Tips to help you streamline HR tasks

PeopleStrategy

DECEMBER 12, 2019

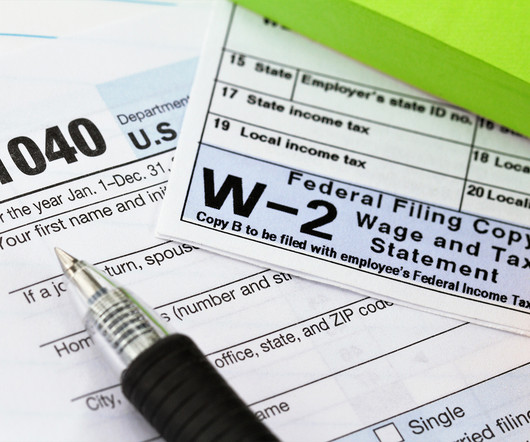

At the same time, you are probably trying to review employee data and payroll records in preparation for year-end reporting, tax filing and setting up the first payroll of 2020. It’s best to streamline payroll and other key HR processes, to achieve optimal levels of efficiency and staff productivity.

Let's personalize your content