For months, conflicting macroeconomic data were used to support both sides of the question about whether we are in a recession.

The good:

- Jobless claims remain low by historical standards

- Wages continue to rise, but so is inflation

- GDP for Q3 was positive after two quarterly declines

- Consumer continue to spend (for now)

The bad:

- Consumer confidence ebbed in October

- After declining for several months, gas prices are up month-over-month and year-over-year

- Home prices are still up year-over-year, but the rate of increase has decelerated at a record rate

- A recession is the base case in many forecasts

- Accordingly, many large corporations are scaling back or freezing hiring or initiating layoffs

Recession? Inflation? Stagflation? Soft or hard landing? Consensus is increasingly converging on the view that a recession is imminent. The prevailing questions now are when it will officially hit; how deep and long it will be; and who it will impact most. To help understand how small and medium sized business (SMB) owners and employees are experiencing and perceiving business and employment, we analyzed behavioral data from more than two million employees working at more than one hundred thousand SMBs. We also conducted a pulse survey in mid-October of 520 owners and 1,256 employees to gauge changes in sentiment.

Summary of findings: Homebase high-frequency timesheet data and mid-October owner and employee sentiment surveys indicate a deceleration in hours worked and employees working, as well as a dip in owner and employee optimism:

- Our key Main Street Health Metrics — hours worked and employees working — are down in October vs. September. Overall hours worked were down 2.2 percentages points in October 2022 vs. September 2022. Generally, the trend in 2022 most closely resembles the trend observed in 2018 at this point in the year.

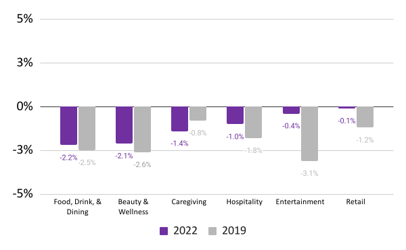

- Most industry categories exhibited declines in employees working in mid-October vs. mid-September, consistent with historical season trends. Leading declines were food, drink, & dining (-2.2%) and Beauty & Wellness (-2.1%). Entertainment (-0.4%) and hospitality (-1.0%) continued to outperform relative to other industries in 2022, as well as compared with the pre-pandemic period.

- Average (nominal) hourly wages in mid-October remained approximately 13% above figures from January of 2021 and increased modestly month-over-month. Wages continue to rise. However, the rate of increase has moderated modestly.

- Sixty-nine percent of SMB owners are optimistic about how their organizations will likely perform this coming Holiday Season. This is especially true of those owners who founded their businesses after 2020. Forty-three percent of owners expect the 2022 Holiday Season to be more profitable than it was in 2021.

- Owners remain optimistic, but the trend is downwardly biased. Fifty-eight percent of SMB owners believe that their organization will be better off financially in one year relative to today. This figure represents a month-over-month decline of six percentage points. Much of shift occurred into the bucket of owners who believe that their organization’s financials will look like their financials this year.

Detailed findings

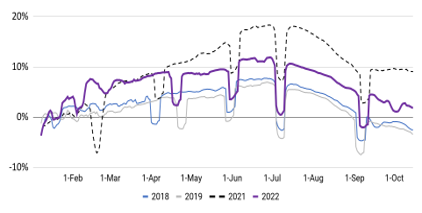

The percentage of employees working in mid-October was down 2.2 percentage points relative to mid-September. This month-over-month deceleration is in-line with results from the pre-pandemic period.

Employees working

(Rolling 7-day average; relative to Jan. of reported year)

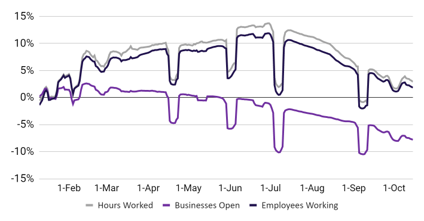

Main Street Health Metrics1

(Rolling 7-day average; relative to Jan. 2022)

1. Some significant dips due to major U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period including the Texas power crisis and severe weather in the Midwest. Dip in late September coincides with Hurricane Ian. Source: Homebase data.

