Form 720 and PCORI fee FAQs

Small Business • May 5, 2023 at 7:44 AM • Written by: Chase Charaba

If you're a small business owner, you may have heard of the acronym PCORI and the fees that come with it. But what is PCORI, and how does it apply to your organization?

Under the Affordable Care Act (ACA), sponsors of self-insured health plans must pay a fee to fund the Patient-Centered Outcomes Research Institute (PCORI).

PCORI is an independent organization created by the ACA that conducts research to help healthcare consumers make better decisions for their specific needs and outcomes. It also supports clinical effectiveness.

Employers offering a self-insured medical reimbursement health plan, such as health reimbursement arrangements (HRAs), must pay this fee by July 31 each year (or August 1 if the date falls on a weekend) via Form 7201.

This fee was initially set to expire in 2019, but Congress extended it through September 30, 20292, due to the Further Consolidated Appropriations Act of 20203.

Looking to provide your employees with a compliant health benefit? Read our free guide on HRAs

Who owes a PCORI fee?

Specified health insurance policies subject to PCORI fees are generally prepaid health coverage arrangements with fixed premiums for accident or health coverage.

If your company offers a self-insured health plan, such as an HRA, you must pay the PCORI fee.

However, an integrated HRA is not subject to PCORI4 if it's offered alongside a self-insured plan from the same plan sponsor. In this case, the HRA and medical plan are considered a single plan for the PCORI fee.

An HRA that only covers dental and vision expenses is also exempt from the PCORI fee.

PCORI fees apply to organizations that offer different benefits, including:

- Specific fully insured plans

- Self-insured plans

- HRAs

- Health flexible spending accounts (FSAs) if employer contributions exceed the greater of either the employee’s contribution or $500

Which plans are exempt from the PCORI fee?

Some benefits, such as health savings accounts (HSAs) and other excepted benefits, aren't subject to the fees.

Health plans exempt from the PCORI fee include:

- Government programs

- Including Medicare, Medicaid, Children's Health Insurance Program (CHIP)

- Insurance policies that only provide excepted benefits, such as vision or dental

- Wellness programs (as long as the program doesn't provide significant medical care or treatment benefits)

- Policies that solely cover international employees

- Archer medical savings accounts (MSAs)

- Hospital indemnity

- Accident-only coverage

- Workers' compensation

How much is the PCORI fee?

For plans ending on or after October 1, 2023, and before October 1, 2024, the PCORI fee5 is $3.22 per covered life. That's up from $3 per covered life for plan years from a year earlier.

The amount is adjusted for inflation every year by the Secretary of Health and Human Services6.

| Plan year | PCORI fee |

| On or after October 1, 2023 and before October 1, 2024 | $3.22 |

| On or after October 1, 2022, and before October 1, 20237 | $3 |

| On or after October 1, 2021, and before October 1, 2022 | $2.79 |

What is IRS Form 720?

Form 720, known as the Quarterly Federal Excise Tax Return8, is used by organizations to report any federal excise taxes collected.

This includes a variety of tax categories and fees, such as:

- Environmental taxes. This includes petroleum oil spill liability, products, and chemicals that cause ozone layer depletion. With these environmental taxes, you’ll also have to complete IRS Form 66279.

- Communications and air transportation taxes. This includes phone service and air travel.

- Fuel taxes. This category includes fuel types such as diesel, kerosene, gasoline, and natural gas.

- Retail taxes. This is for trucks, trailers, and tractors.

- Ship passenger taxes.

- Foreign insurance taxes. This is for insurance that's issued by foreign insurers.

- Manufacturers taxes. This includes a long list of products and services, such as coal, tires, indoor tanning services, and vaccines.

- Other excise taxes.

- PCORI fees. These are for specified health insurance policies and applicable self-insured health plans.

Does my business need to submit IRS Form 720?

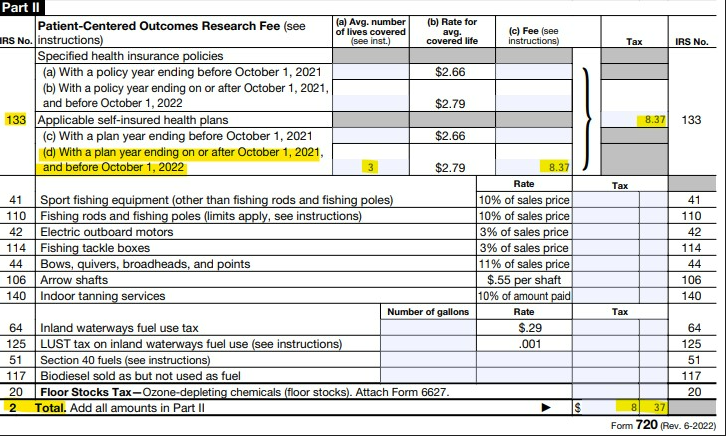

If you owe a PCORI fee, it must be paid using IRS Form 720 by July 31, following the last day of the plan year. For self-insured health plans, see Part II, IRS No. 133 (b) of the form. If your business does not owe a PCORI fee, IRS Form 720 doesn't need to be completed.

If you currently file Form 720, you will pay the fee with your second quarter return. If you don't regularly file Form 720, you only need to file the form once, during the second quarter with your return. You don't need to file Form 720 on a quarterly basis.

How to calculate the PCORI "number of lives"

According to Form 720 instructions, there are three ways to count the number of lives for plan years.

Here's what the instructions state for calculating the number of lives:

- The actual count method: Add the total of lives covered for each day of the plan year and divide that total by the total number of days in the plan year.

