of an on-demand pay experience, it’s critical to shop around for the right vendor instead of just picking your payroll provider’s option. Some on-demand pay providers, for example, require your payroll team to take on additional workstreams. In order to make sure that your organization has a positive experience with on-demand pay, be sure to choose a provider with a recognized gold standard approach to service, flexibility and compliance.

Some digital wallet providers, such as Ceridian Dayforce Wallet, “bundle” your on-demand pay solution with your existing payroll provider. While this might be a tempting solution, there are a number of issues that arise if you choose to partner with a company that is not primarily dedicated to on-demand pay. To have a seamless experience, you will want to partner with an experienced on-demand pay provider.

With no support function, expect more questions from employees daily

When it comes to an employee’s pay, questions and concerns are inevitable. DailyPay offers flexibility and top-of-the-line customer support. Since on-demand pay makes an employee’s pay available anytime, questions and support can also spike anytime. If you partner with your payroll provider to offer on-demand pay, your employees will come to your payroll team for help, just as they have always done. If your payroll team does not have the capacity to handle an influx of employee support inquiries, your organization may need to look into hiring additional team members.

If your team isn’t interested in taking on additional workstreams or hiring more staff, choose an on-demand pay provider who handles employee support. DailyPay is proud to offer a dedicated team of call center representatives 24/7/365 for a majority of our partners. The DailyPay customer support team handles all inbound communication across multiple channels: email, phone, chat. Additionally, we have many escalation support specialists (across 2 locations) who handle more complex user/client questions.

Employee restrictions lead to increased support tickets

This lack of flexibility — and the frustration it can create — leads to disgruntled employees calling in for help. Alternatively, vendors like DailyPay who allow users to send funds to any destination account do not have to handle such issues.

Employee education support

If you work with the right provider, they should handle most of the heavy lifting involved in rolling our a digital wallet solution for you. That’s exactly our approach at DailyPay. We’re committed to offering total excellence throughout the lifetime of our partnership — from implementation to kickoff and ongoing support.

When you launch, with your consent and prior approval, we proactively disburse marketing materials to your workforce about DailyPay, which we are happy to customize for your company. You’ll also have a dedicated account manager throughout our partnership. DailyPay integrates with dozens of different HCM and payroll providers and has over 6,000 API end-point integrations with banks, HCM’s and other technology partners to make your implementation as seamless as possible.

Many payroll companies offering digital wallets typically provide a standard “toolkit” to roll out the benefit — not a customized approach. Because payroll companies’ bread and butter is payroll software — not on-demand pay — they are typically less involved in helping you with an “add-on” product. DailyPay, on the other hand, offers a customized approach and can partner with your payroll provider to provide a seamless and individualized experience. DailyPay provides a way for employees to check their DailyPay Balance™, especially for those who work irregular hours.

Digital Wallet Solution Provider | About the Provider |

DailyPay |

|

Ceridian |

|

UKG |

|

In conclusion …

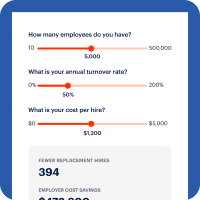

… if your organization is looking to implement an on-demand pay benefit, be sure to choose a provider whose model won’t create additional work for your payroll team or incur unexpected costs for your business. On-demand pay, when done right, should help your organization to save time and money — not add to them.