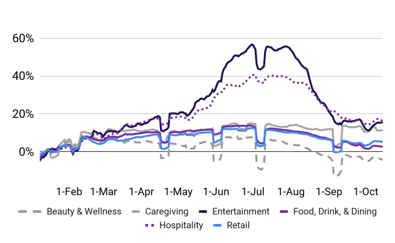

Most industries experienced modest month-over-month declines in employees working, consistent with seasonal trends.

Context: Save for caregiving, most industries have performed relatively well in 2022 with shallower declines than those observed in the corresponding period in 2019.

Percent change in employees working

(Compared to January 2022 baseline using 7-day rolling average)1

Percent change in employees working

(Mid-October vs. mid-September, using January 2022 and January 2019 baselines)1

1. October 9-15 vs. September 11-17 (2022) and October 6-12 vs. September 8-14 (2019). Pronounced dips generally coincide with major US Holidays. Source: Homebase data.

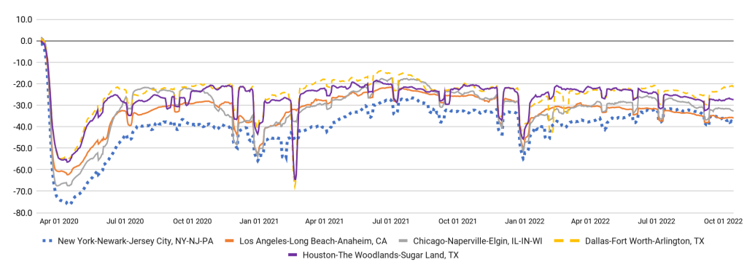

Hours worked in the New York and Los Angeles MSAs decreased modestly in mid-October vs. mid-September. The Houston and Chicago MSAs remained flat month-over-month, and the Dallas MSA increased.

Hours worked

(Rolling 7-day average; relative to Jan. 2020 (pre-Covid))

1. Some significant dips due to major U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period including the Texas power crisis and severe weather in the Midwest. Source: Homebase data.

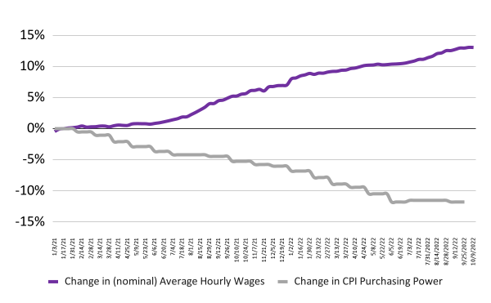

Nominal average hourly wages are 13% higher in October of 2022 compared to January 2021

Average (nominal) hourly wages are approximately 13% higher in mid-October relative to January 2021. The rate of increase in mid-October was in-line with the rate of increase observed in mid-September.

Percent change in nominal average hourly wages and CPI Purchasing Power of the Consumer Dollar relative to January 2021 baseline1

1. Nominal average hourly wage changes and the (monthly) CPI for all Urban Consumers: Purchasing Power of the Consumer Dollar in U.S. Cities. Average (non-seasonally adjusted) calculated relative to a January 2021 baseline. Sources: Homebase data, U.S. BLS.

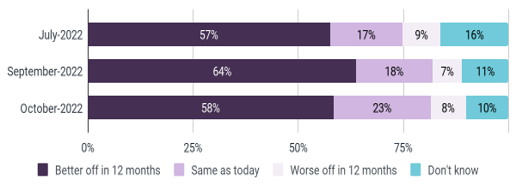

Generally, SMB owners remain optimistic about the future. However, the relative level of their optimism declined month-over-month.

Fifty-eight percent of SMB owners believe that their organization will be better off financially in one year relative to today. This figure represents a month-over-month decline of six percentage points. Much of the shift occurred into the bucket of owners who believe that their organization’s financials next year will look the same as their financials this year.

