More than 60% of workers said they’d consider relocating for a job. But—whether it’s a new city or state—moving from one location to another can quickly get expensive. To sweeten the deal, you can provide relocation assistance.

But before offering help with moving expenses, you may have questions about what it covers, whether it’s taxable, and so on.

What is relocation assistance?

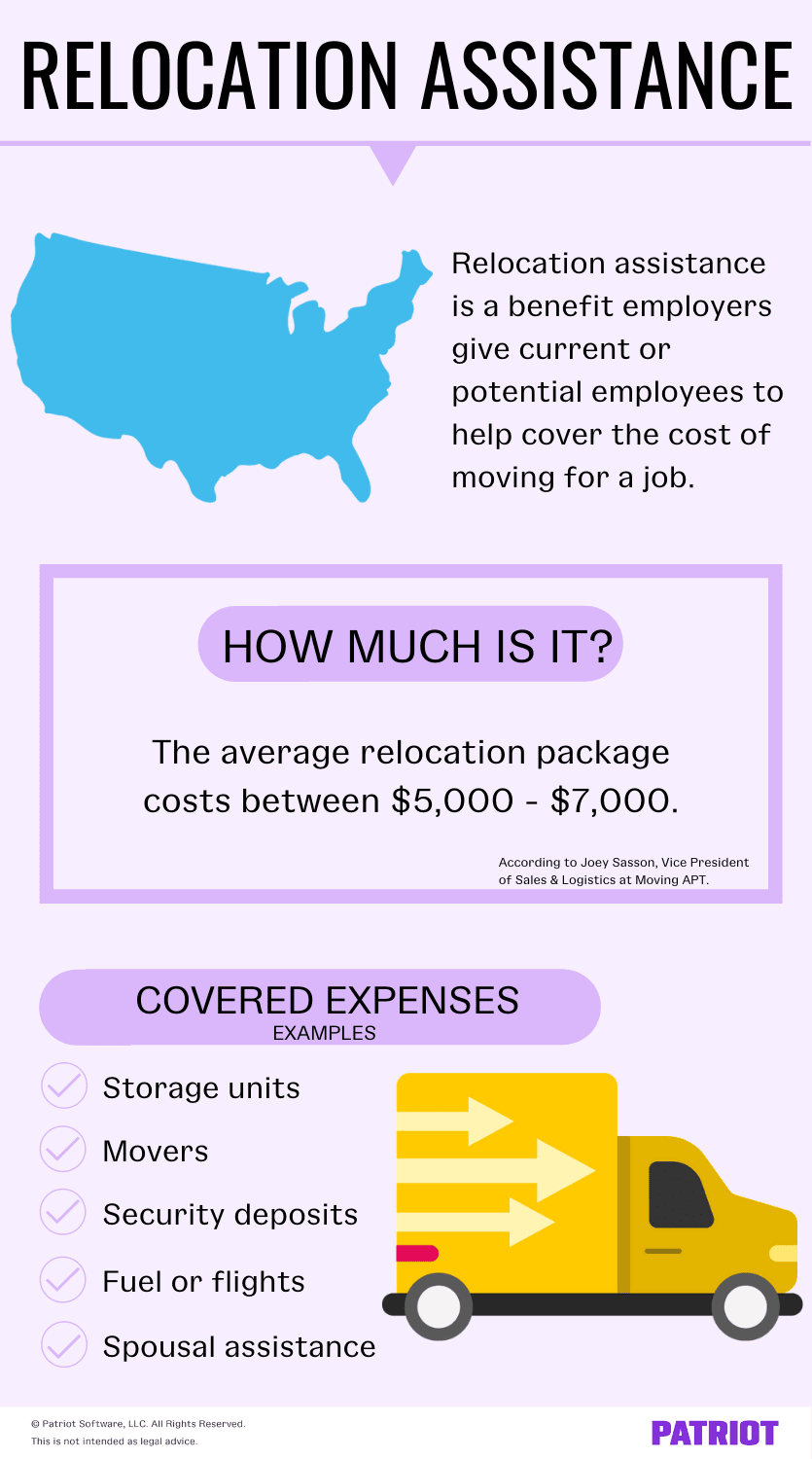

Relocation assistance is a package employers give current or potential employees to help cover the cost of moving for a job. Employers may decide to give an employee relocation assistance as a reimbursement, an upfront lump sum, or a direct payment to the appropriate parties.

A typical relocation package might cover part or all of the expenses associated with:

- Visits to the new community

- Movers or moving trucks

- Storage units

- Temporary living expenses

- Spousal assistance (i.e., helping a spouse find work)

- Buying or selling a home (i.e., marketing)

- Breaking lease agreements

- Security deposits

- Fuel or airline flights

Providing help with moving costs comes with benefits such as attracting senior talent, increasing employee retention, and improving engagement. However, consider the cost of employee relocation.

According to one study, relocating an employee can cost anywhere from $21,327 – $79,425, depending on if they’re renting or owning a home. Of course, you don’t have to pay 100% of the employee’s expenses. In fact, the average relocation lump sum is $7,200 per employee.

Keep in mind that relocation costs vary. Joey Sasson, Vice President of Sales & Logistics at Moving APT, shares his industry insight:

The cost of relocation assistance would depend on the distance that needs to be traveled, the number of people being relocated, and the type of assistance needed. The total cost of relocation assistance would likely be several thousand dollars, with the average relocation package costing between $5,000 and $7,000 for interstate moves.”

Why do workers decide to relocate?

Relocation assistance isn’t the be-all and end-all. Employees decide to relocate for a number of reasons outside of receiving corporate relocation packages.

