Which Guideline pricing plan is right for you?

All businesses should be able to offer an affordable and seamless retirement benefit. But not every 401(k) is suitable for every business.

That’s why we offer three distinct tiers. We know that some business owners are looking for a simple solution that checks the boxes, while others are looking for a more flexible solution that can scale as their business grows. Whatever your needs are, Guideline has a 401(k) that can help meet them.

Below, we’ll break down our three tiers: Starter, Core, and Enterprise. But before we do, it’s important to know that all of our plans include the fundamental services and features needed to offer a great retirement benefit:

- Low cost, low fees: All Guideline plans offer affordable prices for growing businesses. Guideline’s account fees are up to 7x lower than the industry average.¹

- A breeze to manage: Set up in as little as 20 minutes. Save time with employee self-enrollment and intuitive dashboards.

- An all-in-one experience: From serving as your fiduciary to ongoing compliance testing², Guideline offers end-to-end management of your 401(k).

With that said, let’s take a look at our three tiers so you can determine which one works best for your business.

Starter: A simplified 401(k) with limited features and easy administration

Starter is our most simple, out-of-the-box plan built to support employers offering a 401(k) for the first time. Starter is our lowest priced plan. In fact, for businesses with 50 or fewer employees, the cost may be free for the first three years after applying up to $16,500 in tax credits.⁶

Starter plans are exempt from IRS non-discrimination tests, which means they have fewer compliance requirements. That being said, Starter 401(k) plans have lower contribution limits than a standard 401(k), which means employees won’t be able to save as much. Employers also can’t match or contribute to their employees’ savings if they offer a Starter 401(k).⁷

Monthly base fee: $39 + $4 per active participant

Plan details:

- $6,000 employee contribution limit for 2024

- Only available to employers who haven’t previously offered a 401(k)

- No employer contributions allowed

- Must connect with an eligible payroll partner

Benefits of a Starter plan:

- Easy and affordable: Starter plans are a great fit for businesses searching for a predictable, low-cost benefit to retain and attract new talent. They’re also a sound solution for companies wanting to get started now and upgrade after the first or second year.

- Starter plans satisfy compliance tests and state mandates: All Starter 401(k) plans are exempt from IRS compliance tests, which can be particularly beneficial for businesses with limited administrative resources. Guideline’s Starter 401(k) also meets state-specific retirement mandates and offers additional support and features that many state-operated programs may lack.

Starter is a good fit for businesses that:

- Are setting up a 401(k) for the first time

- Want more predictable monthly costs, since there’s no employer match

- Are comfortable with a lower employee contribution limit

Core: Our most popular 401(k) with robust features and more plan design options

As its name implies, our Core plan provides all the core services and features needed for a great retirement benefit, with flexible plan design options like a traditional or a Safe Harbor 401(k).

Monthly base fee: $89 + $8 per active participant

Plan details:

- $23,000 employee contribution limit for 2024

- Safe Harbor or Traditional 401(k)

- Option to offer employer contributions and profit sharing

- Can connect with any payroll provider

Benefits of a Core plan:

- You can save more for retirement: With Core, you and your employees can save more for retirement, with a higher contribution limit than a Starter plan.

- More flexibility for growing businesses: When you sign up for Core, you can design your plan with employer contributions, vesting schedules, service and age eligibility requirements, and implement profit sharing after the end of the year. These options can help keep your 401(k) aligned with your objectives as your business grows.

Core is a good fit for businesses that:

- Want a standard 401(k) contribution limit of $23,000 (2024)

- Want the flexibility of plan design types — whether that's Safe Harbor or Traditional

- Want to offer a more robust employee benefit

Enterprise: Our most custom 401(k) with exclusive pricing options and premium support

As our most custom offering, Enterprise is designed to support growing businesses and their teams that may have more complex business needs. Enterprise offers enhanced features like exclusive pricing options and premium support for both employers and employees.

With our Enterprise plan, employers can open a Safe Harbor 401(k) plan or a traditional 401(k) plan. And in addition to every feature and service we offer in Core, the Enterprise plan provides access to custom features like new comparability profit sharing for no additional fee.

Monthly base fee: $149 + active participant fee

Plan details:

- $23,000 employee contribution limit for 2024

- Safe Harbor or traditional 401(k)

- Features like employer contributions and profit sharing

- Can connect with any payroll provider

- Support for 401(k) plan transfers

Benefits of an Enterprise plan:

With Enterprise, you get everything in our Starter and Core tiers, plus:

- Personalized support for you and your team: Enterprise offers preferred service, with an average 4 business-hour time to response.⁵

- Simple, streamlined onboarding: With Enterprise, you’ll get a dedicated onboarding specialist and client relationship manager, so you have support from us at every stage.

- Support your employees’ financial well-being: Exclusive to Enterprise plans, Participant Perks are special offers on financial tools and services that could help you and your employees create a more well-rounded roadmap to retirement.