Owners of organizations founded in 2022 were the most optimistic, with 82% believing next year will be better for them financially vs. this year. Organizations founded in 2019 or earlier were more likely to believe that next year will either be the same (48%) or worse (12%) than this year, with the remainder uncertain.

Survey question: Do you think your organization will be better off, the same, or worse off financially 12 months from now compared to today?

Source: Homebase Owner Pulse Survey.

Twenty-five percent of SMB owners intend to open new locations of their current businesses in the next one to two years

As of mid-October, 25% of SMB owners intend to open new locations of their current businesses in the next one to two years. This figure represents a decrease of four percentage points since mid-September and the lowest reading since July 2022.

Survey question: Do you intend to open a new location of your current business in the next 12-14 months?

Source: Homebase Owner Pulse Survey.

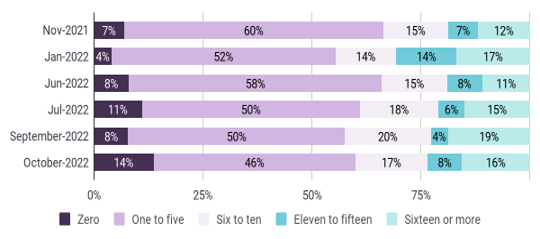

As of October, most SMB owners intended to hire additional workers in the next 12-24 months

Eighty-six percent of owners plan to hire one or more additional workers in the next one to two years. The most frequently cited range was between one to five additional workers (46%) followed by six to ten additional workers (17%).

Although most owners intend to hire additional workers, the percentage of owners who now intend to make no additional hires increased notably from 8% in September to 14% in October, which is the highest figure we have recorded since we began asking this question in November 2021.

Survey question: How many additional workers do you intend on hiring in the next one to two years?

Source: Homebase Owner Pulse Survey.

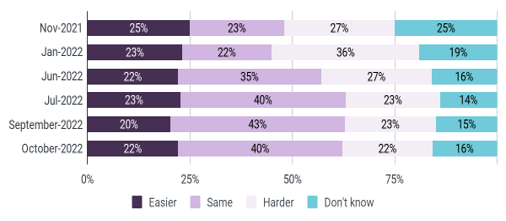

The percentage of owners who believe it will be easier to hire workers a year from now increased month-over-month

The overwhelming majority of SMB owners intend to hire additional employees. We thus asked them whether they believe it will be easier, the same, or harder for them to hire workers next year vs. what they are experiencing in today’s labor market to infer their views on the direction of the labor market. Forty percent of owners expect the labor market a year from now to be the same as it is today. Twenty-two percent of owners believe that it will be easier to hire next year vs. today. This figure represents a 10% increase relative to September.

Survey question: Do you think it will be easier, the same, or harder for your organization or business to hire workers 12 months from now compared to today?

Source: Homebase Owner Pulse Survey.

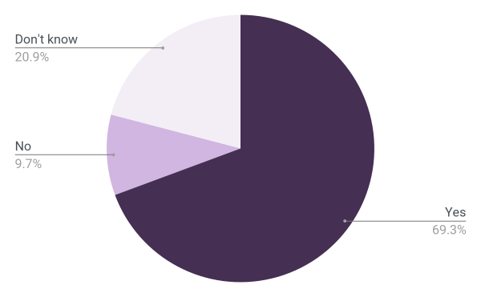

More than two-thirds of SMB owners are optimistic about how their organizations will perform this coming Holiday Season

Sixty-nine percent of SMB owners are optimistic about how their organizations will likely perform this coming Holiday Season.

Survey question: Are you optimistic about how your organization will perform this Holiday Season?

Source: Homebase Owner Pulse Survey.

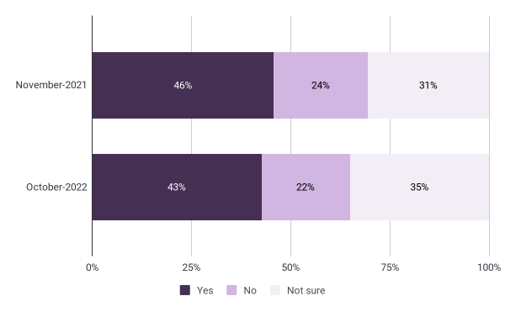

Although owners are generally optimistic about the holidays, their expectations about profitability are down slightly in 2022 vs. 2021

46% of SMB owners expected to have a more profitable Holiday Season in 2021 vs. 2020. In October of 2022, 43% of SMB owners expect to have a more profitable Holiday Season vs. the prior year.

