It’s the end of the month, you’re doing payroll, and you notice that one of your employees logged ten hours of unauthorized overtime on their timesheet. Overtime that — because your clocking in and out policy isn’t clear — you have to pay. You know you should check staff timesheets daily, but you have so many other things on your plate.

Running a small business is tough. Understandably, things slip through the cracks. With ten employees submitting paper timesheets, you didn’t have time to double-check everything. But now you’re on the hook for ten hours of overtime that you have to pay at a rate of time and a half.

Unless you can prove a team member was abusing the system or submitted incorrect timesheets, it’s difficult to challenge recorded hours. And labor is already one of the highest fixed costs for hourly businesses — not keeping on top of clocking in and clocking out makes it even more expensive.

Luckily, it isn’t hard to set up a proper time tracking policy for your small business. Let’s discover how to create a clocking in and out policy so you can avoid payroll inaccuracies and unnecessary expenses.

What is a clock in clock out policy?

A clock in clock out policy is a set of guidelines small businesses set to comply with the Fair Labor Standards Act (FLSA), keep accurate records of how many hours their employees work, and calculate how much they need to pay them.

Without a clear clocking in and out policy, you open your small business up to several risks. For example, having one is essential to ensure you stay in line with FLSA guidelines. The FLSA is US-based legislation that regulates minimum wage, overtime payments, and recordkeeping. It also includes time clock rules for hourly employees. Failure to comply with it may result in lengthy and costly lawsuits.

A concrete clocking in clocking out policy can also protect you from fraud, frequent employee late arrivals or absences, and payroll inaccuracies. As an employer, you may be obliged to pay for clocked hours, even if you suspect they’re not genuine. Proper monitoring of work and hours — for example, with Homebase’s time clock app — gives you the ability to prove when tracked time is inaccurate or fraudulent.

Clocking in and out policy free sample

Here’s a clock in clock out policy template to give you a head start if you want to create your own. Feel free to edit it to make it work for your small business.

Disclaimer: This is just an example. Before implementing it, get your attorney to take a look or talk to a Homebase HR expert and make sure it’s compliant with federal, state, and local labor laws.

| [COMPANY NAME’S] clock in and out policy

This clock in clock out policy is to ensure accurate timekeeping and payroll processes at [COMPANY NAME] and consistent and fair employee treatment. Scope This policy covers all hourly full-time, hourly-part time, and nonexempt salaried workers at [COMPANY NAME]. Clock in clock out procedure All nonexempt employees must clock in and out at the start and end of each shift using the [DESIGNATED TIMEKEEPING SYSTEM]. In addition, all nonexempt employees are required to clock out at the beginning of a meal break and clock in when they return to work.

Manager responsibilities:

Conduct and violations: Any violations of this clock in clock out policy will be considered a serious offense that’s subject to disciplinary action up to and including termination. Example violations include but are not limited to:

|

Key procedures for clocking in and out

The sample above is a good place to start when you’re creating your clock in clock out policy, but you and your business have unique needs and circumstances. So, you need to write a policy that not only abides by the FLSA but also works for you.

But first, you can’t develop your policy before you understand how time tracking works. Keep reading to learn about key clocking in and out procedures and how to stay compliant.

Check eligibility

To start off, it’s a good idea to investigate business and employee eligibility. The FLSA covers businesses with an annual sales volume of $500,000, organizations that provide medical care, schools, and government agencies. In addition, even if you don’t meet those criteria, the legislation might cover your staff. For example, if your employees’ work involves commerce between states, the FLSA includes them.

However, not all types of staff members fall under FLSA legislation. Most importantly, the FLSA distinguishes between exempt and nonexempt employees and only covers hourly workers or nonexempt salaried workers. Under the FLSA, most salaried workers are exempt, can’t receive overtime pay, and don’t need to clock in and out of work.

However, any salaried nonexempt workers — eligible for overtime pay — and hourly full-time or part-time employees are protected under the FLSA. This means it’s especially important to accurately track their work hours and calculate overtime.

Choose your clock in/clock out method

Lots of small businesses still use paper timesheets where employees simply write down the days they worked and for how many hours. But this method is ripe for misuse or mistakes, so we don’t recommend it.