Enterprise is a good fit for businesses that:

- Want more support for them and their employees

- Want a more well-rounded employee benefit, with Participant Perks

- Are larger in size and who desire more custom options

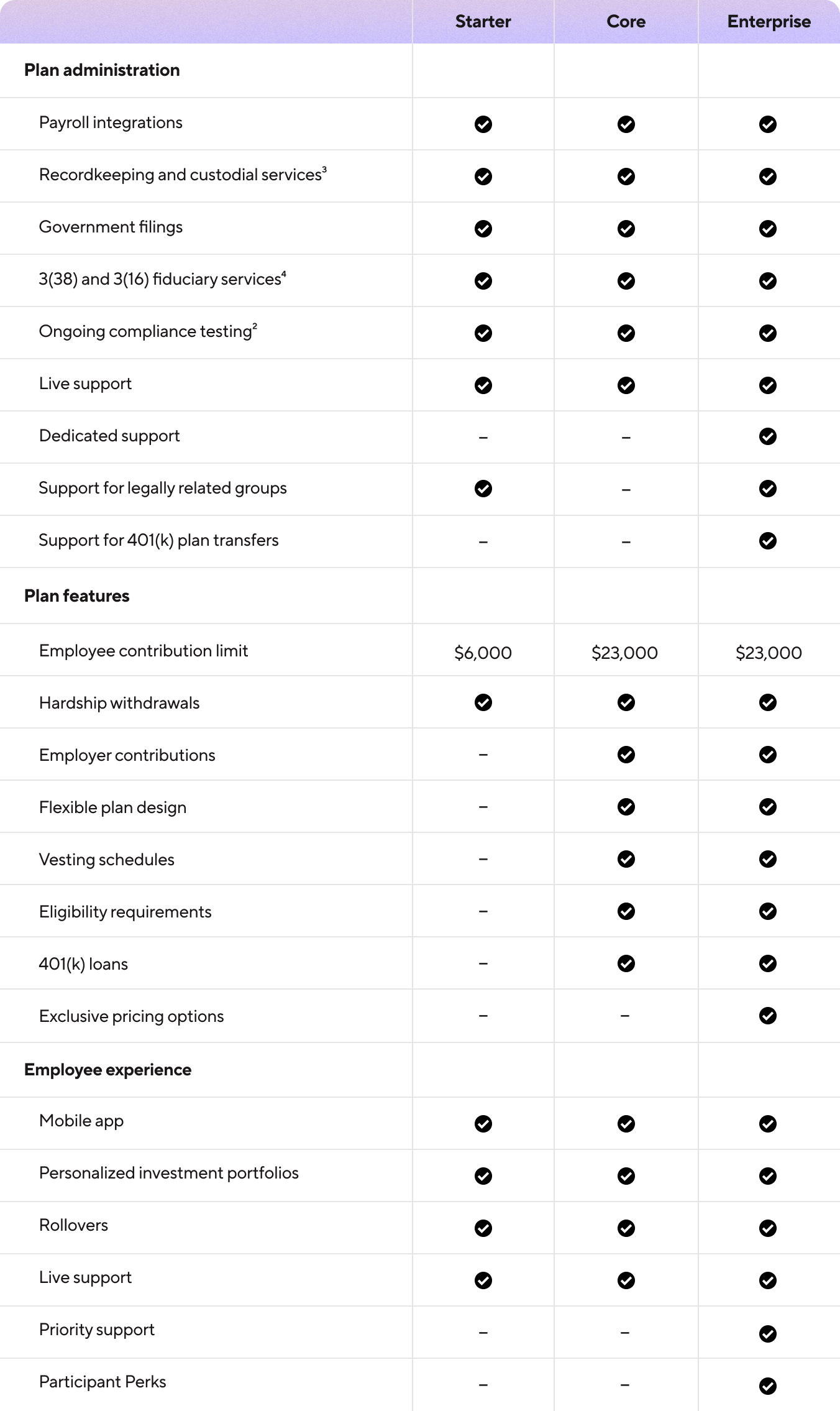

To recap, here’s a side-by-side comparison of our three pricing plans and contribution limits for 2024:

Like we stated in the beginning, there’s no right plan for every business. But we’ve deliberately built our pricing plan structure to help provide plans that work for your business — providing you and your employees with the right foundation to build a brighter future.

Disclosures:

¹ This information is provided for illustrative purposes only, and is not intended to be taken as investment or tax advice. Consult a qualified tax and financial advisor to determine the appropriate investment strategy for you. The average investment expense of plan assets for 401(k) plans with 25 participants and $250,000 in assets is 1.60% of assets, according to the 23rd Edition of the 401k Averages Book, with data updated through September 30, 2022, and is inclusive of investment management fees, fund expense ratios, 12b-1 fees, sub-transfer agent fees, contract charges, wrap and advisor fees or any other asset based charges. Guideline’s managed portfolios have blended expense ratios ranging from 0.064% to 0.067% of assets under management. When combined with an assumed account fee of 0.15%, the estimated total AUM fees for one of Guideline’s managed portfolios can be under 0.22%. Alternative account fee pricing is available ranging from 0.15% to 0.35%. Contact Sales at hello@guideline.com to learn more about exclusive pricing options available in Enterprise tier. See our Form ADV 2A Brochure for more information regarding fees. Expense ratios for custom portfolios will vary. These expense ratios are subject to change by and paid to the fund(s). View full fund lineup here.

² All plans of related entities must be administered by Guideline in order to provide compliance testing.

³ Guideline uses a third-party to provide custodial services. Custodial fees are paid by Guideline.

⁴ Our 3(16) fiduciary services are only available to clients who utilize an integrated payroll provider.

⁵ Based on Guideline internal metrics as of May 2023.

⁶ You should consult a tax professional to determine what types of tax credits or deductions your company is eligible to claim.

⁷ Please note, under current IRS rules Starter 401(k) plans can only be converted to full 401(k) plans (increased limits, employer contributions, and testing) effective the first day of the plan year. This would require you upgrading to the Core or Enterprise tier at the beginning of a calendar year.