This decline in optimism can be attributed to an increase in uncertainty as 35% of SMB owners are not sure whether Holiday Season 2022 will be more profitable than in 2021 when 31% expressed uncertainty about organizational profitability relative to the prior (Covid) year.

Survey question: Do you expect to have a more profitable Holiday Season this year compared with last year?

Source: Homebase Owner Pulse Survey.

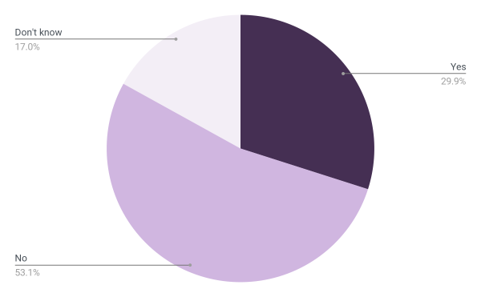

Thus far, most owners have yet to see a rise in customer activity related to the Holiday Season

We asked SMB owners whether they have seen a rise in customer activity in anticipation of the 2022 Holiday Season. As of mid-October, roughly 30% of owners have seen an uptick in customer activity whereas the majority have not.

Some news sources have reported that holiday sales will start earlier this year. We asked SMB owners whether they intended to do likewise.

- Early sales: Twenty-nine percent of owners are planning on offering holiday promotions earlier; fifty percent report not doing so, and the remainder are unsure of whether they will offer earlier discounts to entice shoppers.

- Discounts to offset inflation: Thirty percent of SMB owners plan to offer discounts to help shoppers contend with inflationary pressures; 52% are not planning on offering discounts and 18% are unsure if they will do so.

Survey question: Thus far, have you seen a rise in customer activity related to the Holiday Season (e.g., more traffic, stronger sales)?

Source: Homebase Owner Pulse Survey.

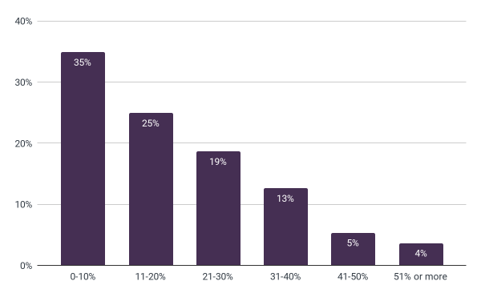

For forty-one percent of owners, the holiday season contributes more than twenty percent of yearly revenue

For 35% of SMBs, the Holiday Season contributes ten percent or less of total yearly revenue. A quarter of SMBs derive between 11-20% of yearly revenue during the Holiday Season. For the remaining forty-one percent of owners, the Holiday Season in a typical year is when more than twenty percent of yearly income is generated.

- What month is busiest for holiday sales? We asked owners what month they expected to be the busiest for their holiday sales. The response was overwhelming: 65% indicated it would be December, followed by November (29%), and October (6%).

Survey question: How much of your yearly revenue is made during the Holiday Season in a typical year?

Source: Homebase Owner Pulse Survey.

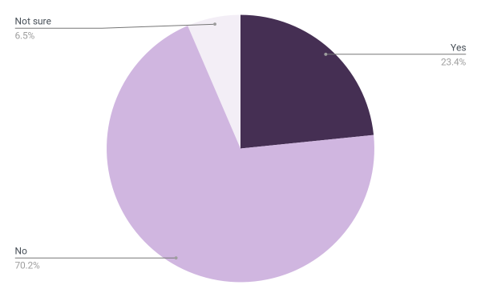

SMB owners face a host of challenges. However, hiring enough seasonal workers is not a matter that is concerning owners right now

Only a relatively small percentage of owners (23%) are concerned about finding enough workers to cover their holiday staffing needs.