It’s better to set up an electronic clock in and clock out system. There are a few ways you can do this. The first is very similar to traditional punch clocks. Employees swipe a card and input their ID number or scan their fingerprints or irises to sign in and out of work. To facilitate this, businesses need to install designated terminals near work entrances and exits. This method can work well — especially for big companies — but comes with expensive setup costs.

Similar to this method are kiosk-based time clocks, where you designate a desktop computer or tablet and ask employees to log in with their unique IDs and PINs. This method is much cheaper than installing a biometric or swipe card system.

Finally, you can require staff members to sign in with flexible apps that work on all kinds of devices. Homebase’s free time clock app is designed specifically for small businesses, and employees can clock in and out of work on their own devices, the company computer, or POS systems. Here, you get the best of both worlds — a flexible method without any hefty initial setup costs.

Homebase can save management a lot of headaches, too. You can:

- Set break and overtime rules within the app to make sure you stay compliant with the FLSA.

- Use GPS and geofencing technology to make sure employees only clock in and out of work when they’re on site.

- Prompt team members to take snapshots of themselves when they’re signing into work to show it’s really them.

- Get accurate, automatic timesheets that are ready for payroll processing each week.

Our time clock app can also send notifications to employees when they have an upcoming shift, when it’s time to take a break, and when it’s time to finish work to avoid them hitting overtime.

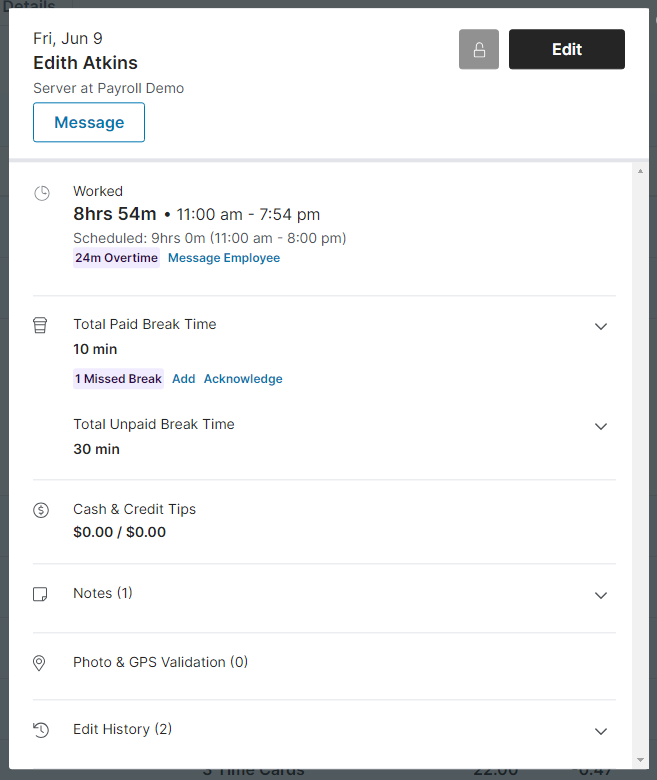

Treat work breaks properly

The FLSA has guidelines for employee break time at work that your clocking in and out policy should address. Basically, it distinguishes between rest breaks and meal breaks. Rest breaks of 20 minutes are paid as work hours, but meal breaks of 30 minutes aren’t. In addition, team members need to clock out when they start their meal breaks and back in when they return to work.

For meal breaks, it’s important that employees step away from their duties completely. That means if staff have lunch at their desks while answering calls or replying to emails, you need to pay them for that time. Meal breaks are only unpaid if employees are genuinely relieved of the work tasks and responsibilities.

All in all, make sure your policy is clear about how your small business treats breaks so team members know not to work while they’re eating their lunch.

