Step into the dynamic world of Malaysian banking as we unveil the secrets of effective succession planning. Discover how this sector’s unique challenges create a thrilling backdrop for banking leadership transitions. Dive deep into core components, unveil 7 key distinctions, and uncover the top 3 tools to propel your bank’s success, while keeping an eye on essential legal and ethical considerations.

Introduction

In the ever-evolving landscape of the banking industry, one fundamental principle remains unchanged – the significance of leadership and talent management. Succession planning is the process of identifying and nurturing future leaders while ensuring the seamless transition of leadership and the preservation of institutional knowledge.

This critical strategy empowers banks to navigate leadership changes, adapt to challenges, and uphold the trust of their stakeholders. This blog embarks on a comprehensive journey through mastering succession planning in the Malaysian banking industry. We will explore the unique challenges, the key distinctions, and the legal and ethical considerations involved in Malaysian banking succession planning.

Understanding the Banking Landscape in Malaysia

Before diving into the unique challenges in Malaysian banking succession planning, it is essential to gain a comprehensive understanding of the sector’s landscape. The Malaysian banking industry is characterised by the following aspects, all of which play a pivotal role in the nation’s robust financial growth and economic development.

Only 50% of Malaysian banks are satisfied with the effectiveness of their succession plans.

Malaysian Institute of Bankers, 2022

Understanding this sets the stage for a more informed exploration of succession planning within this dynamic and diverse sector.

| Diverse Financial Ecosystem | Malaysia boasts a diverse financial ecosystem comprising Islamic and conventional banks, development financial institutions, and foreign banks. This diversity reflects the country’s commitment to accommodating various financial preferences and serving a wide-ranging clientele. |

|---|---|

| Regulatory Framework | Bank Negara Malaysia (BNM), the central bank of the country, serves as the primary regulatory authority overseeing the nation’s financial institutions. BNM’s rigorous regulatory framework ensures the stability, integrity, and transparency of the banking sector. |

| Banking Sector Growth | Malaysia’s banking sector has witnessed steady growth over the years, driven by a robust economy and increasing financial literacy. This growth extends to areas such as retail banking, corporate banking, investment banking, and fintech innovation. |

| Islamic Banking | Malaysia is a global leader in Islamic finance, with a substantial presence of Islamic banks and financial institutions. Sharia-compliant banking and finance products coexist harmoniously with conventional banking, reflecting the nation’s multicultural landscape. |

| Digital Transformation | Like many other nations, Malaysia’s banking sector has undergone a digital transformation. Banks have adopted digital technologies to enhance customer experiences and streamline operations, further intensifying competition in the industry. |

| Cultural Diversity | The country’s multicultural society is reflected in the banking industry’s workforce and customer base. Cultural sensitivities and preferences must be considered in various aspects of banking operations, including customer service and marketing. |

| Financial Inclusion Initiatives | The Malaysian government and banking institutions have actively pursued financial inclusion initiatives, aiming to provide access to financial services for all segments of the population. This commitment to inclusivity shapes the industry’s outlook. |

Three Unique Challenges in Succession Planning for Malaysian Banks

Succession planning in the Malaysian banking industry presents a distinctive set of challenges that require careful consideration and tailored strategies. These challenges stem from the interplay of regulatory compliance, talent dynamics, and the cultural tapestry of the country. Let us explore these challenges in detail.

Regulatory compliance and governance considerations

In Malaysia’s tightly regulated banking industry, succession planning must strictly follow regulatory guidelines, particularly those set by Bank Negara Malaysia (BNM).

- In 2020, CIMB Group announced that it had activated its succession plan for the role of Group CEO and CEO, CIMB Bank Berhad. The appointment was to replace YBM Tengku Dato’ Sri Zafrul Tengku Abdul Aziz, who relinquished his position to join the Malaysian government as the Minister of Finance. This process will be managed by the Board with the appointment subject to the approval of Bank Negara Malaysia.

This example is a reason why strong emphasis is placed on upholding corporate governance standards. BNM expects all banking institutions to operate with integrity and transparency. As a result, when it comes to Malaysian banking succession planning, the process extends beyond merely evaluating the skills of potential leaders.

