Cornerstone Makes A Play To Dominate The Skills Platform Market

This week was the week of Cornerstone’s global user conference, entitled Limitless: Unlocking the Potential of your Workforce. And for the first time, users get to see what the new Cornerstone is all about.

Let me first say that I’ve been working with Cornerstone from the beginning, when the company was a scrappy LMS vendor founded by three hard-working entrepreneurs. Over the last fifteen years the company has become the largest learning platform company in the world, with more than $1 Billion in revenue (almost 40% EBITDA), more than 7,000 customers, and over 100 million end users. Not a bad run, considering how competitive this market can be.

In the process of this growth Cornerstone has acquired EdCast, Saba, SumTotal, Halogen, Lumesse, Clustree, Grovo, and quite a few other small players. So the company is global, scalable, and filled with passionate, hard-working engineers, product managers, sales, and marketing people.

|

Long before Cornerstone went private (for $5.2 Billion in October of 2021), the company was a well aligned, talented, customer-focused company. Most of Cornerstone’s product releases were well positioned, competitive, and complemented with outstanding sales, marketing, and service. The company was never the “most innovative” learning technology company, but it has always been a fast-follower and one that executed well.

Well that is about to change. Now, as the new management team takes charge, Cornerstone is vying to become a technology leader at last. And it’s about time: not only is Cornerstone’s engineering team the largest corporate learning tech organization in the market, customers need a strong market leader. As you’ve heard from me many times, the corporate training market is far too fragmented, there are too many startups, and most vendors are selling things that don’t work quite as well as they should.

The biggest challenge today is what I call SkillsTech: corporate HR systems that try to figure out what skills you have, what skills you need, and how to find, build, and develop skills more quickly. This information is used for almost every major decision: who to hire, how much to pay someone, who to promote, and more.

Because of it’s wide utility in business, almost every HR tech company claims to have such technology, but most of it doesn’t do as much as you would like.

This is not, by the way, because vendors aren’t trying. Rather, this market is still immature and most vendors just don’t appreciate how complex the problem really is. Any vendor that tells you they’re going to infer, index, and identify all the skills in your company is simply dreaming. Every company, every industry, and every business process is creating new skills every day, so what we need is a good infrastructure to build upon: not a panacea solution that is over-sold by vendors.

