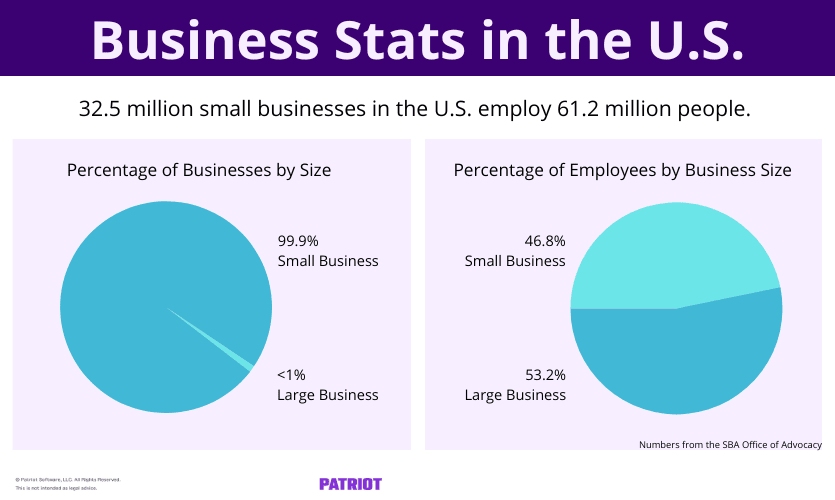

Small businesses are the backbone of the American economy. The numbers don’t lie: 99.9% of American businesses are small businesses, and almost half (46.8%) of US employees work for small businesses. But what makes a small business small? Read on to learn how many employees a small business has and why qualifying as a small business is so important.

How many employees does a small business have?

So, how many employees does a small business have? According to recent statistics, here’s how the numbers look:

- 81% of small businesses have no employees

- In 2019, startups averaged 3.3 employees per business

Even though the majority of small businesses have no employees, they still employ 61.2 million people across the country.

Small business employee size by industry: Chart

According to the Small Business Administration’s Office of Advocacy, the number of employees working for small businesses varies by industry.

The majority of small businesses with employees are in professional, scientific, and technical services (4,594,752) and construction (3,483,077).

Here’s a chart showing the number of small businesses and their employee size, sorted by industry.

| Industry | Number of Small Businesses With No Employees | Number of Small Businesses With 1-19 Employees | Number of Small Businesses With 20-499 Employees | Total Number of Small Business Employees in Industry |

|---|---|---|---|---|

| Professional, Scientific, and Technical Services | 3,772,571 | 770,708 | 51,473 | 4,594,752 |

| Construction | 2,753,720 | 668,863 | 60,494 | 3,483,077 |

| Real Estate and Rental and Leasing | 2,942,243 | 313,387 | 13,134 | 3,268,764 |

| Transportation and Warehousing | 2,856,417 | 174,386 | 20,538 | 3,051,341 |

| Administrative, Support, and Waste Management | 2,595,841 | 311,741 | 39,171 | 2,946,753 |

| Retail Trade | 2,100,019 | 578,829 | 55,456 | 2,734,304 |

| Health Care and Social Assistance | 2,062,908 | 569,629 | 91,229 | 2,723,766 |

| Arts, Entertainment, and Recreation | 1,563,262 | 119,700 | 17,238 | 1,700,200 |

| Accommodation and Food Service | 497,339 | 423,347 | 127,881 | 1,048,567 |

| Finance and Insurance | 755,320 | 220,761 | 15,770 | 991,851 |

| Educational Services | 894,698 | 76,161 | 19,614 | 990,473 |

| Wholesale Trade | 391,670 | 243,976 | 40,191 | 675,837 |

| Manufacturing | 354,198 | 181,091 | 58,560 | 593,849 |

| Information | 363,625 | 71,486 | 10,242 | 445,353 |

| Agriculture, Forestry, Fishing, and Hunting | 255,354 | 20,670 | 1,366 | 277,390 |

| Mining, Quarrying, and Oil and Gas Extraction | 78,854 | 15,132 | 3,136 | 97,122 |

| Utilities | 14,279 | 4,676 | 1,221 | 20,176 |

| Management of Companies and Enterprises | * | 4,786 | 13,450 | 18,236 |

| Industries not classified | * | 11,370 | 36 | 11,407 |

* Not reported by the Census Bureau

Small business employees by state: Chart

What do the numbers of employees for a small business look like state by state?