One study found that workers relocate for the following top five reasons:

- Better pay / perks (44% of workers)

- Family / personal reasons (17% of workers)

- Cost of living (16% of workers)

- Career advancement (16% of workers)

- Weather (6% of workers)

So, you can further strengthen your ability to attract (and retain) talent by putting together a competitive salary and benefits package and providing growth opportunities.

Taxes and job relocation assistance

Is job relocation assistance taxable? Yes, employers must include moving expense reimbursements in employees’ wages, according to the IRS. But, this wasn’t always the case.

Between tax years 2018 and 2025, the following are suspended, thanks to the Tax Cuts and Jobs Act of 2017:

- Moving expenses income tax deduction for employees

- Exclusion from income for qualified moving expense reimbursements

Exception for Armed Forces members: Armed Forces members can still exclude qualifying expense reimbursements from their income if they’re on active duty, they move pursuant to a military order and incident to a permanent change of station, and the expenses would otherwise qualify as a deduction.

Withholding taxes on payments for nondeductible moving expenses

Nondeductible moving expenses and expense reimbursements are subject to federal income, Social Security, and Medicare tax withholding.

Payments for nondeductible moving expenses are a type of supplemental wage. Supplemental wages are additional payments employees receive aside from their regular wages. Other types of supplemental wages include commissions, overtime pay, and back pay.

You can calculate federal income tax on supplemental wages using the supplemental tax rate of 22%. Or, you can calculate federal income tax on the total amount of supplemental plus regular wages if you pay them together.

Calculate Social Security tax and Medicare tax like you do for regular wages.

For more information on withholding taxes from nondeductible moving expenses, check out IRS Publication 15.

Tax gross-up

Withholding taxes from relocation benefits can greatly reduce the employee’s available funds for their move. If you want the employee to receive the full amount of relocation assistance, you can gross up the amount for taxes.

What’s a tax gross-up? A gross-up is when you increase an employee’s gross payment amount to account for taxes. Through a gross-up, the employee gets the specific payment amount (e.g., $5,000 relocation assistance) even after taxes.

To do a gross-up calculation, you can:

- Add up the tax rates that apply to the employee’s wages

- Turn the tax rate into a decimal (e.g., 30% becomes 0.30)

- Subtract the decimal from 1 to get the net percent

- Divide the net wages by the net percent to get the gross amount

Let’s say you want to give an employee relocation assistance of $5,000. The total tax rate that applies to the employee is 29.65% (22% supplemental wage rate + 6.2% Social Security tax + 1.45% Medicare tax). Subtract the decimal form of 29.65% from 1 (1 – 0.2965) to get 0.7035. Now, divide the desired relocation assistance amount ($5,000) by 0.7035 ($5,000 / 0.7035). Your total is $7,107.32. To pay the employee $5,000 after taxes, the gross amount of the relocation assistance must be $7,107.32.

Form W-2 reporting for housing relocation assistance

Report nonqualified moving expenses and expense reimbursements in the following boxes on Form W-2:

- 1: Wages, tips, and other compensation

- 3: Social Security wages

- 5: Medicare wages and tips

- 14: Other (only if railroad retirement taxes apply)

Have an employee who meets the Armed Forces exception? Did you pay qualified moving expense reimbursements directly to the employee? If you answer yes to both questions, report the money in box 12 of Form W-2 with code P. Again, this money is not subject to taxes.

For more information on W-2 reporting of relocation assistance, check out the IRS General Instructions for Forms W-2 and W-3.

Putting together your relocation assistance package

Ready to create a relocation assistance program? Your first order of business is mapping out the terms and conditions of the aid.

Plan out the following details of your housing relocation assistance:

- Disbursement

- Amount

- Eligible costs

- Payback clause

- Taxes

- Qualifying situations

You can include the ins and outs of your package in a relocation assistance agreement and get the employee’s signature. If you have a standard relocation package that you offer existing employees, you might also put it in your employee handbook.

1. Disbursement

How do you plan on giving the employee the relocation assistance?

Again, employers may disburse relocation assistance benefits as a:

- Lump sum: Pay employees a standard amount regardless of their expenses.

- Reimbursement: Pay employees based on their specific costs (generally up to a certain amount).

- Direct payment to vendors: Pay the employees’ vendors (e.g., moving company) directly.

2. Amount

How much do you want to give the employee for relocation assistance?

If you plan on giving workers a standard lump sum, include the amount here. Or if you plan on giving a relocation stipend based on each employee’s specific expenses, include a reimbursement maximum.

For example, your policy may say:

- Standard upfront lump-sum payment of $5,000 OR

- Employee reimbursement of up to $5,000

3. Eligible costs

Which employee moving expenses do you want to cover?

From bubble wrap to moving trucks, there are countless expenses tied to moving. But, you don’t have to pay for all of them. Define and detail eligible expenses covered under your relocation assistance plan. For example, you may opt to only cover the cost to hire movers.

4. Payback clause

Will you ask employees to pay back the relocation assistance if they leave your company early?

Some employers add a payback clause to their relocation assistance agreement. A payback clause states that the employee must pay back all or part (e.g., vesting schedule) of the reimbursement if they leave the business before a specified time.

For example, your payback clause may require an employee to pay back relocation assistance if they leave before 18 months.

Adding a payback clause could help you offset the costs of moving an employee who leaves your business earlier than expected.

5. Taxes

Will you do a tax gross-up on the relocation assistance amount?

If you gross up the relocation assistance bonus for taxes, remember to run a net to gross payroll. Again, you can simplify this process by using payroll software.

6. Qualifying situations

Which situations qualify for relocation assistance?

Determine if you’ll provide assistance for new or current employees. And, decide whether you’ll give assistance to someone moving across the state or across the country only.

For example, you might provide both:

- In-state relocation assistance AND

- Out-of-state relocation assistance