On average, owners expect to expand their employee bases by eighteen percent for the holidays.

Perhaps as a consequence of these views about labor needs, 31% of owners plan on paying employees more during the holiday season; 53% do not; and 17% are unsure.

Survey question: Are you concerned about finding enough workers to cover your holiday staffing needs?

Source: Homebase Owner Pulse Survey.

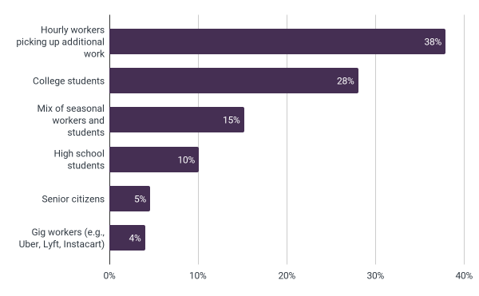

When looking for seasonal workers, SMB owners get the best results with hourly workers looking for additional shifts followed by college students

Hiring for the holidays–or any short duration–entails additional challenges because of the need to get workers quickly up to speed. We thus asked SMB owners where, based on their experience, they find the best seasonal workers. The number one response was hourly workers looking to pick up additional work, cited by 38% of SMB owners. The second most frequently cited response was college students (28%). Gig-workers tend to rate relatively low (4%), on the other hand.

Survey question: Based on your experience, which of the following types of workers make the best seasonal workers for your business?

Source: Homebase Owner Pulse Survey.

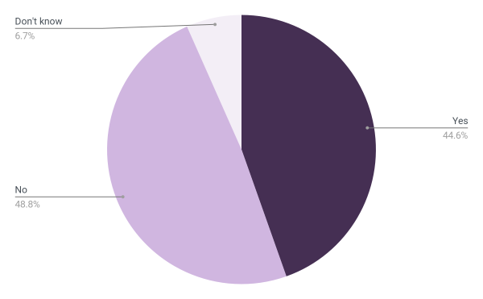

Nearly forty-five percent of owners are experiencing difficulties obtaining basic materials or ingredients–primarily due to cost increases or shortages

The primary reasons cited for difficulties obtaining basic materials or ingredients were:

- Product shortages (74%)

- Cost increases in intermediate goods (62%)

- Longer shipping times (52%)

- Some combination of all these factors (5%)

Survey question: Are you having a more difficult time obtaining material/ingredients you need?

Source: Homebase Owner Pulse Survey.

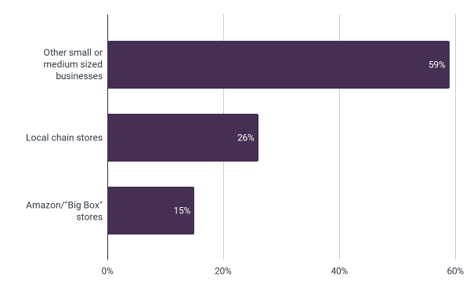

Most SMBs view other SMBs or local chains as their biggest competitors

Contrary to conventional wisdom that focuses on the impact of large businesses on “local” business opportunities, SMB owners primarily view other SMB businesses as their biggest competitors (59%), followed by local chain stores (26%) and, finally, large stores or Amazon or other industry-relevant “Big Box” stores.

The picture is, however, more nuanced for those SMBs in retail or consumer goods. For these businesses, other SMBs were still the biggest competitors (41%). However, the gap between local chains (30%) and Amazon/“Big box” stores (29%) narrowed.

Survey question: Who is your biggest competitor?

Source: Homebase Owner Pulse Survey.

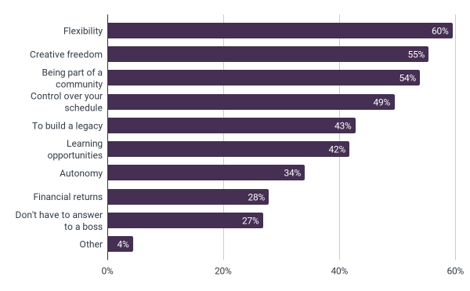

What are SMB owners’ favorite aspects of owning a business? (Hint: It isn’t the money.)

