2023 Best Practices for Payroll Management

PCS

DECEMBER 13, 2022

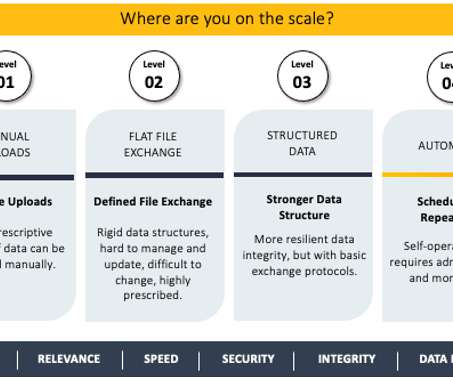

Payroll management has gradually transitioned into a digital platform. In fact, many companies have adopted a completely digitalized payroll system with multiple features and integrated this with other operations of their business. Automation makes things easier for the payroll staff. Payroll Policy.

Let's personalize your content