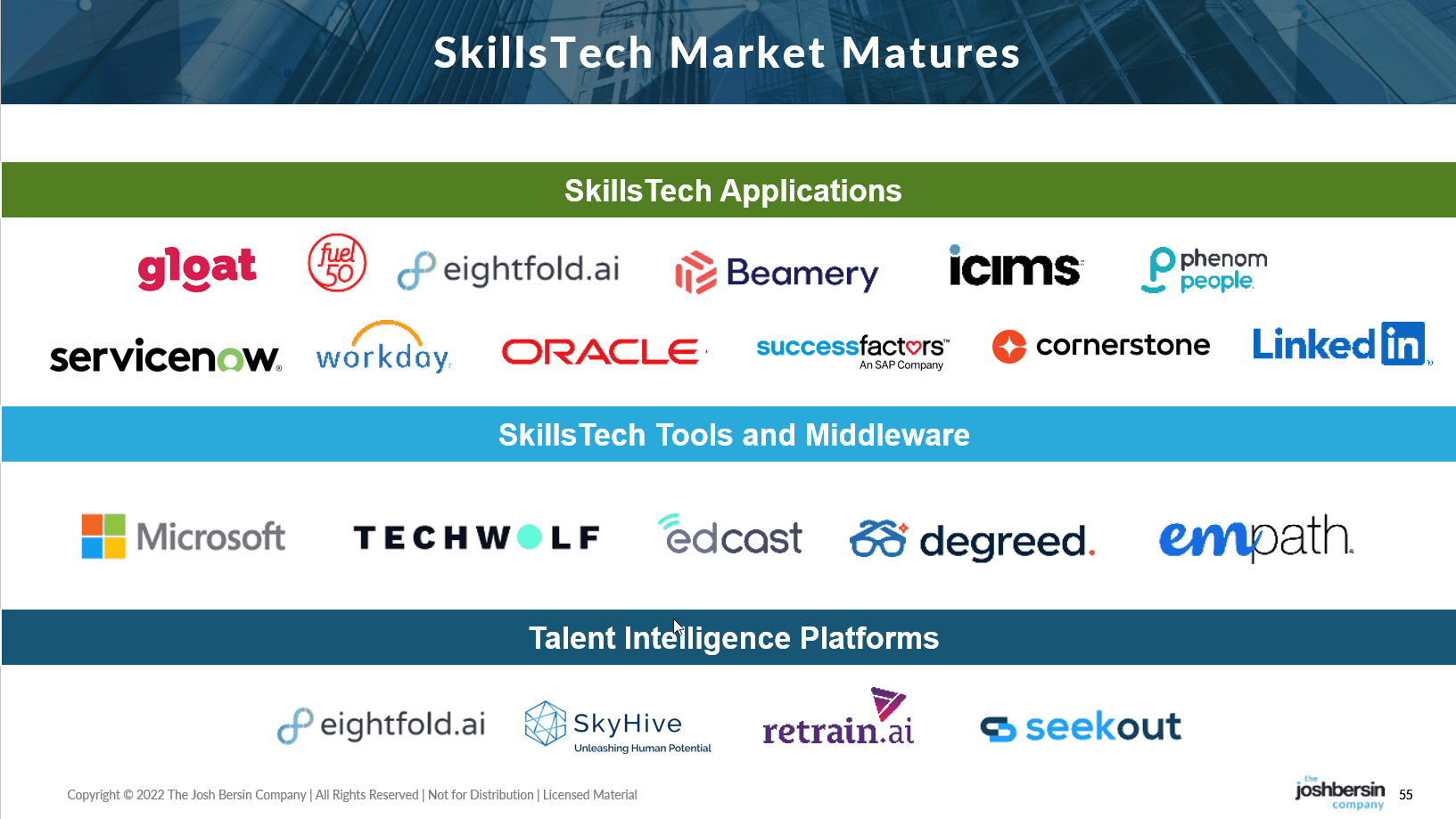

As I talked about at the HR Technology conference this year, there are three major categories of skills vendors today: those that use skills engines to deliver a solution, those that sell skills engines so you can build your own solution, and those that sell data integrated with skills, under the category of Talent Intelligence. It’s a very messy space, and pretty soon LinkedIn and Microsoft will unveil their solution. So companies are struggling to deal with it all. (Read our Talent Intelligence Primer for more.)

|

Why SkillsTech Is So Important

The promise of SkillsTech is real, because “skills” are essentially the “Metadata of People” the way web traffic and webpages are the metadata of the internet.

Consider the myriad of management decisions we make in our companies: who to hire, who to put into what role, how much to pay someone, how to staff a team, and who gets promoted into a new position. All these decisions are made on “judgement,” which means there’s bias, opinion, and lots of politics involved. What if we really knew what capabilities each person had, how much better would our companies and careers really be?

This is the holy grail of management: having a strong and accurate understanding of the capabilities of your people, your teams, and your organization. But it’s devilishly hard and changes every minute. SkillsTech, which is essentially AI-powered indexing technology, tries to guess what skills people have, and it gets smarter and smarter over time.

This is the holy grail of management: having a strong and accurate understanding of the capabilities of your people, your teams, and your organization. But it’s devilishly hard and changes every minute. SkillsTech, which is essentially AI-powered indexing technology, tries to guess what skills people have, and it gets smarter and smarter over time.

LinkedIn, of course, is basically a big SkillsTech platform. How does it know who you should connect to? It simply looks at people who are “similar” to you, and in order to do that it must look at your education, background, experiences, and other factors. So this is “the big thing” in HR, and we need a vendor like Google to bring it all together.

Unlike Google, however, the problem of characterizing human beings is tough. Every skills-oriented application needs hundreds of unique data sources to be accurate. Consider, for example, a system that tries to figure out who is a highly skilled nurse for a particular clinical role. Not only do you need to know someone’s certification and credentials, you probably need to know if this person has worked in a heart and lung clinic, a skin care clinic, or possibly knows a lot about infectious diseases. Do they speak multiple languages? Have the worked in the operating room? And how much trauma care have they done?