Talent scarcity and retention strategies

The banking sector demands specialised and ever-evolving skills, posing challenges for succession planning. Unique knowledge and competencies are essential, compounded by a scarcity of experts in areas like risk management, compliance, and fintech.

Hence, developing a digitally adept workforce is crucial for Malaysian banking. Moreover, fierce global talent competition requires strong succession planning, including talent identification and retention strategies.

The COVID-19 pandemic has accelerated the need for succession planning in the banking industry. A 2022 survey by the Malaysian Employers Federation found that 60% of Malaysian employers are accelerating their succession planning efforts because of the pandemic.

Cultural and organisational dynamics specific to Malaysian banks

Promoting diversity in Malaysia’s banking workforce is essential for aligning leadership with the multicultural community and customer base. This fosters access to diverse talent and perspectives.

Additionally, cultural awareness is crucial for maintaining strong customer relationships and supporting business growth. Future leaders should balance local market insights with global financial trends and regulations, enabling Malaysian banks to thrive regionally and globally.

The Core Components of Effective Succession Planning

Succession planning is not a one-size-fits-all endeavour; instead, it involves a set of core components that work in tandem to identify, develop, and prepare the next generation of leaders. In this section, we explore these fundamental elements and their critical roles in shaping effective Malaysian banking succession planning strategies.

