Home Health Payroll & HR Software: Taking Better Care of Caregivers

Netchex HR Blog

FEBRUARY 6, 2024

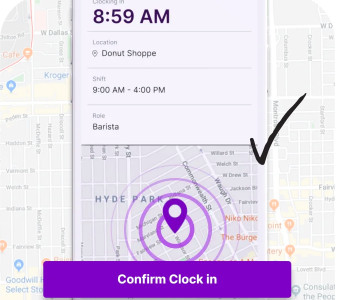

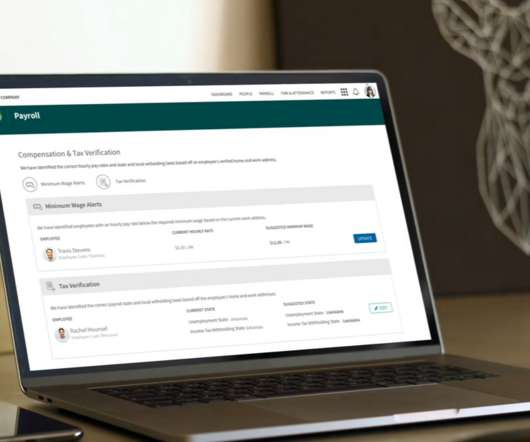

Payroll and HR software helps you improve efficiency and streamline some of the most cumbersome HR management tasks. Treatment protocols change over time, but administrators have their own challenges in keeping up with constant changes in the industry. A short staffed business has a much harder time satisfying customers.

Let's personalize your content