Choosing the Best HR Certification – Ask #HR Bartender

HR Bartender

APRIL 2, 2018

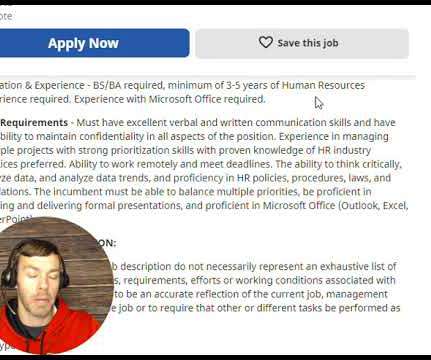

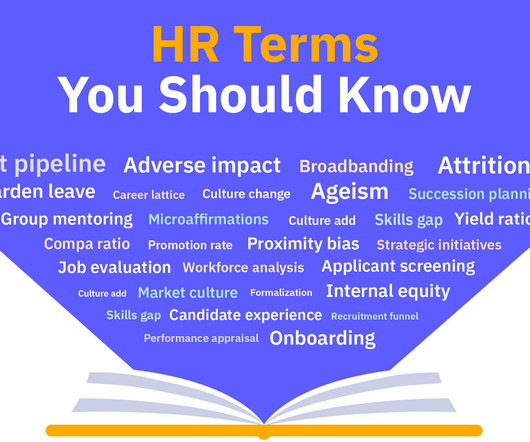

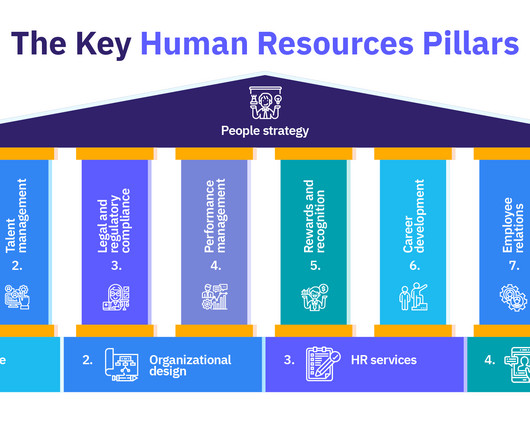

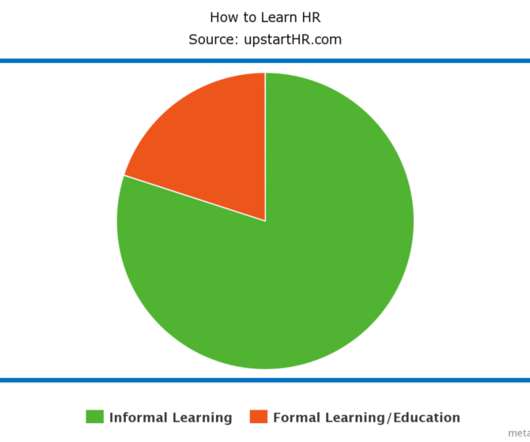

One of the ways that HR professionals can demonstrate their knowledge, skills, abilities, and commitment to the profession is by obtaining a certification. There are quite a few certifications related to human resources. What’s the criteria for maintaining certification? But which one? That’s what today’s reader wants to know.

Let's personalize your content