Regardless of the state, small businesses make up over 99% of state businesses and employ anywhere from 40.5% (Florida) to 66.8% (Montana) of the state’s employees.

Here’s a break down of the share of small businesses and employees by state.

| State | Number of Small Businesses | Percentage of Businesses | Number of Small Business Employees | Percentage of Employees |

|---|---|---|---|---|

| Alabama | 407,092 | 99.4% | 822,668 | 46.8% |

| Alaska | 74,587 | 99.1% | 138,517 | 52.3% |

| Arizona | 641,025 | 99.5% | 1,100,000 | 42.5% |

| Arkansas | 264,245 | 99.3% | 497,605 | 47.2% |

| California | 4,200,000 | 99.8% | 7,400,000 | 47.9% |

| Colorado | 691,320 | 99.5% | 1,200,000 | 47.6% |

| Connecticut | 360,127 | 99.4% | 741,920 | 48.2% |

| Delaware | 93,686 | 98.5% | 195,792 | 47.4% |

| Florida | 3,000,000 | 99.8% | 3,600,000 | 40.5% |

| Georgia | 1,200,000 | 99.6% | 1,700,000 | 42.5% |

| Hawaii | 141,460 | 99.3% | 272,459 | 49.3% |

| Idaho | 183,972 | 99.2% | 247,193 | 56.3% |

| Illinois | 1,200,000 | 99.6% | 2,500,000 | 44.7% |

| Indiana | 534,640 | 99.4% | 1,200,000 | 43.8% |

| Iowa | 273,623 | 99.3% | 644,100 | 46.6% |

| Kansas | 258,384 | 99.1% | 601,426 | 49.7% |

| Kentucky | 364,200 | 99.3% | 722,253 | 43.3% |

| Louisiana | 471,240 | 99.5% | 905,726 | 52.7% |

| Maine | 151,212 | 99.2% | 293,748 | 56.3% |

| Maryland | 634,622 | 99.5% | 1,200,000 | 49.4% |

| Massachusetts | 718,467 | 99.5% | 1,500,000 | 45.4% |

| Michigan | 911,914 | 99.6% | 1,900,000 | 47.9% |

| Minnesota | 534,397 | 99.4% | 1,300,000 | 46.0% |

| Mississippi | 270,534 | 99.3% | 441,099 | 46.0% |

| Missouri | 542,700 | 99.4% | 1,200,000 | 45.3% |

| Montana | 129,180 | 99.3% | 250,680 | 66.8% |

| Nebraska | 182,684 | 99.1% | 413,735 | 48.3% |

| Nevada | 313,257 | 99.2% | 540,044 | 42.8% |

| New Hampshire | 138,199 | 99.0% | 308,296 | 49.7% |

| New Jersey | 953,416 | 99.6% | 1,900,000 | 49.2% |

| New Mexico | 161,921 | 99.0% | 346,374 | 53.7% |

| New York | 2,300,000 | 99.8% | 4,100,000 | 48.1% |

| North Carolina | 994,576 | 99.6% | 1,700,000 | 44.4% |

| North Dakota | 75,265 | 98.8% | 196,770 | 55.7% |

| Ohio | 996,693 | 99.6% | 2,200,000 | 44.7% |

| Oklahoma | 367,405 | 99.4% | 718,033 | 51.1% |

| Oregon | 402,928 | 99.4% | 893,405 | 54.4% |

| Pennsylvania | 1,100,000 | 99.6% | 2,600,000 | 46.2% |

| Rhode Island | 108,360 | 98.9% | 227,699 | 51.2% |

| South Carolina | 463,549 | 99.4% | 837,615 | 43.0% |

| South Dakota | 90,274 | 99.0% | 208,353 | 58.0% |

| Tennessee | 652,795 | 99.5% | 1,200,000 | 42.2% |

| Texas | 3,100,000 | 99.8% | 4,900,000 | 44.5% |

| Utah | 324,821 | 99.3% | 625,571 | 45.5% |

| Vermont | 78,883 | 99.0% | 157,131 | 60.2% |

| Washington | 657,529 | 99.5% | 1,400,000 | 49.8% |

| West Virginia | 111,614 | 98.8% | 269,473 | 48.6% |

| Wisconsin | 462,292 | 99.4% | 1,300,000 | 48.8% |

| Wyoming | 72,081 | 98.9% | 132,595 | 64.1% |

Why does qualifying as a small business matter?

Running a small business is a tough job. It isn’t just setting up the business—it’s also opening the doors, hiring employees, and keeping the doors open. According to the Bureau of Labor Statistics, 20% of small businesses close in the first two years of operation. And only 25% of new businesses make it to or past their 15th year.