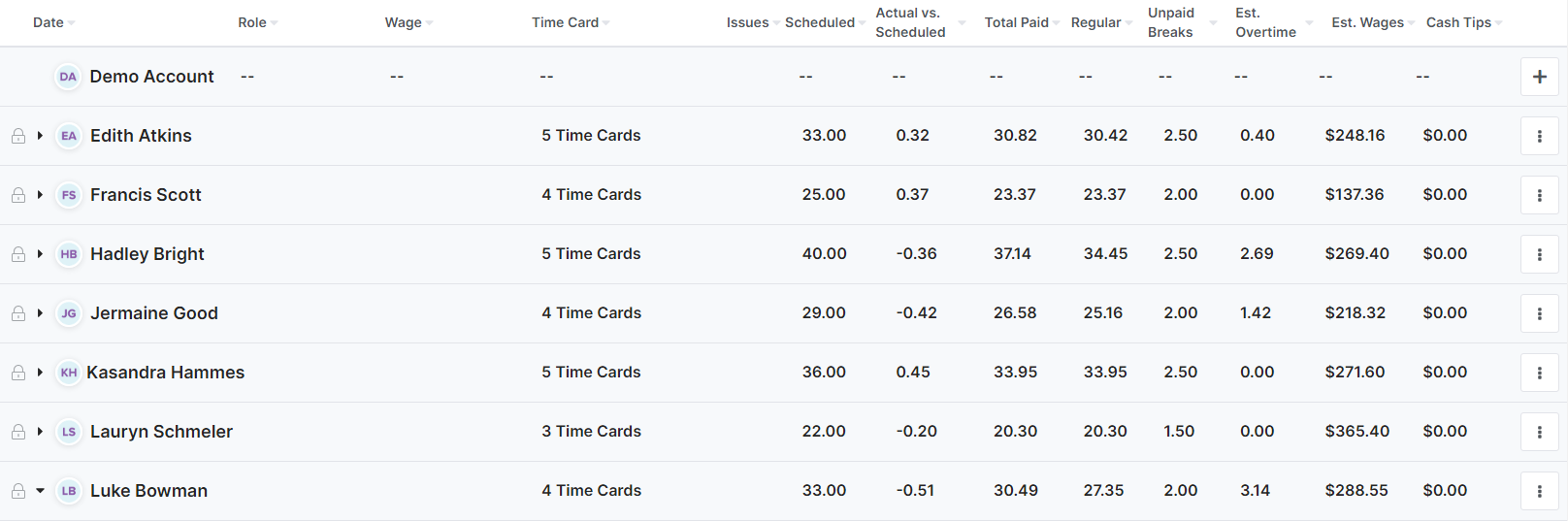

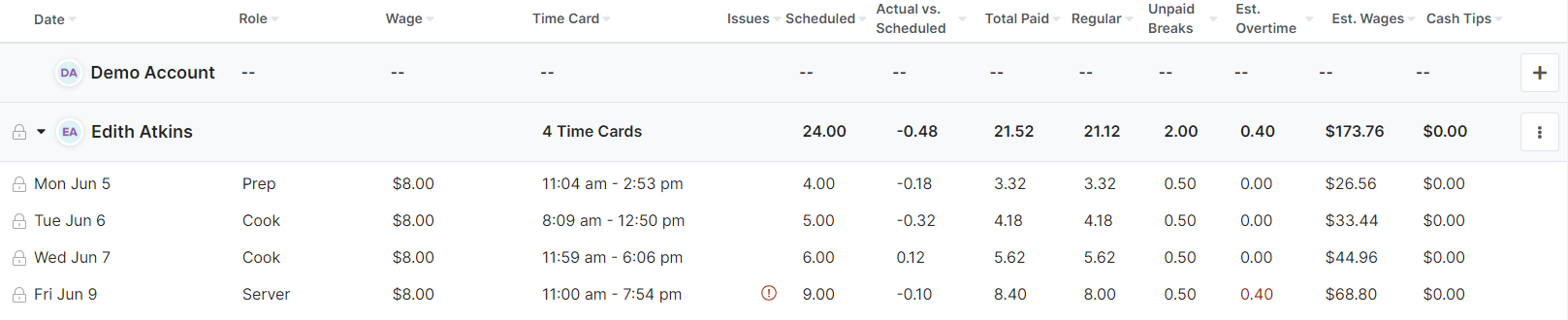

Review timesheets and round hours

Approving timesheets is key because it ensures you pay employees accurately. Unfortunately, it’s also one of the most painstaking administrative steps to do manually. After staff members submit their timesheets, managers need to cross-check the recorded hours with their employee schedules to make sure everything matches up. They also need to make sure any overtime was authorized and all days off were approved in advance.