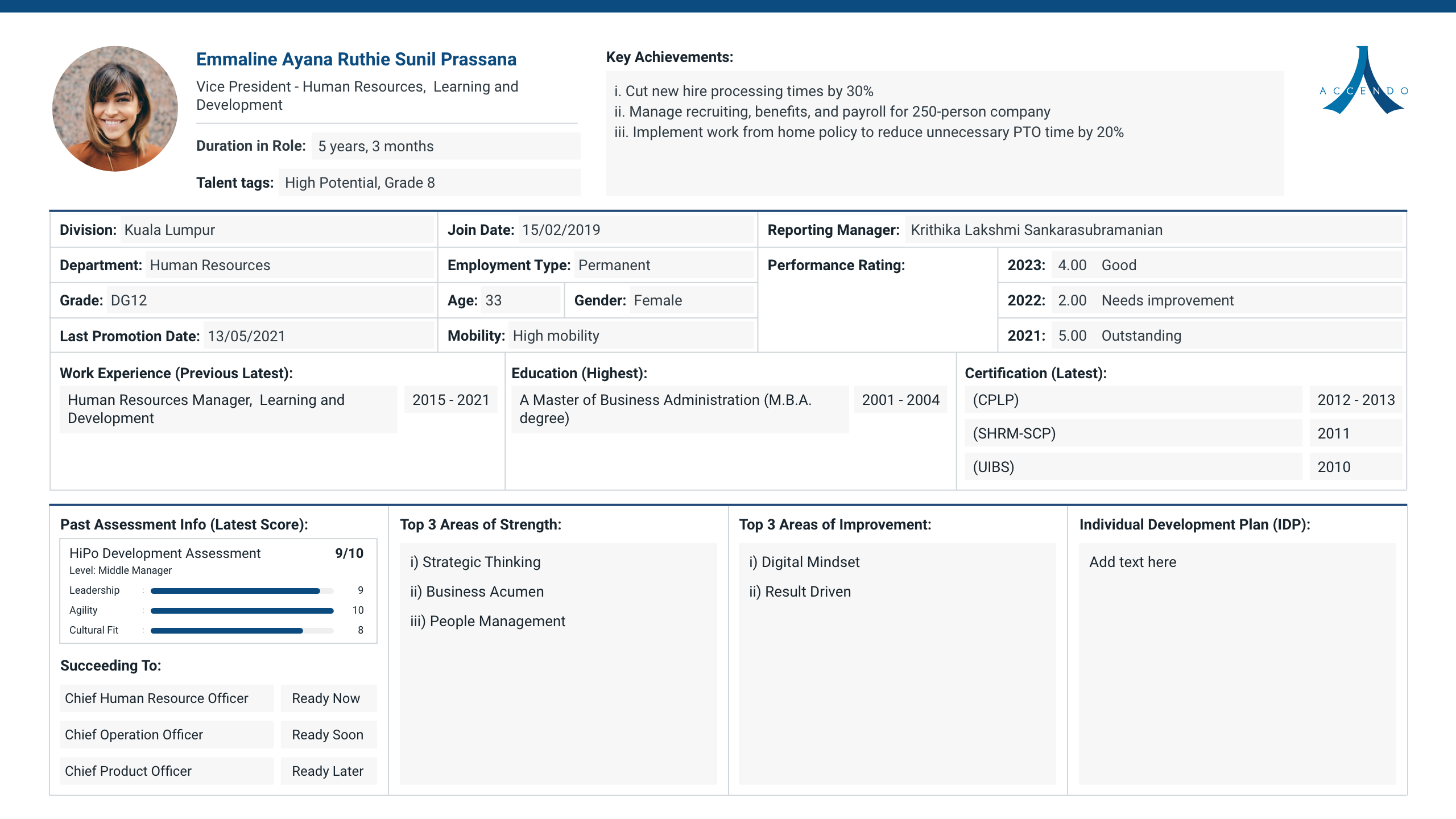

Talent identification and assessment

At the heart of effective succession planning lies the ability to identify and assess high-potential (HiPo) talent within the organisation. This process involves:

- Identifying HiPo employees – Recognising individuals who possess the skills, competencies, and leadership qualities required to fill key roles in the future.

- Competency assessments – Conducting thorough competency assessments to evaluate potential successors’ readiness to step into leadership positions. These assessments consider both technical skills and soft skills, such as adaptability, communication, and strategic hiring.

Leadership development programs

Identifying talent is just the beginning. The next critical component is the development of these identified individuals into capable leaders. Effective banking leadership succession programs encompass:

- Customised training initiatives – Tailoring training and development for banking leadership succession programs to address the specific needs and goals of potential successors. This ensures that individuals acquire the skills and knowledge necessary for leadership roles within the banking sector.

- Mentorship and coaching – Pairing HiPo employees with experienced mentors and coaches who can provide guidance, share wisdom, and facilitate their growth as future leaders. Mentorship plays a pivotal role in passing on institutional knowledge.

Succession planning tools for banks

In an increasingly digitised world, leveraging tools and technologies can enhance the effectiveness of succession planning efforts. This component involves:

- Documenting the succession plan – Utilising digital tools to create and manage comprehensive succession plans that outline the development paths and timelines for potential successors.

- Communication strategies – Employing technology for effective communication within the organisation regarding succession planning efforts. Transparency and clear communication are key to ensuring that all stakeholders understand and support the plan.

Malaysian banks are increasingly focusing on developing internal talent for key positions. A 2023 survey by the Malaysian Institute of Bankers found that 85% of Malaysian banks are investing in internal talent development programs.

In the name of transparency, Malayan Banking Bhd (Maybank) has quelled market speculation by officially announcing that its group president/CEO (GPCEO) does not intend to seek a renewal of his contract. As such, Maybank has initiated the process of searching for a new GPCEO through succession planning, a responsibility entrusted to the board’s nomination and remuneration committee.

7 Key Distinctions of Malaysian Banking Succession Planning

Succession planning principles generally remain consistent across various industries. The core objective of identifying and preparing future leaders to ensure organisational continuity and success is universal. However, there can be some notable differences when it comes to succession planning in the banking industry compared to other sectors. Here are 7 key distinctions:

- Regulatory compliance – Banks often face stringent regulatory requirements related to leadership positions, risk management, and compliance. As such, succession planning in banking must align with these regulations and are more complex compared to industries with fewer regulatory constraints.

- Complexity of roles – Executive and leadership banking roles are highly specialised and complex. Leadership succession planning in banking involves identifying talents with strong leadership skills, deep financial expertise and an understanding of complex financial instruments.

- Risk mitigation – Given the importance of banks, the consequences of leadership gaps can be severe. Succession planning in the banking sector places a strong emphasis on risk mitigation to ensure there are capable individuals ready to step into key roles to prevent disruptions.

- Cultural and ethical considerations – The banking industry places significant emphasis on ethics, integrity, and corporate governance. Succession planning in banking may include an additional focus on identifying leaders to uphold these values and navigate potential ethical dilemmas.

- Talent scarcity – Banks often face competition for top talent, especially in specialised areas like investment banking or risk management. Succession planning must address talent scarcity and may involve strategies for talent development and retention that are specific to the industry.

