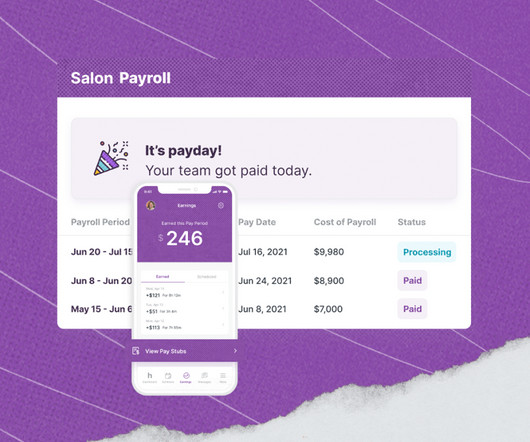

Introducing our integration with Paylocity

Guideline

MAY 5, 2023

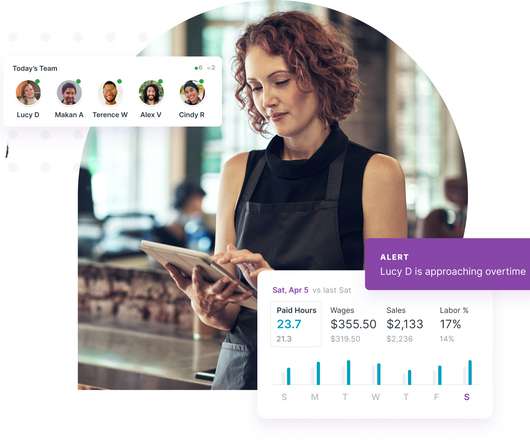

Integrating your payroll directly with your retirement benefit can help prevent unnecessary errors and remove most administrative burdens. Our data shows employees are more likely to save for retirement when payroll is integrated.¹ See our Privacy Policy to learn how we use and protect your information. ¹

Let's personalize your content