Outsourcing HR Functions: Is it Worthwhile?

Hppy

DECEMBER 27, 2021

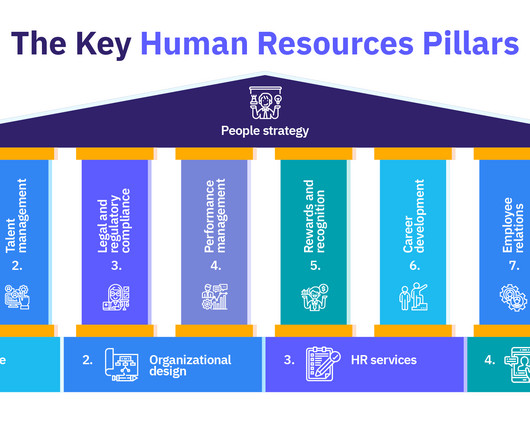

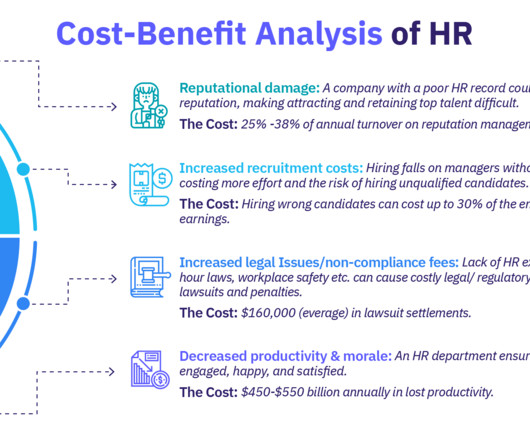

For instance, you can’t force one employee to handle all your employees’ recruitment, payroll, and compliance tasks. Outsourcing streamlines various HR activities, such as payroll, employee administration, and payroll. You will need a team with varying expertise to ensure that all HR functions are handled.

Let's personalize your content