And what I call the “second order” effects are big. Advanced skills engines like Eightfold, for example, use a time-series engine for skills. Eightfold knows, for example, that if you worked in the machine learning group at Google in 2008, you likely know certain algorithms which were used at that time. If you stayed there until 2015, you probably worked on others. And Eightfold also knows that you’re likely to be connected to other people who worked in Google at that time, so it can infer your skills from the skills of these others.

While vendors have been promoting their skills tech for almost a decade, I think this technology is still young. Vendors like Workday and Degreed, who promoted their products early, are already getting outpaced by the newer vendors because the algorithms are newer and data sets are bigger. So companies want a big player to help them, protecting them from dead end investments.

And the real problem of SkillsTech is not just the algorithm: its really a problem of data. Vendors like Eightfold and LinkedIn (and Beamery and Seekout) have been dealing with billions of employee records for years. Any vendor that’s new to this space really won’t mature their product until they run it against huge amounts of data. Hence new vendors need time to build maturity, use-cases, and experience.

I also believe great SkillsTech will be industry specific. When Ford Motor Company wants to build EVs, batteries, and power systems they need a skills ontology that leans toward power systems, storage, motors, and similar devices. Chevron and Exxon need skills in chemical engineering, hydrogen, and solar engineering. And companies like Allstate and GEICO need skills in actuary science, weather prediction, and disaster history. See? It’s not a simple problem.

Any vendor that tells you “we have all the skills you need” is either naive or simply trying to fool you. Your real skills solution will be a living, breathing engine, so you need a vendor with great technology, staying power, and lots of data to index.

Where Does Cornerstone Fit

So where does Cornerstone fit? The new management team, led by Himanshu Palsule (CEO), Karthik Suri (Chief Product Officer), and seasoned experts like Vincent Belliveau (International sales), Srini Ogireddy (Chief Technology Officer), and other seasoned professionals, is trying to redefine the market. So let me explain what they’re up to.

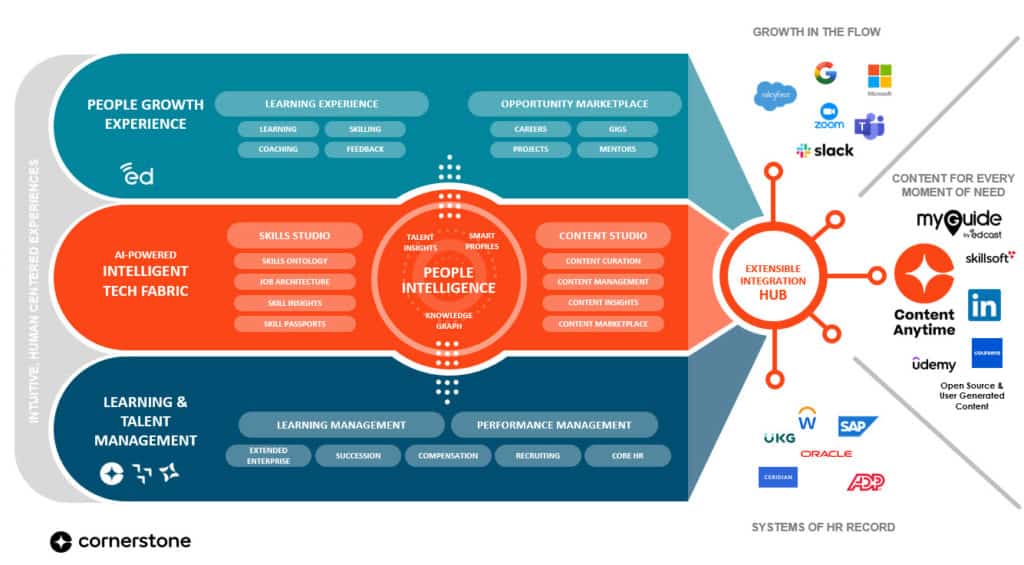

The new product strategy essentially includes five major pieces, each of which is built on existing products and new technology integration.

|

At the base, Cornerstone continues to sell and maintain its core LMS and talent management systems. These are Cornerstone itself, Saba, and SumTotal. Each of these systems, which have hundreds or thousands of users, have extensive LMS capabilities, business rules, performance and talent management features, and other capabilities that deliver learning, talent management, recruiting, or other functions. Products like TalentLink and Halogen also fit into this box.