- Technological advancements – The banking industry has been rapidly evolving due to technological advancements. As such, succession planning may include a focus on identifying individuals with strong digital skills and the ability to adapt to technological changes.

- Customer trust – Banks rely heavily on customer trust. Leadership succession planning in banking must ensure that customer relationships and trust are maintained during banking leadership transitions, as disruptions can erode confidence quickly.

While these distinctions exist, the fundamentals of succession planning are still applicable in both banking and other industries. The key lies in adapting these fundamentals to the unique context and challenges of the banking sector.

Top 3 Succession Planning Tools for Banks

In the banking industry, effective succession planning is key to long-term success. In this section, we will introduce the top three succession planning tools for banks that are designed to streamline this process, ensuring your financial institution’s continued prosperity in a dynamic market.

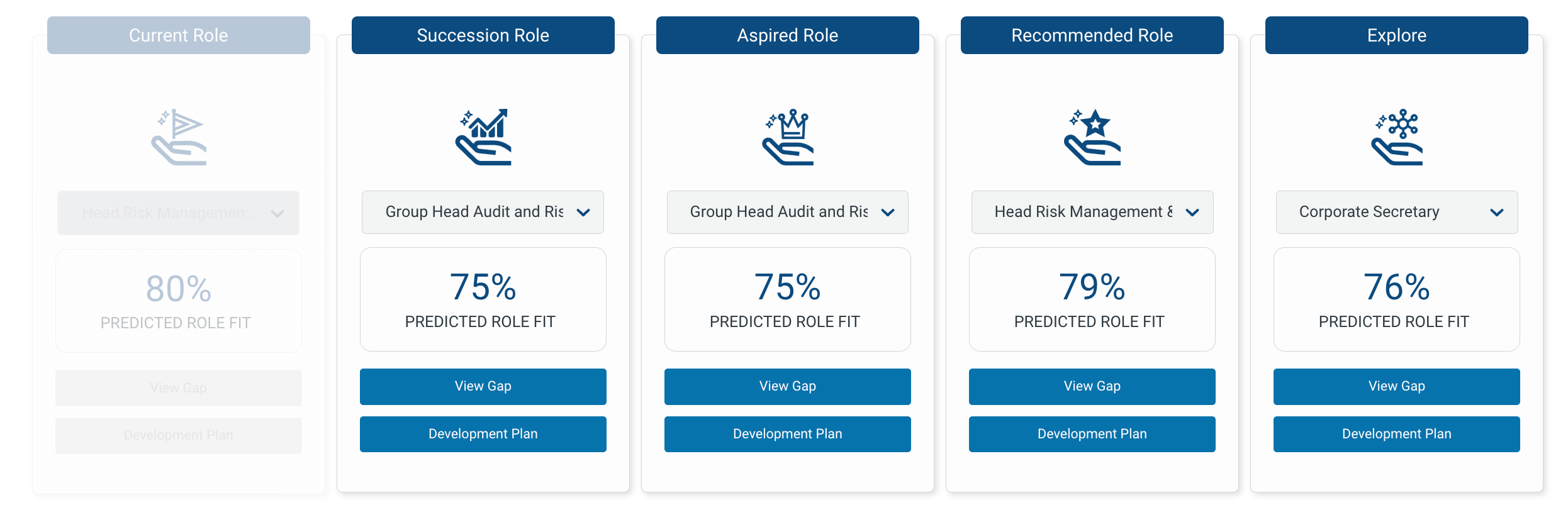

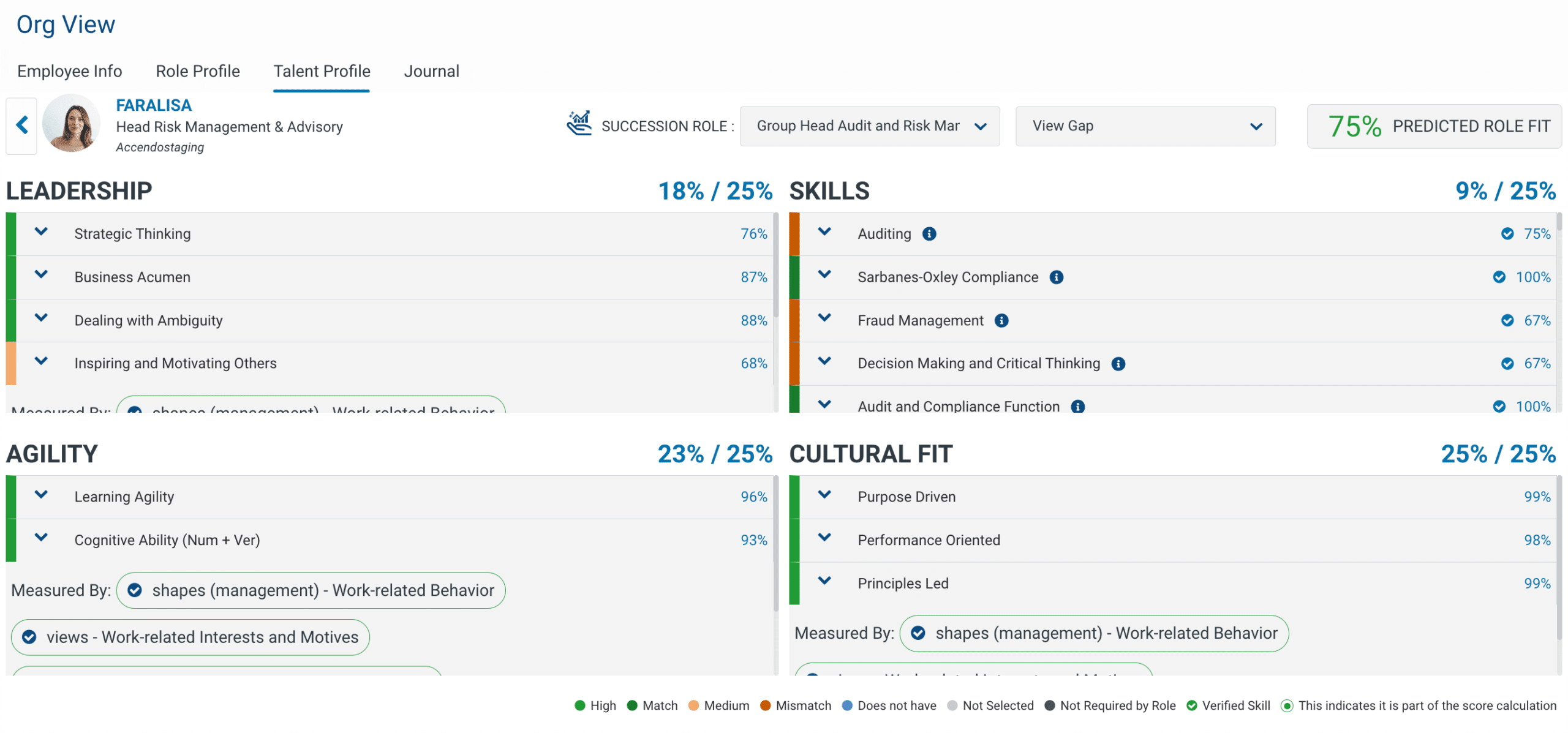

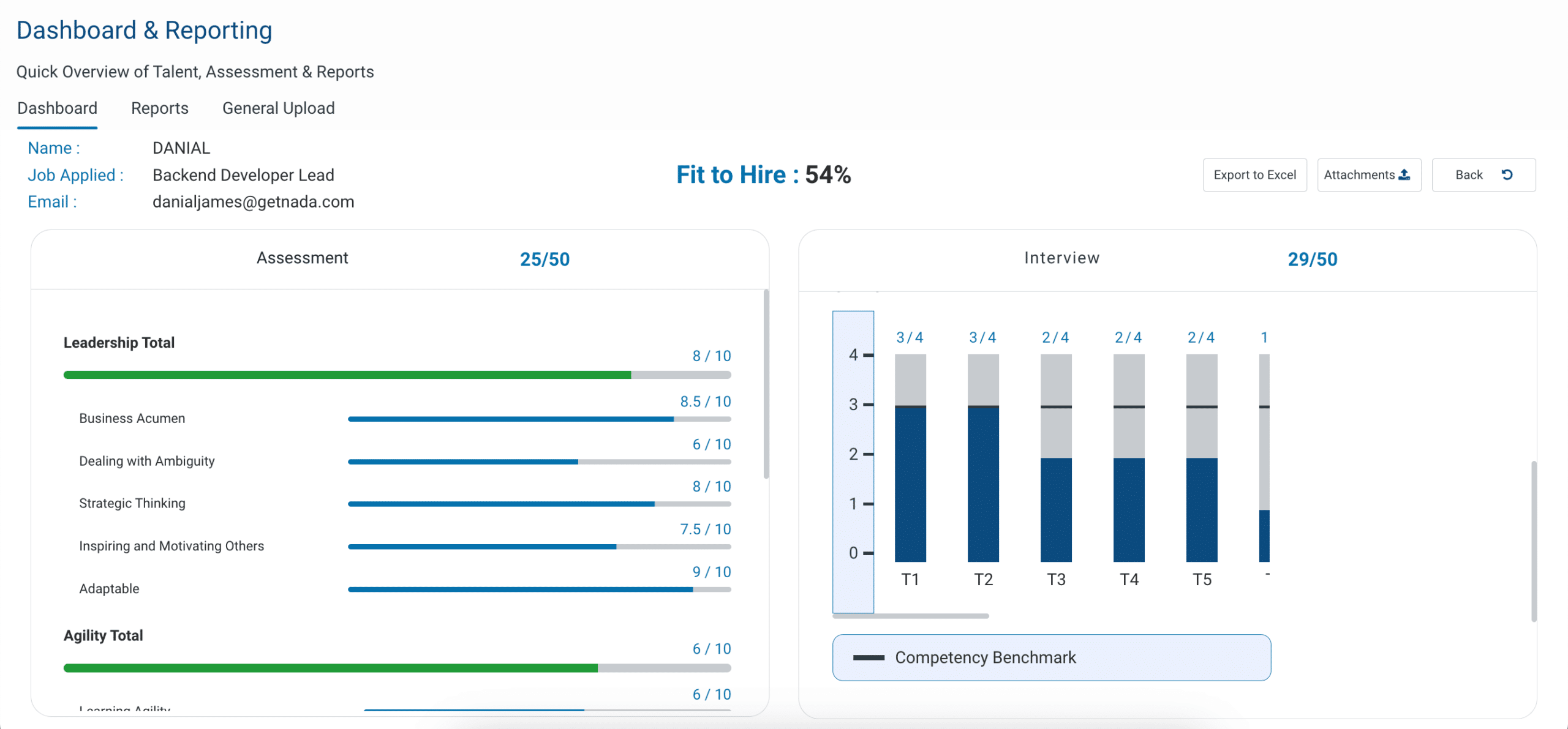

Accendo

Accendo’s Succession Planning solution includes a combination of various talent assessment tools, an extensive success profile library, and a matching algorithm. This combination speeds up the talent identification process to deliver quicker, cost-effective, and more accurate insights while ensuring a strong leadership pipeline to drive the business.

Malaysian banks are also investing in developing their employees’ leadership skills. A 2023 survey by the Malaysian Employers Federation found that 70% of Malaysian employers are investing in leadership development programs for their employees.

Our innovative approach utilises an array of data points which optimise talent identification while minimising biases. By combining multiple factors using advanced talent assessment tools, we deliver a holistic view of candidates to evaluate them based on their skills, competencies, and potential for future leadership positions.

With an extensive library of over 3,000 role profiles from around the world, we guarantee candidates are accurately assessed against universal benchmarks for job success. In situations where time is of the essence, the imperative for reliability is paramount. Our time-tested algorithms, finely tuned over the years of consulting expertise, empower you to quickly identify successors with confidence.

Accendo’s succession planning solution also enables financial institutions to broaden and deepen their talent search, use multifaceted data to assess their talents and conduct data-driven talent discussions prior to planning what’s next after these discussions.

TalentPulse, Accendo’s Talent Intelligence Platform, provides financial institutions with robust analytics and reporting capabilities, enabling them to track succession planning progress, identify skill gaps, and make data-driven decisions.