Business ownership is a cornerstone of the “American Dream.” SMBs are also a key driver of the US economy and labor force. We thus asked SMB owners what they liked most about owning a business.

Interestingly, SMB owners are not (primarily) in it for the money (28%), lack of a boss to answer to (27%), or for the autonomy it can afford (34%). Rather, the most frequently cited “favorite” facets of owning an SMB include flexibility (60%), followed closely by creative freedom (55%), being part of a community (54%), and control over one’s schedule (49%).

Survey question: What are your favorite parts of owning a small business (check all that apply)?

Source: Homebase Owner Pulse Survey.

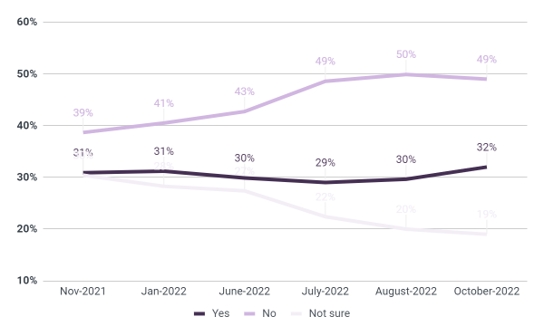

Consistent with results from July and August, generally, employees do not intend to look for a new job

Since July of 2022, the percentage of employees who do not intend to look for a new job in the next one to two years has remained above approximately 49% (reaching a near-term high of nearly 50% in August).

Survey question: Do you intend to look for a new job in the next 12-24 months?

Source: Homebase Employee Pulse Surveys.

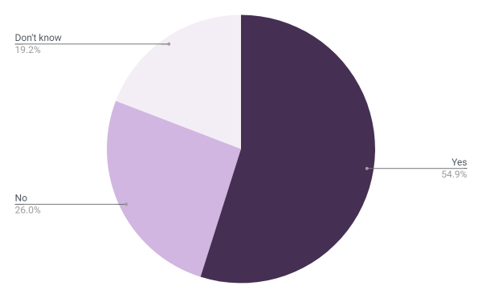

Most employees expect to work more shifts this holiday season, and about a third have seen more opportunities for seasonal work this year

Most employees (54%) expect to work more shifts during the Holiday Season.

When compared with this time last year, 32% of employees have seen more opportunities for seasonal work, 33% have not, and the remainder are uncertain at this point.

Survey question: Do you expect to work more shifts this Holiday Season?

Source: Homebase Employee Pulse Surveys.

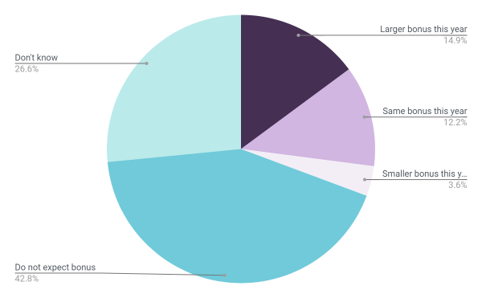

Bah humbug: 43% of employees do not expect to receive a holiday bonus this year

43% of employees do not expect to receive a holiday bonus this year and 27% are uncertain whether they will or will not receive a holiday bonus. For those employees who expect to receive a bonus, a slightly higher percentage (14.9%) expect to receive a larger bonus than last year vs. those who expect to receive the same amount as last year (12.2%).

Although a high percentage of employees do not expect to receive a holiday bonus this year, a higher percentage of employees feel more valued by their employers (35%) vs not (32%) during the holidays.

Survey question: Do you expect to receive a larger, the same, or a smaller holiday bonus this year vs. last year?

Source: Homebase Employee Pulse Surveys.

