Employee Cost: How to Calculate the Cost of an Employee?

HR Lineup

MARCH 29, 2024

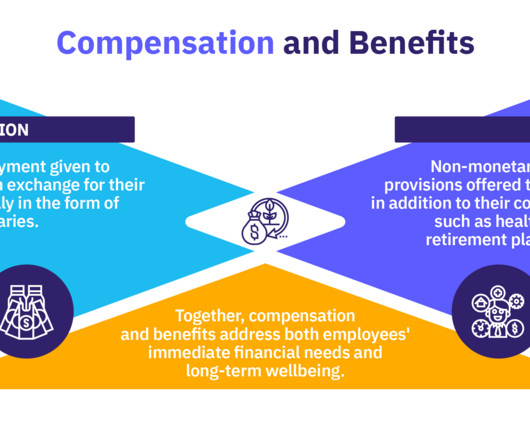

Direct Costs of Employment Direct costs are the most obvious expenses related to employing staff, encompassing elements directly tied to compensation. These include: Base Salary: The primary component of an employee’s compensation, typically determined by factors such as job role, experience, and market rates.

Let's personalize your content