These products, which each have many embedded customers, will continue to be offered and over time will be evolved, maintained, and combined.

At the next level is a common data and skills system called the People Intelligence core. This system, which is built on Clustree and EdCast technology, is essentially a massive skills and people database that combines data from the core talent systems and Cornerstone’s massive content libraries around the world. Unlike engines like Eightfold, Beamery, or even Workday, Cornerstone has indexed tens of thousands of courses. This means the People Intelligence core can tell you “what courses or skills” any individual has consumed, what content is being used (or not used), and what valuable content is trending up or down in the company.

While the system is new so we can’t validate it’s usefulness yet, we know out of the box that the 55,000+ skills in Cornerstone’s engine will be useful to its customers almost immediately. Through its Intelligent Insights front end customers can immediately see what content is being used and start to make smart decisions about what to build, buy, or get rid of. Over time the system will get smarter about the skills of people by job and role and eventually fuel succession, skills depth, and other analysis companies need.

(Interestingly, Cornerstone is going to release its skills database into the market, so people can download it, use it, and compare it to jobs within the People Intelligence core. While this sounds pretty cool, vendors like Lightcast EMSI BurningGlass have been doing this for years.)

Today vendors like Eightfold operate Talent Intelligence at scale (with more than 1.5 billion user profiles in the system), so Cornerstone is starting a bit behind. But with more than 100 million real customers and all the data they include, the system could become useful very quickly. If you’re Sanofi or Deloitte, for example (both of which use Cornerstone products), this engine should be able to tell you thigs about the skills, learning history, and job experience of your teams that’s hard to find elsewhere.

You may ask: what about my Workday, Oracle, or SAP skills cloud? Isn’t this just a duplicate? Well actually the answer is no. The Cornerstone system has data that typically is not included in ERP, so it may turn out to be smarter and more useful than the ERP. We can’t really validate this until these systems go into scale production, but logically Cornerstone may have more and better data than the ERP.

At the third level, Cornerstone offers the user experience layer, built around many of the tools from EdCast. As you know, most companies don’t care how smart or well engineered the back end system is unless employees can use it easily. So the user experience (now called Employee Experience) is really key to success with these systems.

Built around many of the interfaces offered from EdCast, Cornerstone now has a world-class LXP (Learning Experience Platform) and a lot of “in the flow” interfaces to Microsoft Teams, Slack, Google, Salesforce, and other employee-facing systems. While some of Cornerstone’s user workflows are dated, Karthik (the new product officer) is committed to modernizing it all, so the front end experiences will be competitive. Remember also that prior to the acquisition of EdCast Cornerstone was building an employee experience layer called Xplor, so the company is well along with some pretty exciting front end systems.

And by the way, a big new feature here is the Cornerstone Opportunity Marketplace, which appears to have many of the features of Gloat, Fuel50, Eightfold, and others. What’s unique here is that Cornerstone’s integrated LMS and talent management system can recommend courses, projects, developmental assignments, mentors, and jobs. The other talent marketplace vendors still do not index content well, so they are more like “position matching systems” today. And once you join a “project” or “assignment” in Cornerstone, the system helps you assemble that team based on skills, similar to SAP’s new Dynamic Teams system.