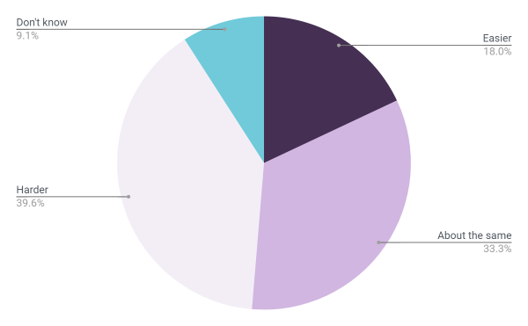

Employees expect it to be harder to afford gifts this year vs. last year

Approximately forty percent of employees believe that it will be harder to afford gifts this year vs. last year; about a third believe it will be about the same and only eighteen percent think it will be easier.

Survey question: Do you think it will be easier, about the same, or harder to afford the gifts you hope to purchase this year vs. last year?

Source: Homebase Employee Pulse Surveys.

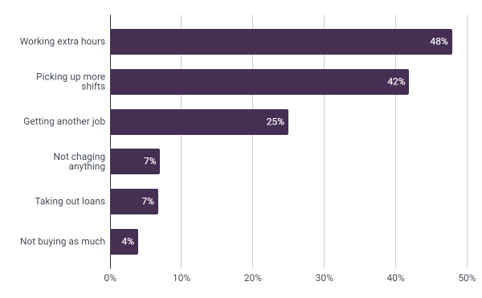

Without a holiday bonus and higher gift costs, employees are working extra hours, picking up more shifts, or finding additional work

With a high percentage of employees not expecting a holiday bonus and a similarly high percentage expecting gifts to be less affordable this year vs. last year, employees are working extra hours (48%), picking up more shifts (42%), or getting another job (25%) to afford holiday gifts.

Survey question: Are you doing any of the following to afford holiday gifts this season (check all that apply)?

Source: Homebase Employee Pulse Surveys.

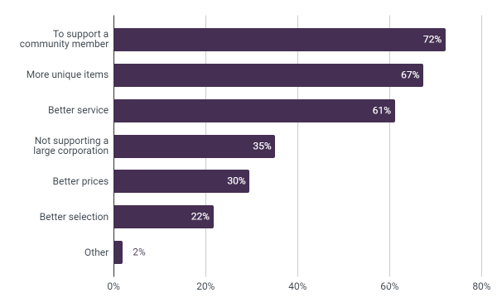

As consumers, SMB employees shop “small” to support community members, for unique items, and for better service

SMB employees are also consumers. As we think about the Holiday Season, we asked SMB owners what the benefits of shopping at a small business are. The number one reason they cited was to support a community member (72%), more unique items (67%), or better service (61%)—suggesting these are all factors small businesses can emphasize to compete with large companies. Interestingly, 35% also shop at small businesses so that they are not supporting a large corporation. As one employee:

“Small businesses are amazing because there’s more care put into the work and products you buy.”

Survey question: What are the benefits of shopping at a small business (check all that apply)?

Source: Homebase Employee Pulse Surveys.

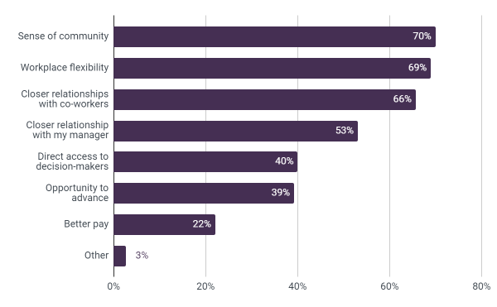

SMB employees are attracted to work at small businesses for a sense of community, flexibility, and relationships

SMB employees’ preference for community is a key driver of their attraction to work at a small vs. large business (70%). Like SMB owners, SMB employees also highly value flexibility (69%).

Consistent with the emphasis of community, SMB employees also highly value relationships, with 66% citing close relationships with co-workers as a reason they were attracted to work at a small vs. large business, and 53% citing a closer relationship with their managers.

Survey question: What attracts you to work at a small business vs. a large business (check all that apply)?

Source: Homebase Employee Pulse Surveys.