Online Payroll: Deep Dive into Employer-Specific Solutions

MP Wired For HR

JUNE 25, 2024

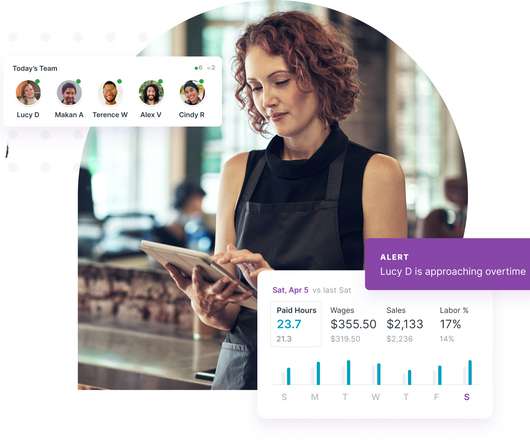

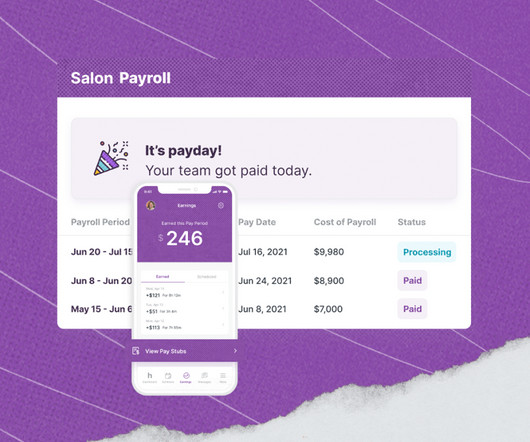

Online Payroll: Deep Dive into Employer-Specific Solutions June 25th, 2024 Share on Facebook Share on Facebook Share on LinkedIn Share on LinkedIn Online Payroll is the foundational element of any successful business, but catering to different workforce configurations and industry demands requires more than just accurate wage calculations.

Let's personalize your content