- The snapshot method: Take the total number of lives covered on one date (or more dates if an equal number of dates is used in each quarter) during the first, second, or third month of each quarter and divide that total by the number of dates on which you made a count.

- Form 5500 Method: Take the number of participants reported on Form 5500, Annual Return/Report of Employee Benefit Plan, or Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan.

Additionally, there are special rules for calculating covered lives if you offer multiple self-funded plans or an integrated HRA from a medical insurance provider.

With an employer-sponsored HRA that's integrated with a fully-insured medical plan, it's a requirement to pay the fee only with respect to each HRA participant.

For multiple self-funded medical plans, they can be treated as a single plan for purposes of the fee, with each unique covered life only being counted once.

You can view detailed information about “lives covered” in the final regulations10 document.

Does COBRA coverage to retirees or former employees count as "lives" covered?

Yes. You must count COBRA-covered individuals and dependents in the total number of lives for your benefit.

How to complete Form 720

New to filling out Form 720? We've compiled some examples. Below, the company plan covered an average of three participants and had a plan year that ended on December 31, 2021.

This section is included for informational purposes only. You should seek professional advice from a tax adviser or legal counsel to ensure proper compliance with the law.

Step 1: Complete company information header

The first part of this tax form asks for the basics, such as your name, address, and your employer identification number, or EIN.

In the header, the quarter ending date will be June 30, 2022, as you're filing the form for the second quarter. Don't check “Final return” unless your organization is going out of business or you aren't required to file Form 720 in future quarters.

Step 2: Complete Part II, line 133(c) or (d)

Complete line 133(c) if your organization's plan year ended before October 1 of the previous year. In this example, the plan year ended in December, so we’d move on to the next section. Complete line 133(d) if the plan year ended on or after October 1 (this is the case with most plans). In this example, the plan did.

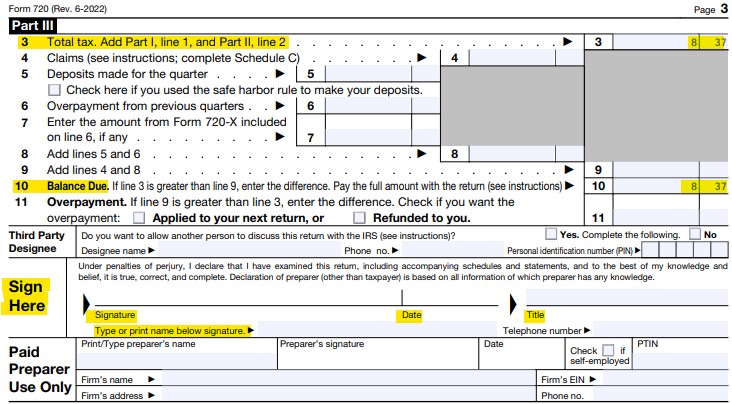

Step 3: Complete Part III lines 3 and 10, sign and date

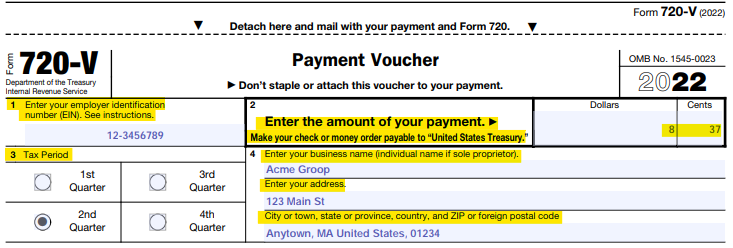

Step 4: Complete the payment voucher

Step 5: Send the completed form, payment voucher, and check to the IRS

You'll send Form 720 to the IRS in Ogden, Utah.

Send to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

Conclusion

For applicable employers, the deadline for filing IRS Form 720 and paying PCORI fees is July 31. You should always consult a tax professional to ensure you're filling out your form and paying the fees correctly.

If you want a compliant, tax-advantaged health benefit for your employees, PeopleKeep can help! Our HRA administration software makes it easy to set up and manage your health benefit in minutes.

This blog article was originally published on August 4, 2020. It was last updated on December 8, 2023.

- https://www.irs.gov/forms-pubs/about-form-720

- https://www.irs.gov/newsroom/patient-centered-outcomes-research-institute-fee

- https://www.congress.gov/bill/116th-congress/house-bill/1865

- https://www.irs.gov/newsroom/application-of-the-patient-centered-outcomes-research-trust-fund-fee-to-common-types-of-health-coverage-or-arrangements

- https://www.irs.gov/pub/irs-drop/n-23-70.pdf

- https://www.irs.gov/affordable-care-act/patient-centered-outcomes-research-trust-fund-fee-questions-and-answers

- https://www.irs.gov/pub/irs-drop/n-22-59.pdf

- https://www.irs.gov/pub/irs-pdf/i720.pdf

- https://www.irs.gov/pub/irs-pdf/f6627.pdf

- https://www.govinfo.gov/content/pkg/FR-2012-12-06/pdf/2012-29325.pdf

Ready to enhance your employee benefits with PeopleKeep?

Chase Charaba

Chase Charaba is the content marketing manager at PeopleKeep. He started with the company as a content marketing specialist in early 2022. Chase has written more than 350 blog posts for various companies and personal projects throughout his career. He’s worked for digital marketing agencies, in-house marketing teams, and as the editor for national award-winning high school and college newspapers. He’s also a YouTuber, landscape photographer, and small business owner.