One of the biggest problems small business owners face is securing proper funding. But, qualifying as a small business can get you some extra help from the Small Business Administration (SBA) through various funding programs.

SBA funding programs include:

- Loans

- Investment capital

- Disaster assistance

- Surety bonds

- Government grants

It isn’t just the SBA that can help with funding. The Department of the Treasury offers a Small Business Tax Credit Program and the Emergency Capital Investment Program.

If you’re a small business owner that’s fallen on hard times or is having trouble opening your business, there are plenty of other options available, like small business support associations and private investors.

The bottom line: Being able to call your company a legitimate “small business” can give you access to credits, grants, loans, and more.

How many employees should a small business have?

Each company must meet a size standard to qualify as a small business for SBA funding. The definition of “small business” for funding varies by industry.

According to the SBA, these size standards can include annual receipts or the annual maximum number of employees. Remember, some industries have different thresholds for employee numbers than others.

For example:

- Logging companies can’t have more than 500 employees for small business status

- Crude petroleum extraction companies can’t have more than 1,250 employees

- Peanut butter manufacturers can’t have more than 750 employees

So, how many employees should a small business have to apply for SBA funding programs?

Here’s a chart of the average maximum number of employees by industry that a business can have and still be considered a small business. (Numbers may vary for certain businesses.)

| Industry | Average Maximum Number of Employees for Small Business Status |

| Mining | 750 |

| Utilities | 523 |

| Food Manufacturing | 907 |

| Furniture and related product manufacturing | 696 |

| Mechanical wholesalers of durable goods | 167 |

| Mechanical wholesalers of nondurable goods | 179 |

| Motor vehicle and parts dealers | 200 |

| Publishing industry | 1,000 |

Check in with the SBA and see if your company meets the size standard for its industry.

Small businesses and workplace laws

Small businesses generally still have to follow workplace laws, including the Fair Labor Standards Act (FLSA), the Americans with Disabilities Act (ADA), and the Civil Rights Act of 1964. But, there are exceptions.

For example, you may be exempt from state-mandated laws, like paid sick leave, depending on your employee count. Take Massachusetts Earned Sick Time as an example. Employers with fewer than 11 employees must provide unpaid sick time—instead of paid sick time—to employees.

Keep in mind that some federal laws also don’t apply to you if you run a business without any employees (e.g., Occupational Safety and Health Administration).

Check in with your state and the Department of Labor to see what laws you must follow.

No matter how many employees you have, Patriot’s online payroll software makes your payroll easier than ever. Patriot offers unlimited payrolls, an employee portal, and free USA-based support. Try it for free today!

This is not intended as legal advice; for more information, please click here.