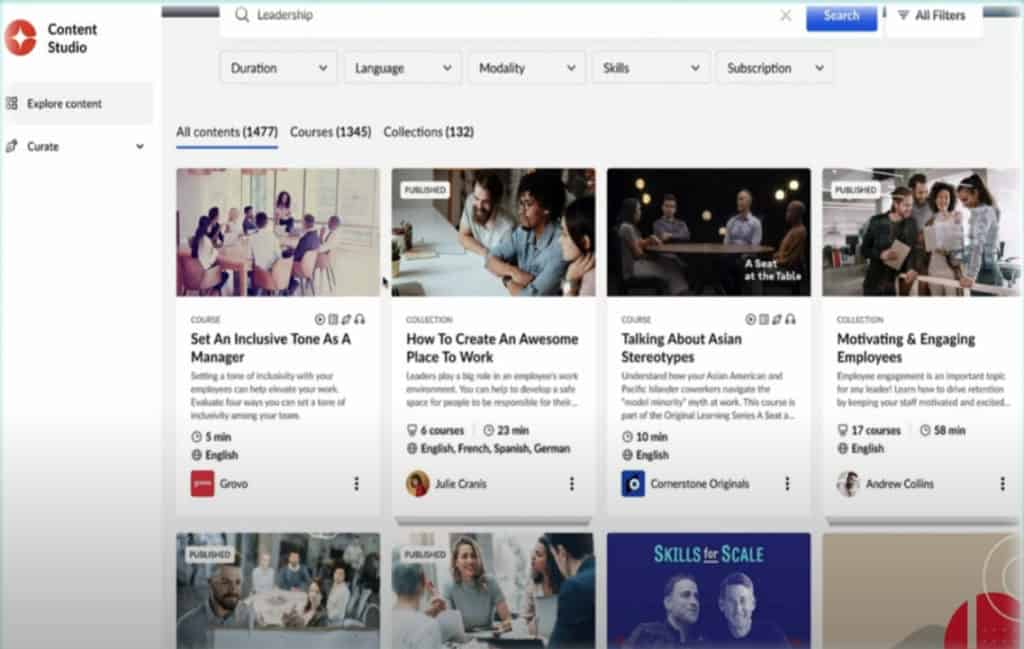

At the fourth level, Cornerstone offers a massive content library and toolset call Content Studio. No other skills vendor really does this, and this is one of Cornerstone’s big strengths in the market. Not only does Cornerstone build content (Cornerstone Studio), the company has integrated, indexed, and managed content from almost every vendor on the planet. So this big content management system means any content you want to build or buy should be trackable, indexed, and manageable in Cornerstone (regardless of which LMS you use).

|

Finally at the fifth level, Karthik has committed to building a strong set of APIs and connectors to third party systems (Integration Hub). Both Himanshu and Karthik are new to the HR Tech market, and they know that big platform vendors must lean toward coexistence with other major players. So Cornerstone wants to be “better integrated with Workday than Workday Learning” and “better integrated with iCims than any talent system” and so on. This commitment is actually massive, and only in the last few years has Workday (through Workday Extend) really invested in its open APIs.

Can Cornerstone Pull This Off?

That’s the big question: where will all this go? Based on many meetings with the management team and a long history with the company, let me give you my thoughts.

First, while some of the details are not clear, the vision for the platform is sound. I think the team knows what they’re getting into, and with 400+ engineers and lots of customers to work with, they have a lot of positive momentum.

Second, the market is desperate for a “big player” to clean up the fragmentation of tools in this space. Cornerstone customers will give the company some time to make this all work, so much of the product management will focus on listening to the big customers and building just what they need. (The pioneers in this space had to guess a lot.)

Third, the problem of matching content to skills is a big opportunity. No other vendor has closed the loop on this potential, so this could be a big win.

The caveats are still many: will the People Intelligence engine match candidates to opportunities well? Will the system infer skills well enough to be useful for succession or capability analysis? And how well will the system accommodate the vast amount of new data sources they will be asked to injest?

I, for one, am rooting for Cornerstone to succeed. While I don’t see any challenges to strong vendors like Eightfold, Gloat, Beamery, Phenom, iCims, or the ERPs, the learning platform market is a bit of a mess. There are too many platforms and most companies simply do not have a strong “system of record” strategy for skills.

Cornerstone, above all, has the potential to make this happen.

Stay tuned, we’ll be watching them closely and look forward to keeping you up to date.

PS: In the meantime, if you’re working on your company’s skills strategy, please call us. We are pretty good at helping you make this all work, and our research and advisory services are here to help.

Additional Information

Understanding SkillsTech: One Of The Biggest Markets In Business

The Talent Intelligence Primer

Cornerstone Goes Private: This Is All About Growth