If you’ve ever tried to do this process manually before, you know how frustrating and error-prone it can be. So, using a system that can do it automatically saves a lot of time. Homebase’s time clock app can review recorded times against scheduled hours to ensure they’re consistent and make it clear how much employees have worked and if there are any issues.

If there are any timesheet irregularities — for example, the employee worked more than their scheduled hours or missed a break — the system will alert you. Then, you can message your team member from within the platform to discuss the issue and make sure it doesn’t cause payroll or legal problems in the future.

Another essential part of a clocking in and out policy is your approach to time clock rounding. One common method is to round to the nearest quarter of an hour. For example, if an employee clocks in at 9:07 am, they get paid from 9:00 am. Or if an employee clocks out at 5:38 pm, they get paid until 5:45 pm. The FLSA doesn’t legally require you to round hours, but it has regulations you have to follow to do so in a compliant manner. If you decide to round staff hours, make sure your approach is fair and consistent. And as always, remember to check applicable state regulations, too.

Make overtime and tax calculations

After you’ve reviewed your timesheets, it’s time to calculate how much overtime pay you owe and how much tax you should withhold. As you likely know, doing this manually can be a very time-consuming task.

For every hour that an employee works over 40 hours per workweek, you need to pay 1.5 times their usual hourly rate. And don’t forget that some states have rules above these FLSA minimums that you’ll have to keep in mind as well. When you have multiple types of staff members and timesheets with both federal and local guidelines, this calculation becomes more difficult than it sounds. It’s all too easy to over (or under) pay for overtime.

Then, there are taxes to consider. With federal taxes as well as state payroll taxes and local taxes, figuring out how much to withhold on your own can be challenging. There’s a lot of opportunity for error, and the process simply might require more time than you realistically have.

However, you don’t have to handle all that on your own. Homebase payroll can automatically pay and file taxes for you so you can focus on running your small business.

Investigate irregularities and take disciplinary action when necessary

Unfortunately, employees aren’t always honest about their work hours. But the more robust your time tracking system is, the harder it’ll be for people to cheat. Here are some of the most common violations:

- Buddy punching. With paper timesheets or punch cards, this was super easy. All employees needed to do was ask their friends to clock in or out of work for them. It was difficult to prove they were abusing the system, too. Well, not anymore. With our time clock tool, when someone signs in or out of work, it prompts them to take a photo or enter an individualized PIN. That way, you can be 100% sure they are who they say they are.

- Time theft. This is when an employee claims they worked hours even though they weren’t on the premises. You might think that letting team members use mobile apps to clock in and out of work would make this an even bigger problem, as they can do so from anywhere. But not with Homebase’s time clock. Every time someone signs in or out of a shift, it shows their geolocation, so you know exactly where they are. You can also set up geofencing so they can only clock in or out within designated areas.

- Unauthorized overtime. People intentionally working more hours than they were scheduled is one way to cheat the system. So, make sure your policy and authorization procedures are clear and easy to understand. Homebase HR and compliance can help you make employee handbooks so your rules don’t leave any room for doubt. Homebase HR experts can also take a look at your overtime policies to make sure they tick all the boxes.

Implement a clock in clock out policy and stay compliant with Homebase

A clock in clock out policy is the best way to protect your small business from FLSA compliance issues. And it means you can be confident your timesheets — and payroll — are accurate.

Dealing with timesheet and payroll issues is one more issue you don’t need on your plate as a small business owner or manager. Instead, let Homebase take care of your time tracking needs. With our time clock tool, you’ll get accurate and automatically reviewed timesheets. And if any issues come up, our platform will alert you.

Homebase can help protect your clocking in and out system from misuse. With photo and GPS snapshots and individualized PINs, you can be sure your employees are who and where they say they are. And clear documentation with Homebase HR help means everyone in your company knows and can refer back to the rules.

No more running around at the end of the pay period cross-checking scheduled and recorded hours. Instead, save time and energy and spend it on growing your business instead with Homebase’s time tracking features.