Succession Wizard

The primary purpose of Succession Wizard is to simplify the whole leadership succession planning process. Its user-friendly interface and powerful features are designed to identify potential succession gaps and assist in efficiently identifying and developing the next generation of leaders within an organisation. Key features of Succession Wizard are:

- Talent identification – Allows organisations to assess and evaluate potential successors by using data-driven insights and performance metrics to pinpoint high-potential employees.

- Gap analysis – Enables companies to identify skill gaps within their workforce and determine the areas where development is needed to create targeted training and development plans.

- Scenario planning – Organisations can create and explore various succession scenarios where users simulate the impact of different succession choices and make informed decisions.

- Development plans – Assists in creating personalised development plans for employees and ensuring they are equipped with the skills and knowledge needed for future leadership roles.

- Customisable reports – Provides insights into succession readiness and progress which aid in making informed decisions about talent development.

A survey of Malaysian banks revealed that 82% of them consider finding suitable successors for critical positions as one of their top succession planning challenges.

PageUp Succession Planning Solution

Like all other succession planning solutions, PageUp’s module offers a seamless approach to identifying, developing, and nurturing talent within organisations. Their intuitive platform streamlines the succession planning process, allowing businesses to build a robust talent pipeline. Key features include:

- 360-degree feedback – Enables organisations to collect feedback from various sources to provide a holistic view of an employee’s performance and potential.

- Skills matrix – Helps organisations assess and visualise the skills and competencies of their workforce to identify areas for skill development and succession planning.

- Calibration and ranking – Ensures objectivity and consistency in the succession planning process which is vital for making data-driven decisions.

- Succession pools – Create and manage succession pools by grouping employees based on their readiness to step into key roles, facilitating targeted development efforts for each group.

- Integration capabilities – Seamlessly integrates with other HR systems and tools to streamline data exchange and ensure that succession planning is aligned with broader talent management strategies.

Success Story in Succession Planning

How This Southeast Asian Telco Leveraged Accendo to Build a Strategic Leadership Pipeline

Key Actionable

Succession planning is essential for any business, but it is especially important in the Malaysian banking sector, which is facing a number of challenges, including an ageing workforce and increasing competition. By digitising your succession planning process, you can ensure that you have a strong pipeline of talented leaders ready to take the helm when the time comes.

Accendo’s Succession Planning solution can help you to digitise your succession planning process and create a more sustainable and successful succession planning. With TalentPulse, you can:

- Identify and develop your high-potential employees

- Create personalised succession plans for each key role

- Track progress and make adjustments as needed

- Ensure that you have the right people in the right roles at the right time

Frequently Asked Questions (FAQs)

What is the importance of succession planning in banking?

Succession planning in banking is crucial for ensuring a smooth transition of leadership within the industry. It helps identify and develop future leaders who can navigate the complexities of the banking sector, including maintaining financial stability, safeguarding customer trust, and preserving institutional knowledge specific to banking operations and regulations.

Why is succession planning essential for the role of bank CEO?

Succession planning is essential for the role of bank CEO to maintain strategic direction, leadership continuity, and investor confidence during leadership changes. It ensures that there is a well-prepared and capable successor ready to step into the CEO’s shoes, minimising disruption and allowing the bank to adapt to evolving market conditions while upholding shareholder trust and long-term vision.

What are the challenges of succession planning in the banking industry?

Challenges in banking succession planning include talent shortages, regulatory compliance, and identifying leaders who can adapt to rapidly evolving financial technologies.

How can banks identify high-potential talent for succession planning?

Banks can identify high-potential talent through performance assessments, leadership assessments, and talent development programs.

How does technology impact succession planning in banking?

Technology impacts succession planning in banking by enabling data-driven talent assessments, remote leadership training, and the automation of succession planning processes for more accuracy and efficiency.

How does technology impact succession planning in banking?

Technology impacts succession planning in banking by enabling data-driven talent assessments, remote leadership training, and the automation of succession planning processes for more accuracy and efficiency.

How often should a bank review and update its succession plan?

Banks should review and update their succession plans at least annually to ensure alignment with evolving organisational goals and changes in leadership talent. Regular updates help identify and address skill gaps, emerging leaders, and potential risks, enhancing the bank’s ability to smoothly transition key roles when needed.

Page Contents