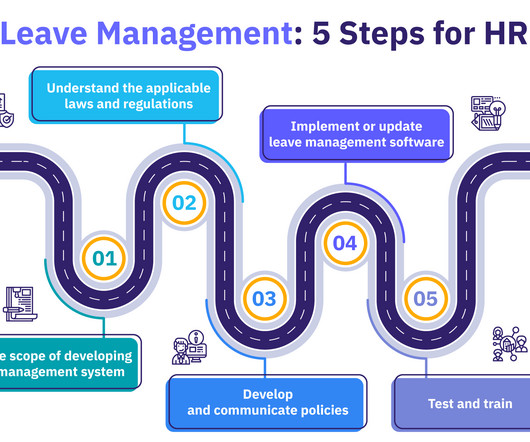

Leave Management: Your 101 Guide for 2024

Analytics in HR

FEBRUARY 27, 2024

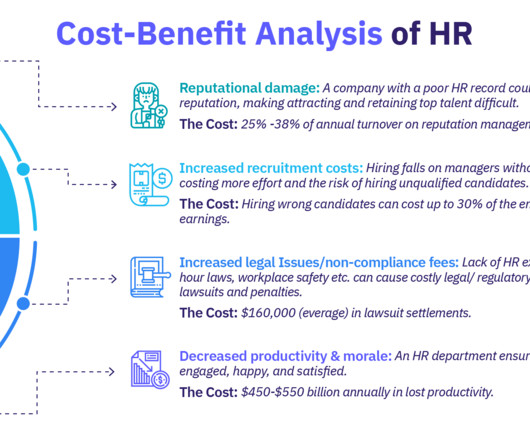

Most companies have policies and programs in place to address when employees need time away from work, and it’s often referred to as a company’s leave management process. Can refer to infrequent or non-consecutive time off, whether planned or unplanned. In fact, 768 million vacation days went unused, totaling around $65.5

Let's personalize your content